IBM 2011 Annual Report Download - page 36

Download and view the complete annual report

Please find page 36 of the 2011 IBM annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

34

Management Discussion

International Business Machines Corporation and Subsidiary Companies

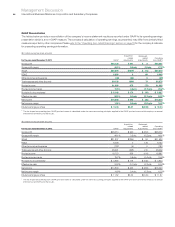

Research, Development and Engineering

($ in millions)

For the year ended December 31: 2011 2010

Yr.-to-Yr.

Percent

Change

Total consolidated research,

development and engineering $6,258 $6,026 3.8%

Non-operating adjustment

Non-operating retirement-related

(costs)/income 88 126 (30.4)

Operating (non-GAAP) research,

development and engineering $6,345 $6,152 3.1%

The company continues to invest in research and development,

focusing its investments on high-value, high-growth opportunities

and to extend its technology leadership. Total research, development

and engineering (RD&E) expense increased 3.8 percent in 2011

versus 2010, primarily driven by acquisitions (up 4 points) and

currency impacts (up 2 points), partially offset by base expense

(down 2 points). Operating (non-GAAP) RD&E expense increased

3.1 percent in 2011 compared to the prior year primarily driven by

the same factors. RD&E investments represented 5.9 percent of

revenue in 2011, compared to 6.0 percent in 2010.

Intellectual Property and Custom Development Income

($ in millions)

For the year ended December 31: 2011 2010

Yr.-to-Yr.

Percent

Change

Sales and other transfers

of intellectual property $ 309 $ 203 52.3%

Licensing/royalty-based fees 211 312 (32.5)

Custom development income 588 638 (8.0)

To t a l $1,108 $1,154 (4.0)%

The timing and amount of sales and other transfers of IP may

vary significantly from period to period depending upon timing

of divestitures, industry consolidation, economic conditions and

the timing of new patents and know-how development. There were

no significant individual IP transactions in 2011 or 2010.

Interest Expense

($ in millions)

For the year ended December 31: 2011 2010

Yr.-to-Yr.

Percent

Change

Interest expense

To t a l $411 $368 11.6%

The increase in interest expense in 2011 versus 2010 was primarily

driven by higher average debt levels, partially offset by lower average

interest rates. Interest expense is presented in cost of financing in

the Consolidated State ment of Earnings only if the related external

borrowings are to support the Global Financing external business.

See pages 66 and 67 for additional information regarding Global

Financing debt and interest expense. Overall interest expense

(excluding capitalized interest) for 2011 was $964 million, an

increase of $41 million year to year.

Stock-Based Compensation

Total pre-tax stock-based compensation cost of $697 million

increased $68 million compared to 2010. The increase was primarily

the result of an increase related to the company’s assumption of stock-

based awards previously issued by acquired entities ($22 million)

and increases related to restricted stock units and performance share

units ($48 million), partially offset by a reduction related to stock

options ($2 million). Cost, and the year-to-year change, was reflected

in the following categories: Cost: $120 million, up $27 million; SG&A

expense: $514 million, up $26 million; and RD&E expense: $62 million,

up $14 million.

See note R, “Stock-Based Compensation,” on pages 118 to 121

for additional information on stock-based incentive awards.

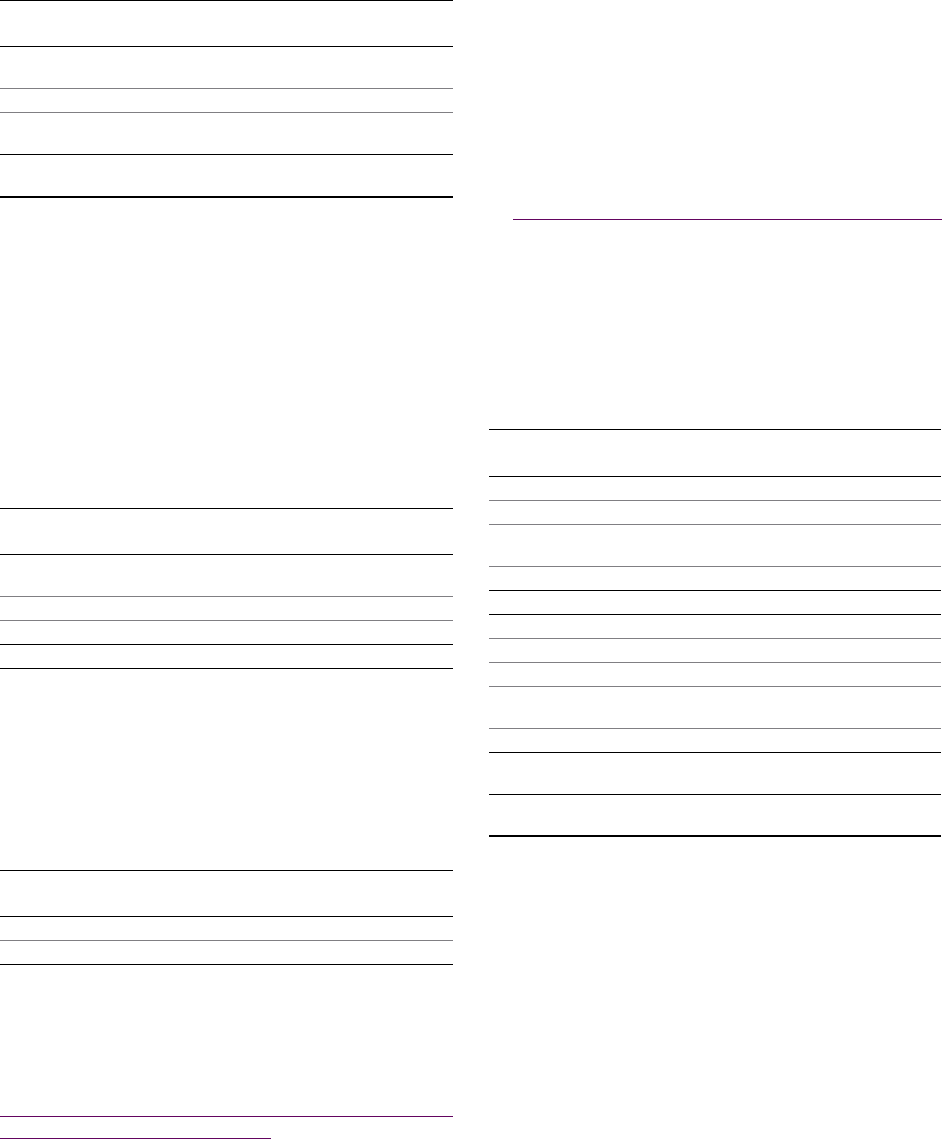

Retirement-Related Plans

The following table provides the total pre-tax cost for all retirement-

related plans. These amounts are included in the Consolidated

Statement of Earnings within the caption (e.g., Cost, SG&A, RD&E)

relating to the job function of the plan participants.

($ in millions)

For the year ended December 31: 2011 2010

Yr.-to-Yr.

Percent

Change

Retirement-related plans—cost

Service cost $ 549 $ 550 (0.2)%

Amortization of prior

service cost/(credits) (157)(183)(14.6)

Cost of defined contribution plans 1,513 1,430 5.8

Total operating costs $ 1,905 $ 1,796 6.0%

Interest cost 4,601 4,763 (3.4)

Expected return on plan assets (6,574)(6,488) 1.3

Recognized actuarial losses 1,788 1,194 49.7

Plan amendments/curtailments/

settlements 127 (98.0)

Multi-employer plan/other costs 112 89 26.0

Total non-operating costs/

(income) $ (72) $ (414) (82.5)%

Total retirement-related

plans—cost $ 1,832 $ 1,382 32.6%

In 2011, total retirement-related plans cost increased by $450 million

compared to 2010, primarily driven by an increase in recognized

actuarial losses of $594 million and increased cost associated with

defined contribution plans ($83 million), partially offset by lower

interest cost of $162 million and an increased expected return on

plan assets of $87 million.