IBM 2011 Annual Report Download - page 91

Download and view the complete annual report

Please find page 91 of the 2011 IBM annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

Notes to Consolidated Financial Statements

International Business Machines Corporation and Subsidiary Companies 89

Note C.

Acquisitions/Divestitures

Acquisitions

2011

In 2011, the company completed five acquisitions of privately held

companies at an aggregate cost of $1,849 million.

These acquisitions were completed as follows: in the second

quarter, TRIRIGA, Inc. (TRIRIGA); and in the fourth quarter, i2,

Algorithmics, Inc. (Algorithmics), Q1 Labs and Curam Software Ltd.

(Curam Software). TRIRIGA was integrated into the Software

and Global Business Services (GBS) segments upon acquisition.

All other acquisitions were integrated into the Software segment

upon acquisition. All acquisitions reflected 100 percent ownership

of the acquired companies.

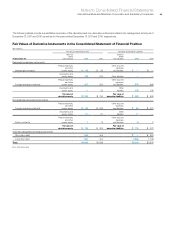

The table below reflects the purchase price related to these acquisitions and the resulting purchase price allocations as of December 31, 2011.

2011 Acquisitions

($ in millions)

Amortization

Life (in Years)

Tot a l

Acquisitions

Current assets $ 251

Fixed assets/noncurrent assets 88

Intangible assets

Goodwill N/A 1,291

Completed technology 7 320

Client relationships 7 222

Patents/trademarks 1 to 7 17

Total assets acquired 2,190

Current liabilities (191)

Noncurrent liabilities (150)

Total liabilities assumed (341)

Total purchase price $1,849

N/A—Not applicable

TRIRIGA is a provider of facility and real estate management software

solutions, which help clients make strategic decisions regarding

space usage, evaluate alternative real estate initiatives, generate

higher returns from capital projects and assess environmental impact

investments. The acquisition adds advanced real estate intelligence

to the company’s smarter buildings initiative. i2 expands the company’s

big data analytics software for smarter cities by helping both public

and private entities in government, law enforcement, retail, insurance

and other industries access and analyze information they need to

address crime, fraud and security threats. Algorithmics provides

software and services for improved business insights at financial

and insurance institutions to assess risk and address regulatory

challenges. Q1 Labs is a provider of security intelligence software

and will accelerate efforts to help clients more intelligently secure

their enterprises by applying analytics to correlate information from

key security domains and creating security dashboards for their

organizations. Curam Software is a provider of software and services

which help governments improve the efficiency, effectiveness and

accessibility of social programs for smarter cities.

Purchase price consideration for all acquisitions as reflected in

the table above, is paid primarily in cash. All acquisitions are reported

in the Consolidated Statement of Cash Flows net of acquired cash

and cash equivalents. The overall weighted-average life of the

indentified intangible assets acquired is 6.9 years. These identified

intangible assets will be amortized on a straight-line basis over

their useful lives. Goodwill of $1,291 million has been assigned to

the Software ($1,277 million) and GBS ($14 million) segments. It is

expected that approximately 25 percent of the goodwill will be

deductible for tax purposes.