IBM 2011 Annual Report Download - page 48

Download and view the complete annual report

Please find page 48 of the 2011 IBM annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

46

Management Discussion

International Business Machines Corporation and Subsidiary Companies

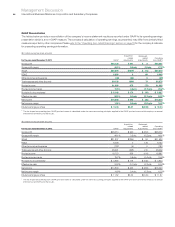

Segment Details

The following is an analysis of the 2010 and 2009 reportable segment results. The table below presents each reportable segment’s external

revenue and gross margin results. Segment pre-tax income includes transactions between the segments that are intended to reflect an

arm’s length transfer price and excludes certain unallocated corporate items.

($ in millions)

For the year ended December 31: 2010*2009*

Yr.-to-Yr.

Percent/

Margin

Change

Yr.-to-Yr.

Percent Change

Adjusted for

Currency

Revenue

Global Technology Services $38,201 $37,347 2.3%0.7%

Gross margin 34.5% 34.8% (0.3) pts.

Global Business Services 18,223 17,653 3.2%1.6%

Gross margin 28.0% 27.8% 0.3 pts.

Software 22,485 21,396 5.1%4.8%

Gross margin 87.9% 86.7% 1.2 pts.

Systems and Technology 17,973 16,190 11.0%11.1%

Gross margin 38.1% 37.5% 0.7 pts.

Global Financing 2,238 2,302 (2.8)% (4.3)%

Gross margin 51.3% 47.5% 3.8 pts.

Other 750 869 (13.7)% (13.8)%

Gross margin (8.6)% 17.5% (26.1) pts.

Total consolidated revenue $99,870 $95,758 4.3%3.3%

Total consolidated gross profit $46,014 $43,785 5.1%

Total consolidated gross margin 46.1% 45.7% 0.3 pts.

Non-operating adjustments

Amortization of acquired intangibles assets 260 204 27.5%

Acquisition-related charges 0 — NM

Retirement-related costs/(income) (204) (259)(21.4)%

Operating (non-GAAP) gross profit $46,070 $43,730 5.4%

Operating (non-GAAP) gross margin 46.1% 45.7% 0.5 pts.

* Reclassified to conform with 2011 presentation.

NM—Not meaningful