IBM 2011 Annual Report Download - page 60

Download and view the complete annual report

Please find page 60 of the 2011 IBM annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

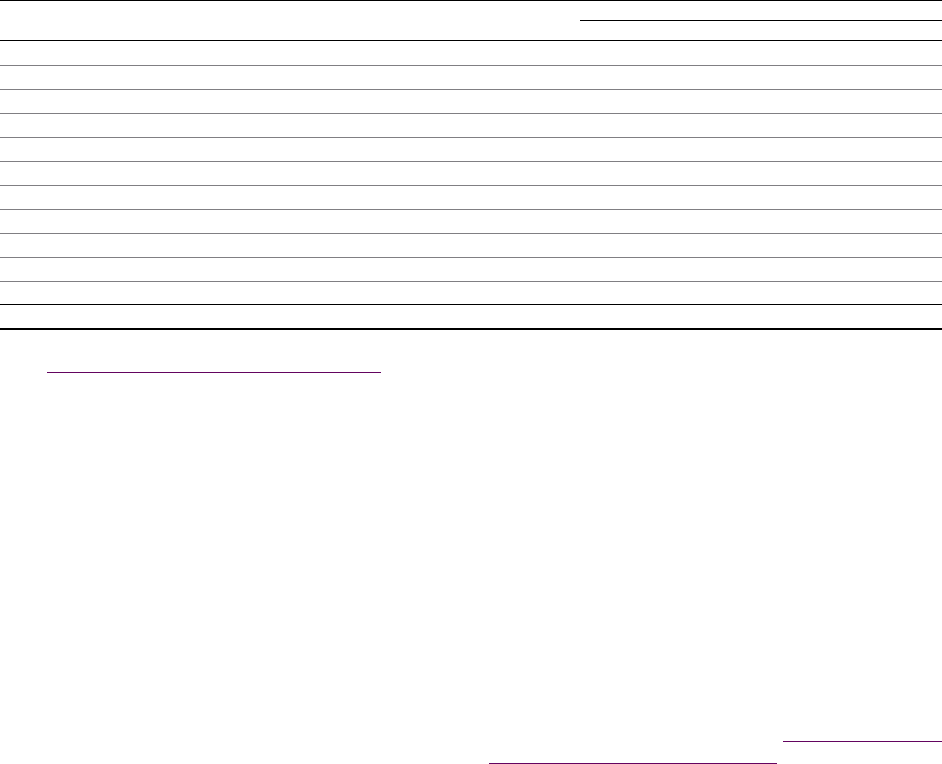

58

Management Discussion

International Business Machines Corporation and Subsidiary Companies

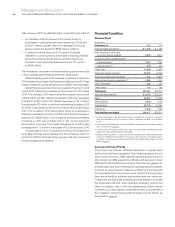

Contractual Obligations

($ in millions)

Total Contractual

Payment Stream

Payments Due In

2012 2013-14 2015-16 After 2016

Long-term debt obligations $26,616 $4,292 $ 9,217 $3,185 $ 9,921

Interest on long-term debt obligations 10,585 1,128 1,711 1,362 6,384

Capital (finance) lease obligations 86 19 41 21 5

Operating lease obligations 5,631 1,562 2,324 1,132 613

Purchase obligations 2,207 1,368 586 201 52

Other long-term liabilities

Minimum pension funding (mandated)* 3,900 800 1,500 1,600 —

Executive compensation 1,440 89 194 214 944

Long-term termination benefits 1,374 132 163 141 938

Tax reserves** 3,728 138 — — —

Other 1,250 64 88 86 1,011

To t a l $56,817 $9,592 $15,824 $7,942 $19,868

* Represents future pension contributions that are mandated by local regulations or statute, all associated with non-U.S. qualified defined benefit and multi-employer pension

plans. See note S, “Retirement-Related Benefits,” on pages 121 to 135 for additional information on the non-U.S. plans’ investment strategies and expected contributions and for

information regarding the company’s total underfunded pension plans of $19,232 million at December 31, 2011. As the funded status on the plans will vary, obligations for mandated

minimum pension payments after 2016 could not be reasonably estimated.

**

These amounts represent the liability for unrecognized tax benefits. The company estimates that approximately $138 million of the liability is expected to be settled within the next

12 months. The settlement period for the noncurrent portion of the income tax liability cannot be reasonably estimated as the timing of the payments will depend on the progress

of tax examinations with the various tax authorities; however, it is not expected to be due within the next 12 months.

Total contractual obligations are reported in the table above excluding

the effects of time value and therefore, may not equal the amounts

reported in the Consolidated Statement of Financial Position.

Purchase obligations include all commitments to purchase goods

or services of either a fixed or minimum quantity that meet any of

the following criteria: (1) they are noncancelable, (2) the company

would incur a penalty if the agreement was canceled, or (3) the

company must make specified minimum payments even if it does

not take delivery of the contracted products or services (take-or-pay).

If the obligation to purchase goods or services is noncancelable, the

entire value of the contract is included in the table above. If the

obligation is cancelable, but the company would incur a penalty if

canceled, the dollar amount of the penalty is included as a purchase

obligation. Contracted minimum amounts specified in take-or-pay

contracts are also included in the table as they represent the portion

of each contract that is a firm commitment.

In the ordinary course of business, the company enters into

contracts that specify that the company will purchase all or a portion

of its requirements of a specific product, commodity or service from

a supplier or vendor. These contracts are generally entered into in

order to secure pricing or other negotiated terms. They do not specify

fixed or minimum quantities to be purchased and, therefore, the

company does not consider them to be purchase obligations.

Interest on floating-rate debt obligations is calculated using the

effective interest rate at December 31, 2011, plus the interest rate

spread associated with that debt, if any.

Off-Balance Sheet Arrangements

From time to time, the company may enter into off-balance sheet

arrangements as defined by the SEC Financial Reporting Release

67 (FRR-67), “Disclosure in Management’s Discussion and Analysis

about Off-Balance Sheet Arrangements and Aggregate Con tractual

Obligations.”

At December 31, 2011, the company had no off-balance sheet

arrangements that have, or are reasonably likely to have, a material

current or future effect on financial condition, changes in financial

condition, revenues or expenses, results of operations, liquidity,

capital expenditures or capital resources. See the table above for

the company’s contractual obligations and note M, “Contingencies

and Commitments,” on pages 114 and 115, for detailed information

about the company’s guarantees, financial commitments and

indemnification arrangements. The company does not have retained

interests in assets transferred to unconsolidated entities or other

material off-balance sheet interests or instruments.

Critical Accounting Estimates

The application of GAAP requires the company to make estimates

and assumptions about certain items and future events that directly

affect its reported financial condition. The accounting estimates and

assumptions discussed in this section are those that the company

considers to be the most critical to its financial statements. An

accounting estimate is considered critical if both (a) the nature of

the estimate or assumption is material due to the levels of subjectivity

and judgment involved, and (b) the impact within a reasonable range

of outcomes of the estimate and assumption is material to the

company’s financial condition. Senior management has discussed