IBM 2011 Annual Report Download - page 43

Download and view the complete annual report

Please find page 43 of the 2011 IBM annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.41

Management Discussion

International Business Machines Corporation and Subsidiary Companies

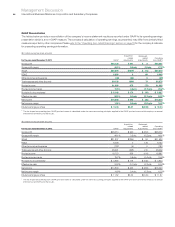

Global Business Services revenue increased 2.5 percent

(2 percent adjusted for currency) to $4,877 million in the fourth quarter

of 2011. Application Outsourcing revenue increased 4.7 percent (4

percent adjusted for currency), led by strong performance in the

growth markets. Consulting and Systems Integration had revenue

growth in the fourth quarter of 1.9 percent (1 percent adjusted for

currency), an improved constant currency growth rate compared to

the third quarter. Overall GBS revenue continued to be impacted by

Japan and the Public Sector; total GBS revenue, excluding Japan

and the Public sector, increased 8.1 percent (9 percent adjusted for

currency) in the fourth quarter of 2011. Although, revenue declines

in Japan and the Public Sector continued in the fourth quarter,

performance in the Public Sector improved compared to the prior

two quarters of 2011. GBS gross profit increased 7.2 percent in the

fourth quarter and gross profit margin expanded 1.3 points versus

the prior year. GBS segment pre-tax income increased 14.4 percent

to $841 million in the fourth quarter of 2011 with pre-tax margin

expanding 1.8 points to 16.6 percent.

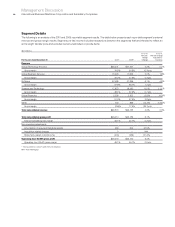

Software

Software revenue increased 8.7 percent (9 percent adjusted for

currency) to $7,648 million in the fourth quarter. Key branded

middleware revenue increased 11.3 percent (11 percent adjusted for

currency) year to year. This was the fifth consecutive quarter of

double-digit revenue growth in key branded middleware along with

17 consecutive quarters of share gains as the business continues to

extend its leadership in the middleware market. WebSphere revenue

increased 21.4 percent (21 percent adjusted for currency) in the

fourth quarter of 2011 year to year and gained share. Each of

WebSphere’s five product areas had revenue growth of 10 percent

or higher in the fourth quarter including the Smarter Commerce

offerings, which were up over 25 percent. Information Management

revenue increased 8.7 percent (9 percent adjusted for currency) in

the fourth quarter year to year and gained share. Distributed Database

software revenue grew double digits in the fourth quarter, led by

performance from the Netezza offerings which were up nearly 70

percent. Revenue from business analytics software offerings, most

of which are part of Information Management, continued to outpace

the market with double-digit growth in the fourth quarter. The

acquisition of Algorithmics in the fourth quarter of 2011 further

strengthens the business analytics and optimization offerings by

providing risk analytics capabilities that help customers make

informed decisions. Tivoli revenue increased 13.7 percent (14 percent

adjusted for currency) year over year in the fourth quarter and gained

share, driven by Storage software growth of 30 percent (30 percent

adjusted for currency). In addition, Security solutions had revenue

growth of 15 percent (15 percent adjusted for currency). With the

recent acquisition of Q1 Labs, the company can now offer clients a

new level of intelligence around security to enable them to better

predict, prevent and detect all types of security threats. Rational

revenue increased 3.7 percent (4 percent adjusted for currency) in

the fourth quarter and gained share, driven by strong performance

in Telelogic. Software gross profit increased 8.9 percent and the

gross profit margin expanded 0.2 points. Software delivered segment

pre-tax income of $3,710 million in the fourth quarter, a growth of

12.5 percent compared to the fourth quarter of 2010, with a pre-tax

margin of 43.7 percent, up 1.4 points.

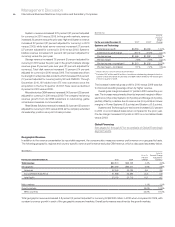

Systems and Technology

Systems and Technology revenue decreased 7.6 percent (8 percent

adjusted for currency) to $5,803 million in the fourth quarter versus

the same period in 2010. The year-to-year decline reflects very strong

growth in the fourth quarter of 2010 of over 20 percent, driven by

mainframe growth of nearly 70 percent. System z revenue decreased

31.2 percent (31 percent adjusted for currency) and MIPS (millions

of instructions per second) shipments decreased 4 percent year to

year. The decline in revenue was a result of the strong fourth quarter

of 2010 when the company successfully launched its zEnterprise

196 server. Power Systems revenue increased 6.3 percent (6 percent

adjusted for currency) and gained share. This reflected 15 consecutive

quarters of share gains in Power Systems. In the fourth quarter, the

company had over 350 competitive displacements resulting in over

$350 million of business; approximately 60 percent of this business

was from Hewlett Packard with most of the balance coming from

Oracle/Sun. This was the strongest quarter of competitive

displacements since the company started tracking this activity in

2006. System x revenue decreased 2.5 percent (3 percent adjusted

for currency) in the fourth quarter year to year. Storage revenue

decreased 1.2 percent (1 percent adjusted for currency) in the fourth

quarter of 2011 versus the comparable period in 2010. Total disk

revenue decreased 1 percent (1 percent adjusted for currency) and

tape revenue decreased 4 percent (4 percent adjusted for currency)

in the fourth quarter. When combined with the storage software

revenue growth of 30 percent, total storage revenue increased

5 percent in the fourth quarter compared to the prior year. Retail

Stores Solutions revenue increased 8.9 percent (9 percent adjusted

for currency) in the fourth quarter and continued to gain share.

Systems and Technology gross margin decreased 3.1 points versus

the prior year driven primarily by product mix (approximately 2 points).

Systems and Technology’s pre-tax income decreased 32.6 percent

to $790 million in the fourth quarter and pre-tax margin decreased

4.8 points to 13.2 percent.

Global Financing

Global Financing revenue of $548 million decreased 12.9 percent

(13 percent adjusted for currency), driven primarily by a decrease in

used equipment sales revenue. The Global Financing segment

fourth-quarter pre-tax income decreased 9.1 percent to $514 million

and the pre-tax margin declined 0.9 points to 46.1 percent.