IBM 2011 Annual Report Download - page 21

Download and view the complete annual report

Please find page 21 of the 2011 IBM annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

19

Management Discussion

International Business Machines Corporation and Subsidiary Companies

statements. Forward-looking statements are based on the company’s

current assumptions regarding future business and financial

performance; these statements by their nature address matters that

are uncertain to different degrees. Forward-looking statements

involve a number of risks, uncertainties and other factors that could

cause actual results to be materially different, as discussed more

fully elsewhere in this Annual Report and in the company’s filings

with the Securities and Exchange Commission (SEC), including the

company’s 2011 Form 10-K filed on February 28, 2012.

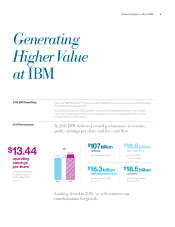

Management Discussion Snapshot

($ and shares in millions except per share amounts)

For the year ended December 31: 2011 2010

Yr.-to-Yr.

Percent/

Margin

Change

Revenue $106,916 $ 99,870 7.1%*

Gross profit margin 46.9% 46.1% 0.8 pts.

Total expense and other income $ 29,135 $ 26,291 10.8%

Total expense and other

income-to-revenue ratio 27.3% 26.3% 0.9 pts.

Income before income taxes $ 21,003 $ 19,723 6.5%

Provision for income taxes 5,148 4,890 5.3%

Net income $ 15,855 $ 14,833 6.9%

Net income margin 14.8% 14.9% 0.0 pts.

Earnings per share

of common stock

Assuming dilution $ 13.06 $ 11.52 13.4%

Weighted-average shares

outstanding

Assuming dilution 1,213.8 1,287.4 (5.7)%

Assets** $116,433 $113,452 2.6%

Liabilities** $ 96,197 $ 90,279 6.6%

Equity** $ 20,236 $ 23,172 (12.7)%

* 3.4 percent adjusted for currency.

** At December 31.

The following table provides the company’s operating (non-GAAP)

earnings for 2011 and 2010.

($ in millions except per share amounts)

For the year ended December 31: 2011 2010

Yr.-to-Yr.

Percent

Change

Net income as reported $15,855 $14,833 6.9%

Non-operating adjustments

(net of tax)

Acquisition-related charges 495 443 12.0

Non-operating retirement-related

costs/(income) (32) (253)(87.3)

Operating (non-GAAP) earnings* $16,318 $15,023 8.6%

Diluted operating (non-GAAP)

earnings per share $ 13.44 $ 11.67 15.2%

*

See page 38 for a more detailed reconciliation of net income to operating earnings.

In 2011, the company delivered strong financial results highlighted by

solid revenue performance, continued margin expansion, strong profit

and cash generation and effective use of cash. In its centennial year,

the company achieved record levels of revenue, profit, free cash flow

and earnings per share (EPS). The financial performance is the result

of the transformation of the company which began years ago. This

transformation has been focused on shifting the business to higher

value areas of the market, improving productivity and investing in

opportunities to drive future growth. These changes have contributed

to nine consecutive years of double-digit earnings per share growth.

More importantly, this transformation has strengthened the business

and put the company on track to achieve its 2015 Road Map objective

of at least $20 of operating (non-GAAP) earnings per share.

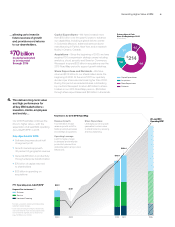

The focus on key growth initiatives and investments in innovation

are enabling the company to expand into new markets and capitalize

on trends like business analytics and cloud computing. The growth

markets strategy to expand into new markets, build out IT infrastructures

and lead in specific industries is driving strong performance and

market share gains. Growth markets revenue increased 16.0 percent

(11 percent adjusted for currency) in 2011 contributing approximately

two-thirds of the total constant currency revenue growth for the year

and represented 22 percent of total geographic revenue. The

company’s business analytics solutions helps clients leverage

massive amounts of data and content to gain business insight and

optimize results. Business analytics revenue increased 16 percent

compared to 2010. The Smarter Planet offerings generated close to

50 percent growth year to year, with Smarter Commerce demonstrating

strong market momentum. In cloud computing, the company is

helping its clients improve the economics of information technology.

In 2011, the company continued to expand its offerings and cloud

revenue for the year was more than three times the prior year results.

With strong contribution from these growth initiatives, the company

delivered revenue growth of 7.1 percent (3 percent adjusted for

currency) compared to 2010.

Segment performance was led by Software which increased

revenue 10.9 percent (8 percent adjusted for currency) driven by key

branded middleware which increased 15.6 percent (13 percent adjusted

for currency) and continued to extend its lead in the middleware

market. In the Global Services business, Global Technology Services

increased 7.0 percent (3 percent adjusted for currency) and Global

Business Services grew revenue 5.8 percent (1 percent adjusted for

currency) driven by strong performance in the growth markets where

both segments grew revenue 11 percent at constant currency. Systems

and Technology delivered revenue growth of 5.6 percent (3 percent

adjusted for currency) driven by strong performance in Power Systems

which increased 12.0 percent (9 percent adjusted for currency) and

the growth markets which increased 14.9 percent (12 percent

adjusted for currency).

The consolidated gross profit margin increased 0.8 points versus

2010 to 46.9 percent. This was the eighth consecutive year of

improvement in the gross profit margin. The operating (non-GAAP)

gross margin of 47.2 percent increased 1.1 points compared to the

prior year. The increase in gross margin in 2011 was driven by margin

improvements in Software, Systems and Technology and Global

Services, and an improved revenue mix driven by Software.