IBM 2011 Annual Report Download - page 68

Download and view the complete annual report

Please find page 68 of the 2011 IBM annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

66

Management Discussion

International Business Machines Corporation and Subsidiary Companies

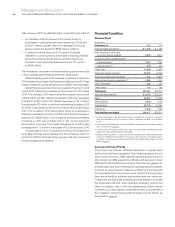

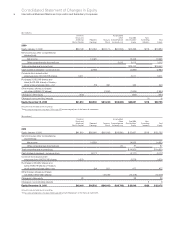

The table below presents the recorded amount of unguaranteed

residual value for sales-type, direct financing and operating leases

at December 31, 2010 and 2011. In addition, the table presents the

residual value as a percentage of the related original amount financed

and a run out of when the unguaranteed residual value assigned to

equipment on lease at December 31, 2011 is expected to be

returned to the company. In addition to the unguaranteed residual

value, on a limited basis, Global Financing will obtain guarantees of

the future value of the equipment to be returned at end of lease.

While primarily focused on IBM products, guarantees are also

obtained for certain OEM products. These third-party guarantees

are included in minimum lease payments as provided for by accounting

standards in the determination of lease classifications for the covered

equipment and provide protection against risk of loss arising from

declines in equipment values for these assets.

The residual value guarantee increases the minimum lease

payments that are utilized in determining the classification of a lease

as a sales-type lease, direct financing lease or operating lease. The

aggregate asset values associated with the guarantees for sales-type

leases were $821 million and $714 million for the financing transactions

originated during the years ended December 31, 2011 and 2010,

respectively. In 2011, the residual value guarantee program resulted

in the company recognizing approximately $532 million of revenue

that would otherwise have been recognized in future periods as

operating lease revenue. If the company had chosen to not participate

in a residual value guarantee program in 2011 and prior years, the

2011 impact would be substantially mitigated by the effect of prior-

year asset values being recognized as operating lease revenue in

the current year. The associated aggregate guaranteed future values

at the scheduled end of lease was $43 million for the financing

transactions originated during 2011 and 2010, respectively. The cost

of guarantees was $4 million for the year ended December 31, 2011

and $5 million for the year ended December 31, 2010.

Unguaranteed Residual Value

($ in millions)

To t a l Estimated Run Out of 2011 Balance

2010 2011 2012 2013 2014

2015 and

Beyond

Sales-type and direct financing leases $ 871 $ 745 $177 $194 $241 $132

Operating leases 328 296 121 97 64 14

Total unguaranteed residual value $ 1,199 $ 1,041 $298 $291 $305 $146

Related original amount financed $20,412 $18,635

Percentage 5.9% 5.6%

Debt

At December 31: 2011 2010

Debt-to-equity ratio 7.2x 7.0x

The company funds Global Financing through borrowings using a

debt-to-equity ratio target of approximately 7 to 1. The debt used to

fund Global Financing assets is composed of intercompany loans

and external debt. The terms of the intercompany loans are set by

the company to substantially match the term and currency underlying

the financing receivable and are based on arm’s-length pricing. Both

assets and debt are presented in the Global Financing Balance Sheet

on page 64.

Global Financing provides funding predominantly for the company’s

external clients assets, as well as for assets under contract by other

IBM units. As previously stated, the company measures Global

Financing as a stand-alone entity, and accordingly, interest expense

relating to debt supporting Global Financing’s external client and

internal business is included in the “Global Financing Results of

Operations” on pages 63 and 64 and in note T, “Segment Infor-

mation,” on pages 135 to 139.

In the company’s Consolidated Statement of Earnings on page

70, however, the external debt-related interest expense supporting

Global Financing’s internal financing to the company is reclassified

from cost of financing to interest expense.