IBM 2011 Annual Report Download - page 138

Download and view the complete annual report

Please find page 138 of the 2011 IBM annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

Notes to Consolidated Financial Statements

International Business Machines Corporation and Subsidiary Companies136

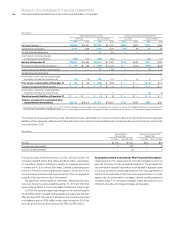

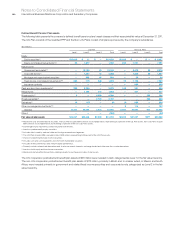

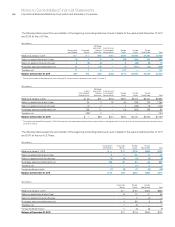

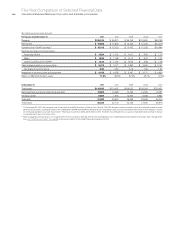

The following tables reflect the results of operations of the company’s segments consistent with the management and measurement system

utilized within the company. Performance measurement is based on pre-tax income. These results are used, in part, by senior management,

both in evaluating the performance of, and in allocating resources to, each of the segments. Effective January 1, 2011, the company transitioned

its management and measurement system to reflect operating earnings in an effort to provide better transparency into the operating results

of the business. As a result, certain acquisition-related charges and non-operating retirement-related costs are not reflected in the segment

results. See the “Operating (non-GAAP) Earnings” section on page 18 for additional information regarding this change. Prior year segment

pre-tax income and pre-tax margin have been reclassified to conform to the new management and measurement system.

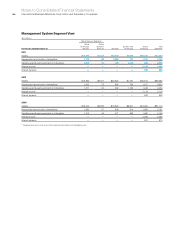

Management System Segment View

($ in millions)

Global Services Segments

For the year ended December 31:

Global

Technology

Services

Global

Business

Services Software

Systems and

Technology

Global

Financing

Tot a l

Segments

2011

External revenue $40,879 $19,284 $24,944 $ 18,985 $2,102 $106,194

Internal revenue 1,242 797 3,276 838 2,092 8,246

Total revenue $42,121 $20,081 $28,219 $19,823 $4,195 $114,440

Pre-tax income $ 6,284 $ 3,006 $ 9,970 $ 1,633 $2,011 $ 22,904

Revenue year-to-year change 6.6% 5.6% 10.9% 5.6% 2.8% 7.1%

Pre-tax income year-to-year change 14.3% 18.1% 5.3% 12.2% 2.8% 9.5%

Pre-tax income margin 14.9% 15.0% 35.3% 8.2% 47.9% 20.0%

2010

External revenue $38,201 $18,223 $22,485 $ 17,973 $2,238 $ 99,120

Internal revenue 1,313 798 2,950 804 1,842 7,707

Total revenue $39,514 $19,021 $25,436 $18,777 $4,080 $106,827

Pre-tax income* $ 5,499 $ 2,546 $ 9,466 $ 1,456 $1,956 $ 20,923

Revenue year-to-year change 2.0% 2.6% 5.7% 9.8% 0.1% 4.2%

Pre-tax income year-to-year change* 0.3% 1.8% 13.8% 12.1% 13.5% 8.3%

Pre-tax income margin* 13.9% 13.4% 37.2% 7.8% 48.0% 19.6%

2009

External revenue $37,347 $17,653 $21,396 $ 16,190 $2,302 $ 94,889

Internal revenue 1,386 887 2,677 911 1,774 7,635

Total revenue $38,734 $18,540 $24,073 $17,102 $4,076 $102,524

Pre-tax income* $ 5,482 $ 2,501 $ 8,319 $ 1,298 $1,724 $ 19,323

Revenue year-to-year change (5.1)% (10.3)% (3.1)% (15.2)% (8.4)% (7.6)%

Pre-tax income year-to-year change* 23.0% (3.4)% 13.9% (8.8)% 7.1% 11.2%

Pre-tax income margin* 14.2% 13.5% 34.6% 7.6% 42.3% 18.8%

* Reclassified to conform with 2011 presentation.