IBM 2011 Annual Report Download - page 94

Download and view the complete annual report

Please find page 94 of the 2011 IBM annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

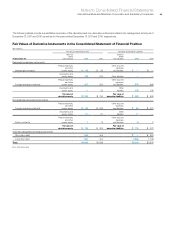

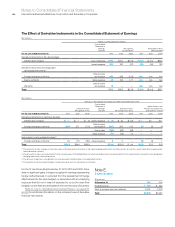

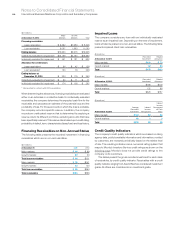

Notes to Consolidated Financial Statements

International Business Machines Corporation and Subsidiary Companies92

2009 Acquisitions

($ in millions)

Amortization Life

(in Years) SPSS

Other

Acquisitions

Current assets $ 397 $ 13

Fixed assets/noncurrent assets 20 1

Intangible assets

Goodwill N/A 748 255

Completed technology 4 to 7 105 39

Client relationships 5 to 7 30 20

Other identifiable assets 1 to 7 36 1

Total assets acquired 1,336 330

Current liabilities (157) (34)

Noncurrent liabilities (2) 0

Total liabilities assumed (160) (35)

Total purchase price $1,177 $295

N/A—Not applicable

Other Acquisitions—The Software segment also completed

acquisitions of four privately held companies: in the second quarter,

Outblaze Limited, a messaging software provider, and Exeros, Inc.,

a data discovery firm; in the third quarter, security provider Ounce

Labs, Inc.; and in the fourth quarter, Guardium, Inc., a database

security company. GTS completed an acquisition in the fourth quarter:

RedPill Solutions PTE Limited, a privately held company focused on

business analytics.

Purchase price consideration for the “Other Acquisitions,” as

reflected in the table above, was paid primarily in cash. All acquisitions

were reported in the Consolidated Statement of Cash Flows net of

acquired cash and cash equivalents. For the “Other Acquisitions,”

the overall weighted-average life of the identified intangible assets

acquired was 6.5 years. With the exception of goodwill, these identified

intangible assets will be amortized on a straight-line basis over their

useful lives. Goodwill of $255 million was assigned to the Software

($246 million) and GTS ($10 million) segments. Substantially all of

the goodwill is not deductible for tax purposes.

Divestitures

2011

During the fourth quarter of 2011, the company completed the

divestiture of the iCluster business to Rocket Software. iCluster,

which was acquired in the Data Mirror acquisition in 2007, was

part of the Software business. This transaction was not material

to the Consolidated Financial Statements.

During the second quarter of 2011, the company completed

two divestitures related to subsidiaries of IBM Japan. The impact

of these transactions was not material to the Consolidated Financial

Statements.

2010

On March 31, 2010, the company completed the sale of its activities

associated with the sales and support of Dassault Systemes’

(Dassault) product lifecycle management (PLM) software, including

customer contracts and related assets to Dassault. The company

received net proceeds of $459 million and recognized a net gain

of $591 million on the transaction in the first quarter of 2010. The

gain was net of the fair value of certain contractual terms, certain

transaction costs and the assets and liabilities sold. The gain was

recorded in other (income) and expense in the Consolidated Statement

of Earnings and the net proceeds were reflected in proceeds from

disposition of marketable securities and other investments within

cash flow from investing activities in the Consolidated Statement of

Cash Flows.