IBM 2011 Annual Report Download - page 12

Download and view the complete annual report

Please find page 12 of the 2011 IBM annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

16.6

20.2%

6.7

10.1%

00 11

3

6

$18

12

15

9

0

IBM has built a record of leadership by pursuing the most

transformational opportunities, inventing the breakthrough

technologies to capture them and building an organization

able to deliver superior results over the long term.

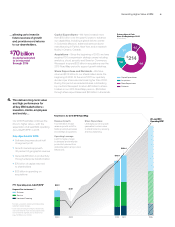

We continually change

our business mix toward

higher-value, more profitable

technologies and market

opportunities.

About

50%

of IBM segment

profit expected

to come from

Software by 2015

We have become a globally

integrated enterprise, to

capture new growth and

improve productivity.

Approaching

30%

of geographic revenue

from growth markets

by 2015

By aligning our business

model with our clients’

needs we generated

superior financial results …

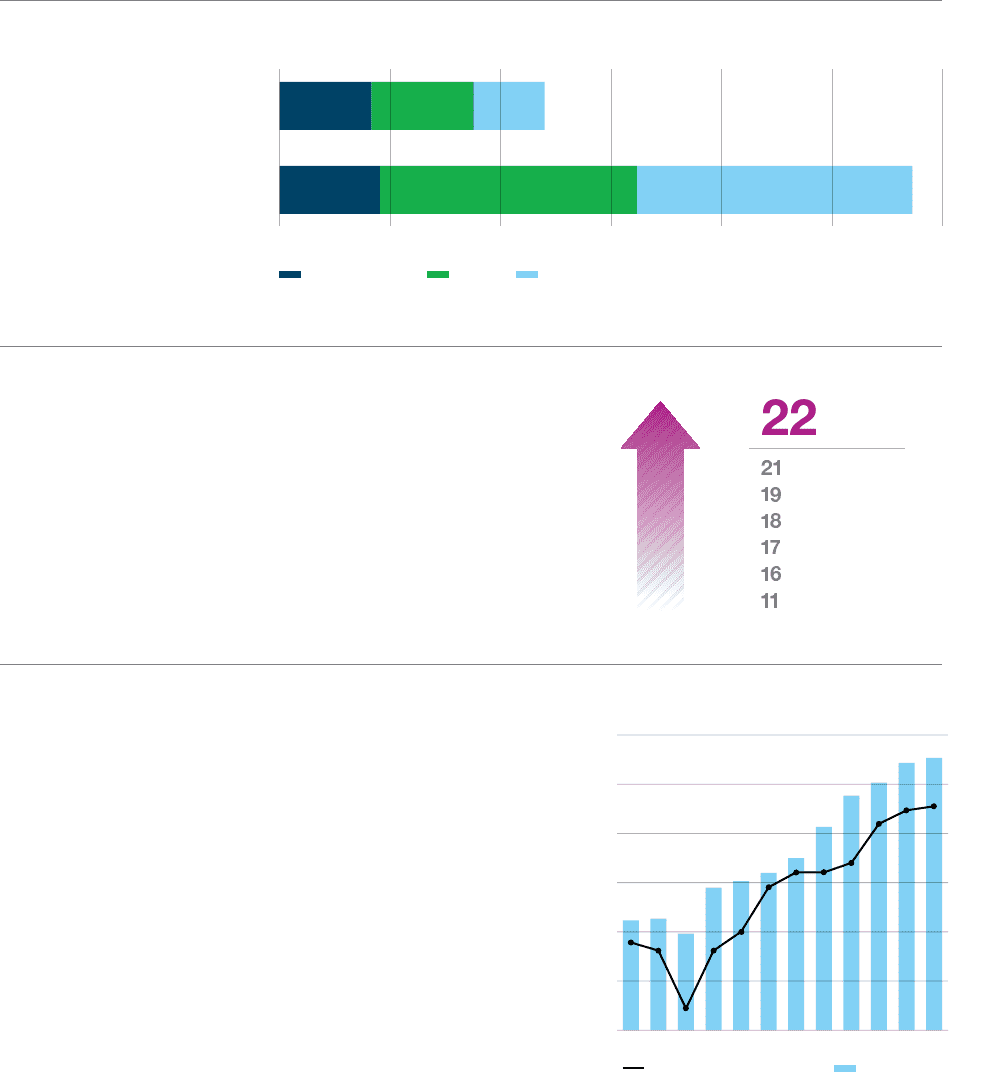

Hardware/Financing Services Software

Segment Pre-Tax Income*

($ in billions)

IBM operations in more than 170 countries

leverage the company’s global scale and

expertise.

Global integration of all our major enterprise

functions—from service delivery to

marketing—has enabled IBM to gain more

than $6 billion in enterprise productivity

savings over the past five years while

improving quality.

A globally integrated model allows us to

focus resources on client-oriented work and

enable rapid deployment of IBM capabilities

to growth markets.

1.

2.

3.

0$2416 201284

3.6 9.3 10.0

3.3 3.7 2.6

2000**

2011

35%38%27%

16%41%44%

Operating Pre-tax Income Margin and Free Cash Flow

($ in billions)

* Sum of external segment pre-tax income not equal to IBM pre-tax income.

** Excludes Enterprise Investments and not restated for stock-based compensation. 2000 Segment PTI is reclassified to conform with 2011 presentation.

Growth Markets Share of Geographic Revenue

* Excluding divested businesses of PCs and printers.

Operating Pre-tax Income Margin Free Cash Flow

2011

2010

2009

2008

2007

2006

2000

%

%

%

%

%

%

%*

Our operating (non-GAAP) pre-tax income

margin in 2011 was 20.2 percent, 10 points

higher than in 2000. The primary driver

of this performance was gross profit margin

expansion, as a result of the shift in

our business mix to more profitable, higher-

value segments and improved productivity

across the enterprise.

At the same time, we’ve increased R&D

investment. Since the beginning of

2000, we’ve spent nearly $70 billion in R&D,

enabling us to deliver key innovations

and maintain U.S. patent leadership for

our 19th consecutive year in 2011.

Our strong business model performance

has resulted in consistently strong free cash

flow generation. In 2011 our free cash flow

was $16.6 billion—an increase of nearly

$10 billion since 2000.

10