IBM 2011 Annual Report Download - page 110

Download and view the complete annual report

Please find page 110 of the 2011 IBM annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

Notes to Consolidated Financial Statements

International Business Machines Corporation and Subsidiary Companies108

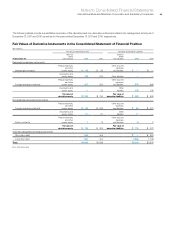

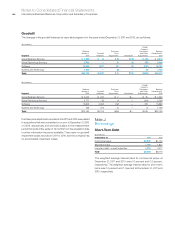

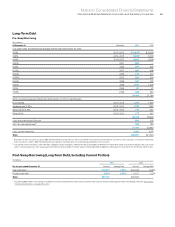

Pre-swap annual contractual maturities of long-term debt outstanding

at December 31, 2011, are as follows:

($ in millions)

To t a l

2012 $ 4,311

2013 5,495

2014 3,763

2015 197

2016 3,009

2017 and beyond 9,926

To t a l $26,702

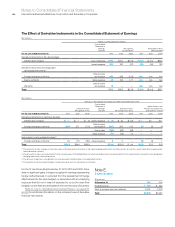

Interest on Debt

($ in millions)

For the year ended December 31: 2011 2010 2009

Cost of financing $553 $555 $ 706

Interest expense 402 365 404

Net investment derivative activity 93 (1)

Interest capitalized 95 13

Total interest paid and accrued $973 $928 $1,122

Refer to the related discussion on page 137 in note T, “Seg ment

Infor mation,” for total interest expense of the Global Financing

segment. See note D, “Financial Instruments,” on pages 96 to 100

for a discussion of the use of currency and interest rate swaps in

the company’s debt risk management program.

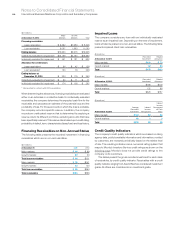

Lines of Credit

In 2011 the company renewed its five-year, $10 billion Credit Agreement

(the “Credit Agreement”), which now expires on November 10, 2016.

The total expense recorded by the company related to this facility

was $5.0 million in 2011, $6.2 million in 2010 and $6.3 million in 2009.

The Credit Agreement permits the company and its Subsidiary

Borrowers to borrow up to $10 billion on a revolving basis. Borrowings

of the Subsidiary Borrowers will be unconditionally backed by the

company. The company may also, upon the agreement of either

existing lenders, or of the additional banks not currently party to

the Credit Agreement, increase the commitments under the Credit

Agreement up to an additional $2.0 billion. Subject to certain terms

of the Credit Agreement, the company and Subsidiary Borrowers

may borrow, prepay and reborrow amounts under the Credit

Agreement at any time during the Credit Agreement. Interest rates

on borrowings under the Credit Agreement will be based on prevailing

market interest rates, as further described in the Credit Agreement.

The Credit Agreement contains customary representations and

warranties, covenants, events of default, and indemnification

provisions. The company believes that circumstances that might give

rise to breach of these covenants or an event of default, as specified

in the Credit Agreement, are remote. As of December 31, 2011, there

were no borrowings by the company, or its subsidiaries, under the

Credit Agreement.

The company also has other committed lines of credit in some

of the geographies which are not significant in the aggregate. Interest

rates and other terms of borrowing under these lines of credit vary

from country to country, depending on local market conditions.

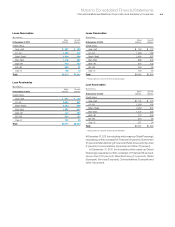

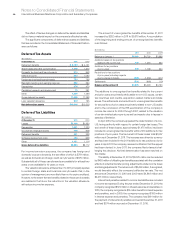

Note K.

Other Liabilities

($ in millions)

At December 31: 2011 2010

Income tax reserves $3,989 $3,486

Executive compensation accruals 1,388 1,302

Disability benefits 835 739

Derivatives liabilities 166 135

Special actions 347 399

Workforce reductions 366 406

Deferred taxes 549 378

Environmental accruals 249 249

Noncurrent warranty accruals 163 130

Asset retirement obligations 166 161

Other 777 841

To t a l $8,996 $8,226

In response to changing business needs, the company periodically

takes workforce reduction actions to improve productivity, cost

competitiveness and to rebalance skills. The noncurrent contractually

obligated future payments associated with these activities are

reflected in the workforce reductions caption in the previous table.

In addition, the company executed certain special actions as

follows: (1) the second quarter of 2005 associated with Global

Services, primarily in Europe, (2) the fourth quarter of 2002 associated

with the acquisition of the PricewaterhouseCoopers consulting

business, (3) the second quarter of 2002 associated with the

Microelectronics Division and the rebalancing of the company’s

workforce and leased space resources, (4) the 2002 actions

associated with the hard disk drive business for reductions in

workforce, manufacturing capacity and space, (5) the actions taken

in 1999, and (6) the actions that were executed prior to 1994.