IBM 2011 Annual Report Download - page 123

Download and view the complete annual report

Please find page 123 of the 2011 IBM annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.Notes to Consolidated Financial Statements

International Business Machines Corporation and Subsidiary Companies 121

In connection with vesting and release of RSUs and PSUs,

the tax benefits realized by the company for the years ended

December 31, 2011, 2010 and 2009 were $283 million, $293 million

and $156 million, respectively.

IBM Employees Stock Purchase Plan

The company maintains a non-compensatory Employees Stock

Pur chase Plan (ESPP). The ESPP enables eligible participants to

purchase full or fractional shares of IBM common stock at a 5 percent

discount off the average market price on the day of purchase through

payroll deductions of up to 10 percent of eligible compensation. Eligible

compensation includes any compensation received by the employee

during the year. The ESPP provides for offering periods during which

shares may be purchased and continues as long as shares remain

available under the ESPP, unless terminated earlier at the discretion

of the Board of Directors. Individual ESPP participants are restricted

from purchasing more than $25,000 of common stock in one

calendar year or 1,000 shares in an offering period.

Employees purchased 1.9 million, 2.4 million and 3.2 million shares

under the ESPP during the years ended December 31, 2011, 2010

and 2009, respectively. Cash dividends declared and paid by the

company on its common stock also include cash dividends on the

company stock purchased through the ESPP. Dividends are paid

on full and fractional shares and can be reinvested in the ESPP. The

company stock purchased through the ESPP is considered outstanding

and is included in the weighted-average outstanding shares for

purposes of computing basic and diluted earnings per share.

Approximately 5.4 million, 7.2 million and 9.6 million shares were

available for purchase under the ESPP at December 31, 2011, 2010

and 2009, respectively.

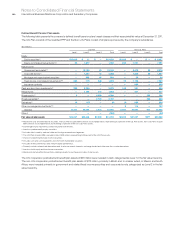

Note S.

Retirement-Related Benefits

Description of Plans

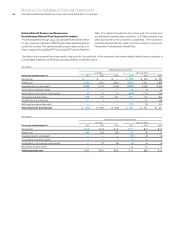

IBM sponsors defined benefit pension plans and defined contribution

plans that cover substantially all regular employees, a supplemental

retention plan that covers certain U.S. executives and nonpension

postretirement benefit plans primarily consisting of retiree medical

and dental benefits for eligible retirees and dependents.

U.S. Plans

Defined Benefit Pension Plans

IBM Personal Pension Plan

IBM provides U.S. regular, full-time and part-time employees hired

prior to January 1, 2005 with noncontributory defined benefit pension

benefits via the IBM Personal Pension Plan. Prior to 2008, the IBM

Personal Pension Plan consisted of a tax qualified (qualified) plan

and a non-tax qualified (nonqualified) plan. Effective January 1, 2008,

the nonqualified plan was renamed the Excess Personal Pension

Plan (Excess PPP) and the qualified plan is now referred to as the

Qualified PPP. The combined plan is now referred to as the PPP.

The Qualified PPP is funded by company contributions to an

irrevocable trust fund, which is held for the sole benefit of participants

and beneficiaries. The Excess PPP, which is unfunded, provides

benefits in excess of IRS limitations for qualified plans.

Benefits provided to the PPP participants are calculated using

benefit formulas that vary based on the participant. The first method

uses a five-year, final pay formula that determines benefits based

on salary, years of service, mortality and other participant-specific

factors. The second method is a cash balance formula that calculates

benefits using a percentage of employees’ annual salary, as well as

an interest crediting rate.

Benefit accruals under the IBM Personal Pension Plan ceased

December 31, 2007 for all participants.

U.S. Supplemental Executive Retention Plan

The company also sponsors a nonqualified U.S. Supplemental

Executive Reten tion Plan (Retention Plan). The Retention Plan, which

is unfunded, provides benefits to eligible U.S. executives based on

average earnings, years of service and age at termination of employment.

Benefit accruals under the Retention Plan ceased December 31,

2007 for all participants.

Defined Contribution Plans

IBM 401(k) Plus Plan

U.S. regular, full-time and part-time employees are eligible to

participate in the IBM 401(k) Plus Plan, which is a qualified defined

contribution plan under section 401(k) of the Internal Revenue Code.

Effective January 1, 2008, under the IBM 401(k) Plus Plan, eligible

employees receive a dollar-for-dollar match of their contributions

up to 6 percent of eligible compensation for those hired prior to

January 1, 2005, and up to 5 percent of eligible compensation for

those hired on or after January 1, 2005. In addition, eligible employees

receive automatic contributions from the company equal to 1, 2 or

4 percent of eligible compensation based on their eligibility to

participate in the PPP as of December 31, 2007. Employees receive

automatic contributions and matching contributions after the

completion of one year of service. Further, through June 30, 2009,

IBM contributed transition credits to eligible participants’ 401(k) Plus

Plan accounts. The amount of the transition credits was based on a

participant’s age and service as of June 30, 1999.

The company’s matching contributions vest immediately and

participants are always fully vested in their own contributions. All

contributions, including the company match, are made in cash and

invested in accordance with participants’ investment elections. There

are no minimum amounts that must be invested in company stock,

and there are no restrictions on transferring amounts out of company

stock to another investment choice, other than excessive trading

rules applicable to such investments.