IBM 2011 Annual Report Download - page 20

Download and view the complete annual report

Please find page 20 of the 2011 IBM annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

18

Management Discussion

International Business Machines Corporation and Subsidiary Companies

Overview

The financial section of the International Business Machines

Cor por ation (IBM or the company) 2011 Annual Report includes the

Management Discussion, the Consolidated Financial State ments and

the Notes to the Consolidated Financial State ments. This Over view

is designed to provide the reader with some perspective regarding

the information contained in the financial section.

Organization of Information

• The Management Discussion is designed to provide readers

with an overview of the business and a narrative on the

company’s financial results and certain factors that may affect

its future prospects from the perspective of the company’s

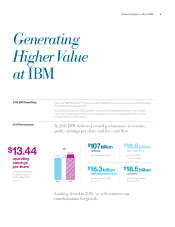

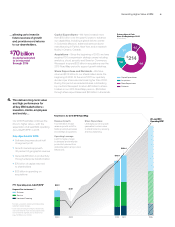

management. The “Management Discussion Snap shot” on pages

19 and 20, presents an overview of the key performance drivers

in 2011.

•

Beginning with the “Year in Review” on page 26, the Manage ment

Discussion contains the results of operations for each reportable

segment of the business and a discussion of the company’s

financial position and cash flows. Other key sections within the

Management Discussion include: “Looking Forward” on page

55, and “Liquidity and Capital Resources” on pages 56 to 58. It

is useful to read the Management Dis cussion in conjunction with

note T, “Segment Information,” on pages 135 to 139.

•

Global Financing is a reportable segment that is measured as a

stand-alone entity. A separate “Global Financing” section is

included beginning on page 63.

•

The Consolidated Financial Statements are presented on pages

70 through 75. These statements provide an overview of the

company’s income and cash flow performance and its financial

position.

•

The Notes follow the Consolidated Financial Statements. Among

other items, the Notes contain the company’s accounting policies

(pages 76 to 86), acquisitions and divestitures (pages 89 to 93),

detailed information on specific items within the financial statements,

certain contingencies and commitments (pages 112 to 115) and

retirement-related benefits information (pages 121 to 135).

• The Consolidated Financial Statements and the Notes have been

prepared in accordance with accounting principles generally

accepted in the United States (GAAP).

• The references to “adjusted for currency” or “at constant currency”

in the Management Discussion do not include operational

impacts that could result from fluctuations in foreign currency

rates. Certain financial results are adjusted based on a simple

mathematical model that translates current period results in local

currency using the comparable prior year period’s currency

conversion rate. This approach is used for countries where the

functional currency is the local country currency. This information

is provided so that certain financial results can be viewed without

the impact of fluctuations in foreign currency rates, thereby

facilitating period-to-period comparisons of business performance.

See “Currency Rate Fluctuations” on page 61 for additional

information.

• Within the financial statements and tables in this Annual Report,

certain columns and rows may not add due to the use of rounded

numbers for disclosure purposes. Percentages reported are

calculated from the underlying whole-dollar numbers.

Operating (non-GAAP) Earnings

In an effort to provide better transparency into the operational results

of the business, the company separated business results into

operating and non-operating categories beginning January 1, 2011.

Operating earnings is a non-GAAP measure that excludes the effects

of certain acquisition-related charges and retirement-related costs,

and their related tax impacts. For acquisitions, operating earnings

exclude the amortization of purchased intangible assets and

acquisition-related charges such as in-process research and

development, transaction costs, applicable restructuring and related

expenses and tax charges related to acquisition integration. For

retirement-related costs, the company has characterized certain

items as operating and others as non-operating. The company

includes defined benefit plan and nonpension postretirement benefit

plan service cost, amortization of prior service cost and the cost of

defined contribution plans in operating earnings. Non-operating

retirement-related cost includes defined benefit plan and nonpension

postretirement benefit plan interest cost, expected return on plan

assets, amortized actuarial gains/losses, the impacts of any plan

curtailments/settlements and multi-employer plan costs, pension

insolvency costs and other costs. Non-operating costs are primarily

related to changes in pension plan assets and liabilities which are

tied to financial market performance and the company considers

these costs to be outside the operational performance of the business.

Overall, the company believes that providing investors with a view

of operating earnings as described above provides increased

transparency and clarity into both the operational results of the

business and the performance of the company’s pension plans;

improves visibility to management decisions and their impacts

on operational performance; enables better comparison to peer

companies; and allows the company to provide a long-term strategic

view of the business going forward. For its 2015 earnings per share

Road Map, the company is utilizing an operating view to establish

its objectives and track its progress. Effective January 1, 2011, the

company’s segment financial results and performance reflect

operating earnings, consistent with the company’s management

and measurement system. The 2010 and 2009 financial results

in this Annual Report have been reclassified to conform with the

2011 presentation of business results into operating and non-

operating categories.

Forward-Looking

and Cautionary Statements

Certain statements contained in this Annual Report may constitute

forward-looking statements within the meaning of the Private

Secur ities Litigation Reform Act of 1995. Any forward-looking statement

in this Annual Report speaks only as of the date on which it is made;

the company assumes no obligation to update or revise any such