IBM 2011 Annual Report Download - page 117

Download and view the complete annual report

Please find page 117 of the 2011 IBM annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

Notes to Consolidated Financial Statements

International Business Machines Corporation and Subsidiary Companies 115

The company has applied the guidance requiring a guarantor to

disclose certain types of guarantees, even if the likelihood of requiring

the guarantor’s performance is remote. The following is a description

of arrangements in which the company is the guarantor.

The company is a party to a variety of agreements pursuant to

which it may be obligated to indemnify the other party with respect

to certain matters. Typically, these obligations arise in the context of

contracts entered into by the company, under which the company

customarily agrees to hold the other party harmless against losses

arising from a breach of representations and covenants related to

such matters as title to assets sold, certain IP rights, specified

environmental matters, third-party performance of nonfinancial

contractual obligations and certain income taxes. In each of these

circumstances, payment by the company is conditioned on the other

party making a claim pursuant to the procedures specified in the

particular contract, the procedures of which typically allow the

company to challenge the other party’s claims. While typically

indemnification provisions do not include a contractual maximum

on the company’s payment, the company’s obligations under these

agreements may be limited in terms of time and/or nature of claim,

and in some instances, the company may have recourse against

third parties for certain payments made by the company.

It is not possible to predict the maximum potential amount of

future payments under these or similar agreements due to the

conditional nature of the company’s obligations and the unique facts

and circumstances involved in each particular agreement. Historically,

payments made by the company under these agreements have not

had a material effect on the company’s business, financial condition

or results of operations.

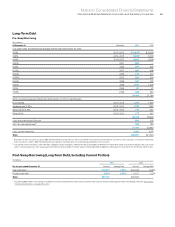

In addition, the company guarantees certain loans and financial

commitments. The maximum potential future payment under

these financial guarantees was $42 million and $48 million at

December 31, 2011 and 2010, respectively. The fair value of the

guarantees recognized in the Consolidated Statement of Financial

Position is not material.

Note N.

Ta xe s

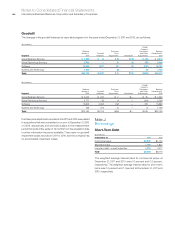

($ in millions)

For the year ended December 31: 2011 2010 2009

Income before income taxes

U.S. operations $ 9,716 $ 9,140 $ 9,524

Non-U.S. operations 11,287 10,583 8,614

Total income before income taxes $21,003 $19,723 $18,138

The provision for income taxes by geographic operations is as follows:

($ in millions)

For the year ended December 31: 2011 2010 2009

U.S. operations $2,141 $2,000 $2,427

Non-U.S. operations 3,007 2,890 2,286

Total provision for income taxes $5,148 $4,890 $4,713

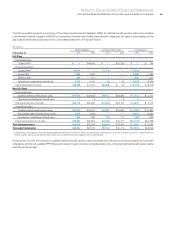

The components of the provision for income taxes by taxing jurisdiction

are as follows:

($ in millions)

For the year ended December 31: 2011 2010 2009

U.S. federal

Current $ 268 $ 190 $ 473

Deferred 909 1,015 1,341

1,177 1,205 1,814

U.S. state and local

Current 429 279 120

Deferred 81 210 185

510 489 305

Non-U.S.

Current 3,239 3,127 2,347

Deferred 222 69 247

3,461 3,196 2,594

Total provision for income taxes 5,148 4,890 4,713

Provision for social security,

real estate, personal property

and other taxes 4,289 4,018 3,986

Total taxes included in net income $9,437 $8,908 $8,699

A reconciliation of the statutory U.S. federal tax rate to the company’s

effective tax rate is as follows:

($ in millions)

For the year ended December 31: 2011 2010 2009

Statutory rate 35% 35% 35%

Foreign tax differential (10) (10) (9)

State and local 22 1

Other (2) (2) (1)

Effective rate 25% 25% 26%

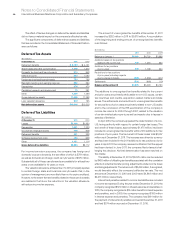

The significant components reflected within the tax rate reconciliation

above labeled “Foreign tax differential” include the effects of foreign

subsidiaries’ earnings taxed at rates other than the U.S. statutory

rate, foreign export incentives, U.S. tax impacts of non-U.S. earnings

repatriation and any net impacts of intercompany transactions. These

items also reflect audit settlements or changes in the amount of

unrecognized tax benefits associated with each of these items.

In the second quarter of 2011, the company reached agreement

with the Internal Revenue Service (IRS) related to the valuation of

certain intellectual property within the 2004-2005 and 2006-2007

audit periods. The agreement resolved all open matters for the period

2004 though 2007 with the IRS. As a result, the company recorded

a benefit to the provision for income taxes of $173 million.

In the fourth quarter of 2011, the IRS commenced its audit of the

company’s U.S. tax returns for the years 2008 through 2010.