IBM 2011 Annual Report Download - page 66

Download and view the complete annual report

Please find page 66 of the 2011 IBM annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

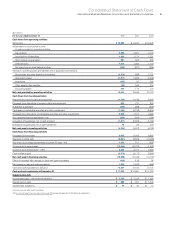

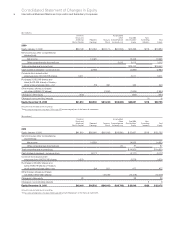

64

Management Discussion

International Business Machines Corporation and Subsidiary Companies

Total revenue in 2010 increased $4 million versus 2009 as a result of:

• An increase in internal revenue of 3.8 percent driven by

an increase in used equipment sales revenue (up 7.0 percent

to $1,277 million), partially offset by a decrease in financing

revenue (down 2.6 percent to $565 million); offset by

• A decline in external revenue of 2.8 percent (4 percent

adjusted for currency), due to a decrease in financing revenue

(down 7.9 percent to $1,580 million), partially offset by an

increase in used equipment sales revenue (up 12.1 percent

to $659 million).

The decreases in external and internal financing revenue were due

to lower average asset balances and lower asset yields.

Global Financing gross profit increased 3.4 percent compared to

2009 primarily due to higher used equipment sales gross profit. Gross

margin increased 2.0 points primarily due to a higher financing margin.

Global Financing pre-tax income increased 2.8 percent in 2011

versus 2010, following an increase of 13.5 percent in 2010 versus

2009. The increase in 2011 was driven by the increase in gross profit

of $122 million, partially offset by increases in financing receivables

provisions of $51 million and SG&A expenses of $13 million.

Normalizing for $2 million of workforce rebalancing charges in 2011

and 2010, respectively, pre-tax income increased 2.8 percent versus

2010. The increase in 2010 was primarily driven by a decrease in

financing receivables provisions of $152 million and the increase in

gross profit of $85 million. The increase in financing receivables

provisions in 2011 was primarily due to the current economic

environment in Europe. The overall allowance for credit losses

coverage rate is 1.3 percent, a decrease of 0.2 points versus 2010.

The decrease in return on equity from 2010 to 2011 was driven

by a higher average equity balance, and the increase in return on

equity from 2009 to 2010 was driven by higher after-tax income and

a lower average equity balance.

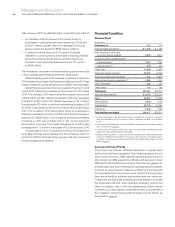

Financial Condition

Balance Sheet

($ in millions)

At December 31: 2011 2010

Cash and cash equivalents $ 1,308 $ 1,353

Net investment in sales-type

and direct financing leases 9,209 9,370

Equipment under operating leases

External clients (a) 1,567 1,827

Internal clients (b)(c) 219 500

Client loans 11,363 10,630

Total client financing assets 22,358 22,326

Commercial financing receivables 7,130 6,819

Intercompany financing receivables (b)(c) 4,586 4,204

Other receivables 334 321

Other assets 712 790

Total assets $36,427 $35,813

Intercompany payables

(b) $ 6,213 $ 6,717

Debt (d) 23,332 22,823

Other liabilities 3,633 3,016

Total liabilities 33,178 32,557

Total equity 3,249 3,256

Total liabilities and equity $36,427 $35,813

(a)

Includes intercompany mark up, priced on an arm’s-length basis, on products purchased

from the company’s product divisions, which is eliminated in IBM’s consolidated

results.

(b)

Entire amount eliminated for purposes of IBM’s consolidated results and therefore

does not appear on page 72.

(c) These assets, along with all other financing assets in this table, are leveraged at the

value in the table using Global Financing debt.

(d) Global Financing debt is comprised of intercompany loans and external debt.

A portion of Global Financing debt is in support of the company’s internal business,

or related to intercompany mark up embedded in the Global Financing assets. See

table on page 67.

Sources and Uses of Funds

The primary use of funds in Global Financing is to originate client

and commercial financing assets. Client financing assets for end

users consist primarily of IBM systems, software and services, but

also include non-IBM equipment, software and services to meet

IBM clients’ total solutions requirements. Client financing assets are

primarily sales-type, direct financing and operating leases for systems

products as well as loans for systems, software and services with

terms generally from one to seven years. Global Financing’s client

loans are primarily for software and services and are unsecured.

These loans are subjected to additional credit analysis to evaluate

the associated risk and, when deemed necessary, actions are

taken to mitigate risks in the loan agreements which include

covenants to protect against credit deterioration during the life of

the obligation. Client financing also includes internal activity as

described on page 24.