IBM 2011 Annual Report Download - page 59

Download and view the complete annual report

Please find page 59 of the 2011 IBM annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

57

Management Discussion

International Business Machines Corporation and Subsidiary Companies

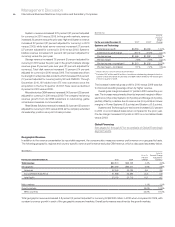

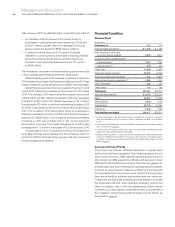

The table below represents the way in which management reviews cash flow as described above.

($ in billions)

For the year ended December 31: 2011 2010 2009 2008 2007

Net cash from operating activities per GAAP $ 19.8 $ 19.5 $20.8 $ 18.8 $ 16.1

Less: the change in Global Financing receivables (0.8) (0.7) 1.9 (0.0) (1.3)

Net cash from operating activities, excluding Global Financing receivables 20.7 20.3 18.9 18.8 17.4

Capital expenditures, net (4.1) (4.0) (3.7) (4.5)(5.0)

Free cash flow 16.6 16.3 15.1 14.3 12.4

Acquisitions (1.8) (5.9) (1.2) (6.3)(1.0)

Divestitures 0.0 0.1 0.4 0.1 0.3

Share repurchase (15.0) (15.4) (7.4) (10.6)(18.8)

Dividends (3.5) (3.2) (2.9) (2.6) (2.1)

Non-Global Financing debt 1.7 2.3 (4.7) (3.2)10.9

Other (includes Global Financing receivables and Global Financing debt) 2.3 3.5 1.7 5.0 3.8

Change in cash, cash equivalents and short-term marketable securities $ 0.3 $ (2.3)$ 1.1 $ (3.2)$ 5.5

Events that could temporarily change the historical cash flow

dynamics discussed above include significant changes in operating

results, material changes in geographic sources of cash, unexpected

adverse impacts from litigation, future pension funding requirements

during periods of severe downturn in the capital markets or the

timing of tax payments. Whether any litigation has such an adverse

impact will depend on a number of variables, which are more

completely described in note M, “Contingencies and Commitments,”

on pages 112 to 114. With respect to pension funding, in 2011, the

company contributed $798 million to its non-U.S. defined benefit

plans, versus $865 million in 2010. As highlighted in the Contractual

Obligations table on page 58, the company expects to make legally

mandated pension plan contributions to certain non-U.S. plans of

approximately $3.9 billion in the next five years. The 2012 contributions

are currently expected to be approximately $800 million. Financial

market performance and/or further weakening in the European

sovereign debt credit environment in 2012 could increase the legally

mandated minimum contributions in certain non-U.S. countries that

require more frequent remeasurement of the funded status. The

company is not quantifying any further impact from pension funding

because it is not possible to predict future movements in the capital

markets or pension plan funding regulations.

The Pension Protection Act of 2006 was enacted into law in 2006,

and, among other things, increases the funding requirements for certain

U.S. defined benefit plans beginning after December 31, 2007. No

mandatory contribution is required for the U.S. defined benefit plan

in 2012 as of December 31, 2011.

The company’s U.S. cash flows continue to be sufficient to fund

its current domestic operations and obligations, including investing

and financing activities such as dividends and debt service. The

company’s U.S. operations generate substantial cash flows, and,

in those circumstances where the company has additional cash

requirements in the U.S., the company has several liquidity options

available. These options include the ability to borrow funds at

reasonable interest rates, utilizing its committed global credit facility,

repatriating certain foreign earnings and calling intercompany loans

that are in place with certain foreign subsidiaries.

The company does earn a significant amount of its pre-tax

income outside the U.S. The company’s policy is to indefinitely

reinvest the undistributed earnings of its foreign subsidiaries, and

accordingly, no provision for federal income taxes has been made

on accumulated earnings of foreign subsidiaries. The company

periodically repatriates a portion of these earnings to the extent that

it does not incur an additional U.S. tax liability. Quantification of the

deferred tax liability, if any, associated with indefinitely reinvested

earnings is not practicable. While the company currently does not

have a need to repatriate funds held by its foreign subsidiaries, if

these funds are needed for operations and obligations in the U.S.,

the company could elect to repatriate these funds which could result

in a reassessment of the company’s policy and increased tax expense.