IBM 2011 Annual Report Download - page 95

Download and view the complete annual report

Please find page 95 of the 2011 IBM annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

Notes to Consolidated Financial Statements

International Business Machines Corporation and Subsidiary Companies 93

2009

On October 1, 2009, the company completed the divestiture of its

UniData and UniVerse software products and related tools to Rocket

Software, a privately held global software development firm. The

company recognized gains related to this transaction in the fourth

quarter of 2009 and in the fourth quarter of 2010.

On March 16, 2009, the company completed the sale of certain

processes, resources, assets and third-party contracts related to

its core logistics operations to Geodis. The company received

proceeds of $365 million and recognized a net gain of $298 million

on the transaction in the first quarter of 2009. The gain was net of

the fair value of certain contractual terms, certain transaction costs

and related real estate charges. As part of this transaction, the

company outsourced its logistics operations to Geodis which enables

the company to leverage industry-leading skills and scale and

improve the productivity of the company’s supply chain.

Note D.

Financial Instruments

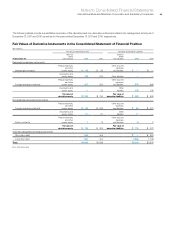

Fair Value Measurements

Financial Assets and Liabilities Measured at Fair Value on a Recurring Basis

The following tables present the company’s financial assets and financial liabilities that are measured at fair value on a recurring basis at

December 31, 2011 and 2010.

($ in millions)

At December 31, 2011: Level 1 Level 2 Level 3 To t a l

Assets

Cash equivalents (1)

Time deposits and certificates of deposit $ — $2,082 $— $2,082

Commercial paper — 1,760 — 1,760

Money market funds 1,886 — — 1,886

U.S. government securities — 2,750 — 2,750

Other securities — 8 — 8

To ta l 1,886 6,600 — 8,486(5)

Debt securities—noncurrent (2) 1 7 — 8

Available-for-sale equity investments (2) 69 14 — 83

Derivative assets (3)

Interest rate contracts — 783 — 783

Foreign exchange contracts — 510 — 510

Equity contracts — 7 — 7

To ta l — 1,300 — 1,300 (6)

Total assets $1,956 $7,921 $— $9,877 (6)

Liabilities

Derivative liabilities (4)

Foreign exchange contracts $ — $ 523 $— $ 523

Equity contracts — 8 — 8

Total liabilities $ — $ 531 $— $ 531 (6)

(1) Included within cash and cash equivalents in the Consolidated Statement of Financial Position.

(2) Included within investments and sundry assets in the Consolidated Statement of Financial Position.

(3)

The gross balances of derivative assets contained within prepaid expenses and other current assets, and investments in sundry assets in the Consolidated Statement of Financial

Position at December 31, 2011 are $546 million and $754 million, respectively.

(4)

The gross balances of derivative liabilities contained within other accrued expenses and liabilities, and other liabilities in the Consolidated Statement of Financial Position

at December 31, 2011 are $365 million and $166 million, respectively.

(5) Available-for-sale securities with carrying values that approximate fair value.

(6)

If derivative exposures covered by a qualifying master netting agreement had been netted in the Consolidated Statement of Financial Position, the total derivative asset and

liability positions would have been reduced by $324 million each.