IBM 2011 Annual Report Download - page 53

Download and view the complete annual report

Please find page 53 of the 2011 IBM annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

51

Management Discussion

International Business Machines Corporation and Subsidiary Companies

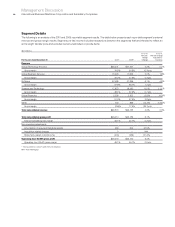

Total Expense and Other Income

($ in millions)

For the year ended December 31: 2010 2009

Yr.-to-Yr.

Percent/

Margin

Change

Total consolidated expense

and other (income) $26,291 $25,647 2.5%

Non-operating adjustments

Amortization of acquired

intangible assets (253) (285) (11.3)

Acquisition-related charges (46) (9) NM

Non-operating retirement-related

(costs)/income 210 250 (15.9)

Total operating (non-GAAP)

expense and other (income) $26,202 $25,603 2.3%

Total consolidated

expense-to-revenue ratio 26.3% 26.8%(0.5) pts.

Operating (non-GAAP)

expense-to-revenue ratio 26.2%26.7%(0.5) pts.

NM—Not meaningful

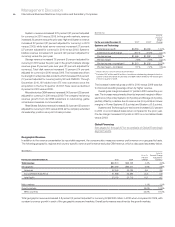

Total expense and other (income) increased 2.5 percent in 2010

compared to the prior year. Total operating (non-GAAP) expense

and other (income) increased 2.3 percent in 2010 versus 2009. The

key drivers of the year-to-year change in total expense and other

(income) for both expense presentations were approximately:

• Acquisitions* 3 points

• Currency** 1 point

• Base expense (2) points

* Includes acquisitions completed in prior 12-month period.

** Reflects impacts of tranlation and hedging programs.

The company’s expense-to-revenue ratio improved in both presentations

in 2010 versus 2009. The increase in total expense and other income

was primarily driven by the company’s acquisitions and the effects

of currency.

Base expense improved approximately 2 points in both

presentations in 2010 when compared to the prior year. The company

has had an ongoing focus on increasing efficiency and driving

productivity across the business. Savings from productivity initiatives

result in improved profitability and enables continued investments

in innovation and key growth initiatives.

Examples of the company’s investments in 2010 include:

• Industry sales skills to support Smarter Planet

• Sales capabilities for business analytics, including

the establishment of eight analytics solution centers

• Development, sales and marketing to support new high-end

technology solutions in mainframes and POWER7

• Sales resources and sales enablement to drive growth

market performance

• Acquisition of 17 companies adding significant capabilities

For additional information regarding total expense and other income,

see the following analyses by category.

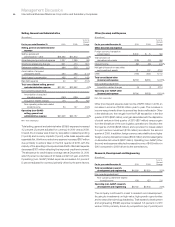

Revenue from the major markets increased 1.1 percent (1 percent

adjusted for currency) and was led by growth in the U.S., the U.K.

and France. Performance in the major markets improved in the

second half of 2010. The major markets grew 0.3 percent (declined

1 percent adjusted for currency) in the first half and increased

1.7 percent (3 percent adjusted for currency) in the second half.

Revenue from the growth markets increased 16.0 percent (11 percent

adjusted for currency). The growth markets performance, adjusted

for currency, outpaced the more established major markets by

10 points in 2010 and geographic revenue contribution increased to

21 percent, 2 points higher versus 2009. The combined revenue in

the BRIC countries, which represented approximately 40 percent of

the growth markets in 2010, increased 22.8 percent (18 percent

adjusted for currency) with growth in each of the four countries

and strong growth in China and Russia. The company continued to

make investments in these markets to drive market expansion

and infrastructure development. The growth markets performance

overall was broad based with double-digit growth at constant

currency in a total of 40 growth market countries.

Americas revenue increased 4.6 percent (3 percent adjusted for

currency) in 2010. Within the major market countries, the U.S. increased

2.7 percent and Canada increased 10.4 percent (flat adjusted for

currency). Revenue in the Latin America growth markets increased

15.4 percent (14 percent adjusted for currency) led by Brazil with

growth of 20.4 percent (12 percent adjusted for currency).

Europe/Middle East/Africa (EMEA) revenue decreased 2.2 percent

(increased 1 percent adjusted for currency) in 2010 compared to

2009. In the major market countries, revenue increased in the U.K.

4.5 percent (6 percent adjusted for currency), while revenue declined

in Spain 5.6 percent (1 percent adjusted for currency), Germany

7.7 percent (3 percent adjusted for currency) and Italy 8.7 percent

(4 percent adjusted for currency). In France, revenue declined 1.8 percent

as reported, but increased 4 percent at constant currency. Russia

revenue increased 49.0 percent (48 percent adjusted for currency).

Asia Pacific revenue increased 11.8 percent (5 percent adjusted

for currency) year over year. Asia Pacific growth market countries

increased 18.3 percent (11 percent adjusted for currency), led by

growth in China and India. China revenue increased 23.4 percent

(23 percent adjusted for currency) and India revenue increased

19.2 percent (13 percent adjusted for currency). Japan revenue

increased 5.0 percent as reported but declined 2 percent adjusted

for currency in 2010 compared to the prior year.

OEM revenue of $2,811 million in 2010 increased 23.3 percent

(23 percent adjusted for currency) compared to 2009 driven by

growth in the Microelectronics OEM business.