IBM 2011 Annual Report Download - page 96

Download and view the complete annual report

Please find page 96 of the 2011 IBM annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

Notes to Consolidated Financial Statements

International Business Machines Corporation and Subsidiary Companies94

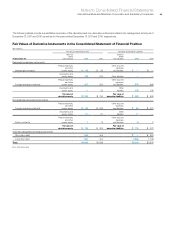

($ in millions)

At December 31, 2010: Level 1 Level 2 Level 3 To t a l

Assets

Cash equivalents (1)

Time deposits and certificates of deposit $ — $2,473 $— $ 2,473

Commercial paper — 2,673 — 2,673

Money market funds 1,532 — — 1,532

Canada government securities — 1,054 — 1,054

U.S. government securities — 44 — 44

U.S. government agency securities — 22 — 22

Other securities — 3 — 3

To ta l 1,532 6,269 — 7,801(6)

Debt securities—current (2)

Commercial paper — 490 — 490

U.S. government securities — 500 — 500

Other securities — 1 — 1

To ta l — 990 — 990

(6)

Debt securities—noncurrent (3) 1 6 — 7

Available-for-sale equity investments (3) 445 13 — 458

Derivative assets (4)

Interest rate contracts — 548 — 548

Foreign exchange contracts — 539 — 539

Equity contracts — 12 — 12

To ta l — 1,099 — 1,099 (7)

Total assets $1,978 $8,377 $— $10,355 (7)

Liabilities

Derivative liabilities (5)

Foreign exchange contracts $ — $1,003 $— $ 1,003

Equity contracts — 3 — 3

Total liabilities $ — $1,006 $— $ 1,006 (7)

(1) Included within cash and cash equivalents in the Consolidated Statement of Financial Position.

(2)

Reported as marketable securities in the Consolidated Statement of Financial Position.

(3) Included within investments and sundry assets in the Consolidated Statement of Financial Position.

(4)

The gross balances of derivative assets contained within prepaid expenses and other current assets, and investments and sundry assets in the Consolidated Statement

of Financial Position at December 31, 2010 are $511 million and $588 million, respectively.

(5)

The gross balances of derivative liabilities contained within other accrued expenses and liabilities, and other liabilities in the Consolidated Statement of Financial Position

at December 31, 2010 are $871 million and $135 million, respectively.

(6) Available-for-sale securities with carrying values that approximate fair value.

(7)

If derivative exposures covered by a qualifying master netting agreement had been netted in the Consolidated Statement of Financial Position, the total derivative asset and

liability positions would have been reduced by $475 million each.

There were no significant transfers between Levels 1 and 2 for the years ended December 31, 2011 and 2010.