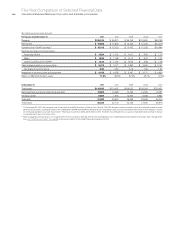

IBM 2011 Annual Report Download - page 139

Download and view the complete annual report

Please find page 139 of the 2011 IBM annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

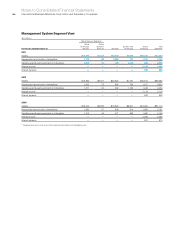

Notes to Consolidated Financial Statements

International Business Machines Corporation and Subsidiary Companies 137

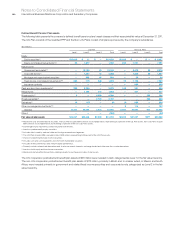

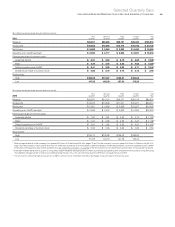

Reconciliations of IBM as Reported

($ in millions)

For the year ended December 31: 2011 2010 2009

Revenue

Total reportable segments $114,440 $106,827 $102,524

Other revenue and adjustments 722 750 869

Elimination of internal transactions (8,246) (7,707) (7,635)

Total IBM consolidated revenue $106,916 $ 99,870 $ 95,758

($ in millions)

For the year ended December 31: 2011 2010* 2009*

Pre-tax income

Total reportable segments $22,904 $20,923 $19,323

Amortization of acquired

intangible assets (629) (512)(489)

Acquisition-related charges (46) (46)(9)

Non-operating retirement-

related (costs)/income 72 414 509

Elimination of internal transactions (1,243) (957)(744)

Unallocated corporate amounts** (56) (98)(453)

Total IBM consolidated

pre-tax income $21,003 $19,723 $18,138

* Reclassified to conform with 2011 presentation.

** The 2009 amount included a provision related to a joint venture investment, while

the 2010 amount included an adjustment of that provision as the venture was divested.

The 2009 and 2010 amounts included gains related to the divestiture of the printing

business.

Immaterial Items

Investment in Equity Alliances

and Equity Alliances Gains/(Losses)

The investments in equity alliances and the resulting gains and

(losses) from these investments that are attributable to the segments

did not have a material effect on the financial position or the financial

results of the segments.

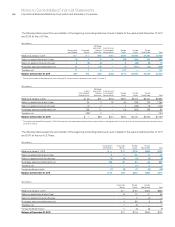

Segment Assets and Other Items

Global Technology Services assets are primarily accounts receivable,

plant, property and equipment including the assets associated with

the outsourcing business, goodwill, acquired intangible assets,

deferred services arrangement transition costs and maintenance parts

inventory. Global Business Services assets are primarily goodwill

and accounts receivable. Software assets are mainly goodwill,

acquired intangible assets and accounts receivable. Systems and

Technology assets are primarily plant, property and equipment,

manufacturing inventory and accounts receivable. Global Financing

assets are primarily financing receivables and fixed assets under

operating leases.

To ensure the efficient use of the company’s space and equipment,

several segments may share plant, property and equipment assets.

Where assets are shared, landlord ownership of the assets is

assigned to one segment and is not allocated to each user segment.

This is consistent with the company’s management system and is

reflected accordingly in the table on page 138. In those cases, there

will not be a precise correlation between segment pre-tax income

and segment assets.

Similarly, the depreciation amounts reported by each segment

are based on the assigned landlord ownership and may not be

consistent with the amounts that are included in the segments’ pre-

tax income. The amounts that are included in pre-tax income reflect

occupancy charges from the landlord segment and are not specifically

identified by the management reporting system. Capital expenditures

that are reported by each segment also are consistent with the

landlord ownership basis of asset assignment.

Global Financing amounts for interest income and interest

expense reflect the interest income and interest expense associated

with the Global Financing business, including the intercompany

financing activities discussed on page 24, as well as the income from

investment in cash and marketable securities. The explanation of the

difference between cost of financing and interest expense for segment

presentation versus presentation in the Consolidated Statement of

Earnings is included on page 66 of the Management Discussion.