IBM 2011 Annual Report Download - page 105

Download and view the complete annual report

Please find page 105 of the 2011 IBM annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

Notes to Consolidated Financial Statements

International Business Machines Corporation and Subsidiary Companies 103

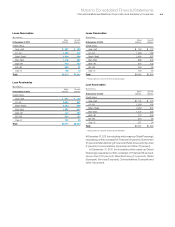

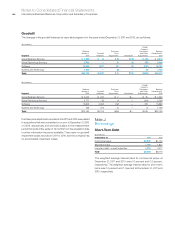

Lease Receivables

($ in millions)

At December 31, 2011:

Major

Markets

Growth

Markets

Credit rating

Aaa – Aa3 $ 697 $ 139

A1 – A3 1,459 306

Baa1 – Baa3 2,334 654

Ba1 – Ba2 1,118 457

Ba3 – B1 534 252

B2 – B3 260 97

Caa – D 108 15

To t a l $6,510 $1,921

Loan Receivables

($ in millions)

At December 31, 2011:

Major

Markets

Growth

Markets

Credit rating

Aaa – Aa3 $ 971 $ 185

A1 – A3 2,034 407

Baa1 – Baa3 3,255 869

Ba1 – Ba2 1,559 607

Ba3 – B1 744 335

B2 – B3 362 129

Caa – D 151 20

To t a l $9,077 $2,552

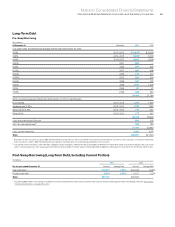

Lease Receivables*

($ in millions)

At December 31, 2010:

Major

Markets

Growth

Markets

Credit rating

Aaa – Aa3 $ 794 $ 173

A1 – A3 1,463 182

Baa1 – Baa3 2,494 837

Ba1 – Ba2 899 403

Ba3 – B1 518 242

B2 – B3 230 93

Caa – D 164 54

To t a l $6,562 $1,983

* Reclassified to conform with 2011 presentation.

Loan Receivables*

($ in millions)

At December 31, 2010:

Major

Markets

Growth

Markets

Credit rating

Aaa – Aa3 $1,100 $ 173

A1 – A3 2,026 183

Baa1 – Baa3 3,453 841

Ba1 – Ba2 1,245 405

Ba3 – B1 718 243

B2 – B3 318 94

Caa – D 227 54

To t a l $9,087 $1,993

* Reclassified to conform with 2011 presentation.

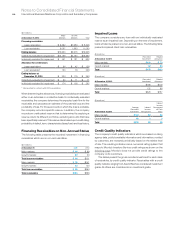

At December 31, 2011, the industries which made up Global Financing’s

receivables portfolio consisted of: Financial (39 percent), Government

(15 percent), Manufacturing (13 percent), Retail (9 percent), Services

(7 percent), Communications (6 percent) and Other (11 percent).

At December 31, 2010, the industries which made up Global

Financing’s receivables portfolio consisted of: Financial (36 percent),

Government (16 percent), Manufacturing (14 percent), Retail

(9 percent), Services (8 percent), Communications (5 percent) and

Other (12 percent).