IBM 2011 Annual Report Download - page 3

Download and view the complete annual report

Please find page 3 of the 2011 IBM annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.1

I am pleased to report that IBM had

another strong year in 2011. Your

company continued to outperform

our industry and the market at large.

We capped IBM’s rst century by

achieving record revenue, prot,

free cash ow and earnings per share.

At the same time, we continued to

deliver superior returns to you, and we

are well positioned for future growth

in a globally integrating economy.

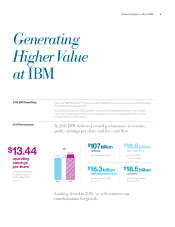

Revenue and income: Our revenue in 2011 was

$107 billion, up 7 percent. We grew operating pre-tax

income by 9 percent, to $21.6 billion, our highest ever.

Margins: IBM’s operating pre-tax income margin rose for

the ninth consecutive year

—

to 20.2 percent, up 10 points

since 2000. We achieved this by continuing to shift our

business mix to more protable segments and by driving

productivity. More than 90 percent of our segment prot

in 2011 was from software, services and nancing.

Earnings per share: We have continued to achieve

strong EPS growth. Last year was another record, with

diluted operating earnings per share of $13.44, up

15 percent. This marked nine straight years of double-

digit EPS growth.

Cash ow: IBM has consistently generated strong

cash ow, a key indicator of real business performance.

In 2011 our free cash ow was $16.6 billion. We have

improved our free cash ow by nearly $10 billion over

the past decade. We ended 2011 with $11.9 billion of

cash and marketable securities.

Investment and return to shareholders: Our cash ow

has enabled us to invest in the business and to generate

substantial returns to investors, while spending

$6.3 billion on R&D. In 2011 we invested $1.8 billion for

ve acquisitions in key areas of software and $4.1 billion

in net capital expenditures. We were able to return

$18.5 billion to you

—

$15 billion through share

repurchases and $3.5 billion through dividends. Last year’s

dividend increase was 15 percent, marking the 16th

year in a row in which we have raised our dividend, and

the 96th consecutive year in which we have paid one.

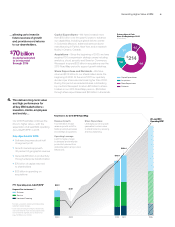

A road map to the future

This performance was the result of disciplined execution

by more than 400,000 IBMers and the strategic

repositioning of the company over the past decade.

We have steadily realigned our business to lead in a

new era of computing and to enable our clients to

benet from the new capabilities that era is creating.

As a consequence, our investors benet from a business

model that is both sustainable over the long term

and fueled by some of the world’s most attractive high-

growth markets and technologies.

A Letter from

the President and CEO