IBM 2015 Annual Report Download - page 45

Download and view the complete annual report

Please find page 45 of the 2015 IBM annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

43

Management Discussion

International Business Machines Corporation and Subsidiary Companies

Snapshot

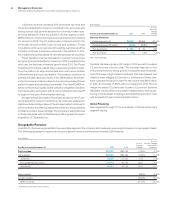

In the fourth quarter of 2015, the company reported $22.1billion

in revenue and delivered $4.5billion in income from continuing

operations with diluted earnings per share from continuing oper-

ations of $4.59 as reported and $4.84 on an operating (non-GAAP)

basis. The results of continuing operations exclude net income

from discontinued operations of $3million related to the divesti-

ture of the company’s Microelectronics business. The company

generated $5.3billion in cash from operations and $6.1billion in

free cash flow in the fourth quarter and continued a high level of

investment, including $2.5billion in acquisitions and driving share-

holder returns of $2.0billion in gross common stock repurchases

and dividends.

Performance in the fourth quarter continued to reflect the

transitions in the business as the company addressed both the

significant shifts in the industry as well as some of the cyclical

challenges of the global business environment.

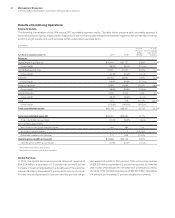

In the fourth quarter, total consolidated revenue decreased

8.5percent as reported and 2percent adjusted for currency, with

a year-to-year impact of $1.5billion due to currency. Revenue in the

strategic imperatives grew 10percent as reported and 16percent

adjusted for currency.

Within the company’s segments, total Global Services reve-

nue declined 8.1percent as reported and 1percent adjusted for

currency. Global Technology Services revenue decreased 7.1per-

cent as reported but grew 1percent adjusted for currency as the

company continues to help clients transition to a hybrid cloud

services platform bringing more mobility and security to infra-

structure services. Global Business Services revenue decreased

9.9percent (4percent adjusted for currency). GBS has continued

to add resources and transition to the strategic areas while shift-

ing away from some of the more traditional areas of the business.

Software revenue decreased 10.7percent (6percent adjusted for

currency). Software annuity content grew but transactional per-

formance continued to be impacted by the flexibility the company

has provided in Enterprise License Agreements with clients. Sys-

tems Hardware revenue decreased 1.4percent but grew 3percent

adjusted for currency driven by zSystems and Power Systems.

From a geographic perspective, revenue in the major markets

declined 6.9percent and 2percent adjusted for currency. While

the U.S. was down, revenue in Europe and Japan grew on an

adjusted basis. Growth markets revenue decreased 13.6percent

and 4percent adjusted for currency with growth in Latin America

and the Middle East and Africa region more than offset by declines

in Asia Pacific.

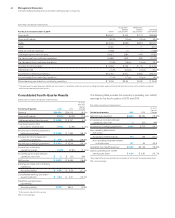

The consolidated gross profit margin decreased 1.6points

versus the fourth quarter of 2014 to 51.7percent. The operating

(non-GAAP) gross margin of 52.7percent decreased 1.2points

with year-to-year declines across all business segments.

Total expense and other (income) increased 9.4percent in the

fourth quarter of 2015 compared to the prior year. Total operating

(non-GAAP) expense and other (income) increased 9.2percent

year to year. The key drivers of the year-to-year change in total

expense and other (income) were approximately:

Total Operating

Consolidated (non-GAAP)

• Currency* (8) points (8) points

• Divestiture gains 23 points 24 points

• Workforce rebalancing (10) points (10) points

* Reflects impacts of translation and hedging programs.

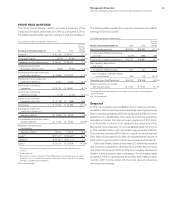

The year-to-year increase in expense was driven by prior year

items. A gain of $1.4billion associated with the Systemx dives-

titure was recorded in the fourth quarter of 2014 and a charge

of $86million for the impairment of equity securities received as

consideration was recorded in the fourth quarter of 2015. These

items were partially offset by lower workforce rebalancing charges

of $0.6billion and the impact of currency in the fourth quarter of

2015 compared to the prior-year period.

Pre-tax income from continuing operations of $5,098 million

decreased 28.1percent year to year and the pre-tax margin was

23.1percent, a decrease of 6.3points versus the fourth quarter

of 2014. The prior period gain from the Systemx divestiture rep-

resented effectively all of the year-to-year decline in the pre-tax

margin, but the margin performance also reflected higher levels

of investment, mix of contracts and resource shifts in the ser-

vices business. The continuing operations effective tax rate for