IBM 2011 Annual Report Download - page 122

Download and view the complete annual report

Please find page 122 of the 2011 IBM annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

Notes to Consolidated Financial Statements

International Business Machines Corporation and Subsidiary Companies120

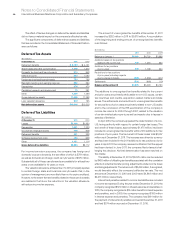

Stock Awards

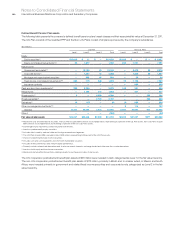

In lieu of stock options, the company currently grants its employees stock awards. These awards are made in the form of Restricted Stock

Units (RSUs), including Retention Restricted Stock Units (RRSUs) or Performance Share Units (PSUs).

The tables below summarize RSU and PSU activity under the Plans during the years ended December 31, 2011, 2010 and 2009.

RSUs

2011 2010 2009

Weighted

Average

Grant Price

Number

of Units

Weighted

Average

Grant Price

Number

of Units

Weighted

Average

Grant Price

Number

of Units

Balance at January 1 $110 11,196,446 $102 13,405,654 $100 12,397,515

RSUs granted 154 5,196,802 122 3,459,303 105 4,432,449

RSUs released 106 (3,508,700) 98 (5,102,951)99 (2,748,613)

RSUs canceled/forfeited 122 (665,947) 105 (565,560)101 (675,697)

Balance at December 31 $129 12,218,601 $110 11,196,446 $102 13,405,654

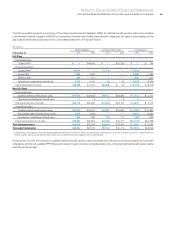

PSUs

2011 2010 2009

Weighted

Average

Grant Price

Number

of Units

Weighted

Average

Grant Price

Number

of Units

Weighted

Average

Grant Price

Number

of Units

Balance at January 1 $111 3,649,288 $107 3,476,737 $102 3,078,694

PSUs granted at target 154 1,055,687 117 1,239,468 101 1,568,129

Additional shares earned above target* 118 230,524 103 463,913 83 396,794

PSUs released 118 (1,189,765) 103 (1,486,484)83 (1,440,099)

PSUs canceled/forfeited 118 (58,743) 108 (44,346)111 (126,781)

Balance at December 31** $122 3,686,991 $111 3,649,288 $107 3,476,737

* Represents additional shares issued to employees after vesting of PSUs because final performance metrics exceeded specified targets.

**

Represents the number of shares expected to be issued based on achievement of grant date performance targets. The actual number of shares issued depends on the company’s

performance against specified targets over the vesting period.

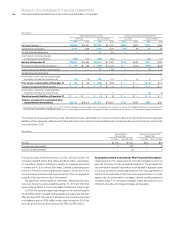

unrecognized compensation cost related to non-vested RSUs. The

company received no cash from employees as a result of employee

vesting and release of RSUs for the years ended December 31, 2011,

2010 and 2009. In the second quarter of 2011, the company granted

equity awards valued at approximately $1 thousand each to about

400,000 non-executive employees. These awards were made under

the Plans and vest in December 2015.

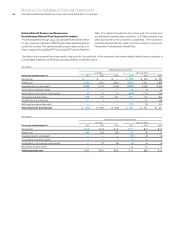

PSUs are stock awards where the number of shares ultimately

received by the employee depends on the company’s performance

against specified targets and typically vest over a three-year period.

The fair value of each PSU is determined on the grant date, based

on the company’s stock price, and assumes that performance

targets will be achieved. Over the performance period, the number

of shares of stock that will be issued is adjusted upward or downward

based upon the probability of achievement of performance targets.

The ultimate number of shares issued and the related compensation

cost recognized as expense will be based on a comparison of the

final performance metrics to the specified targets. The fair value of

PSUs granted at target during the years ended December 31, 2011,

2010 and 2009 was $165 million, $145 million and $159 million,

respectively. Total fair value of PSUs vested and released during

the years ended December 31, 2011, 2010 and 2009 was $141 million,

$153 million and $120 million, respectively.

RSUs are stock awards granted to employees that entitle the holder

to shares of common stock as the award vests, typically over a

one- to five-year period. The fair value of the awards is determined

and fixed on the grant date based on the company’s stock price.

RSUs granted to employees prior to January 1, 2008 are considered

participating securities as they receive non-forfeitable dividend

equivalents at the same rate as common stock. Any unvested awards

that contain these rights are included in computing earnings per

share pursuant to the two-class method. For RSUs awarded on or

after January 1, 2008, dividend equivalents are not paid. The fair

value of such RSUs is determined and fixed on the grant date based

on the company’s stock price adjusted for the exclusion of dividend

equivalents.

The remaining weighted-average contractual term of RSUs at

December 31, 2011, 2010 and 2009 is the same as the period over

which the remaining cost of the awards will be recognized, which

is approximately three years. The fair value of RSUs granted during

the years ended December 31, 2011, 2010 and 2009 was $803 million,

$421 million and $467 million, respectively. The total fair value of RSUs

vested and released during the years ended December 31, 2011,

2010 and 2009 was $373 million, $503 million and $272 million,

respectively. As of December 31, 2011, 2010 and 2009, there was

$1,021 million, $865 million and $892 million, respectively, of