IBM 2011 Annual Report Download - page 5

Download and view the complete annual report

Please find page 5 of the 2011 IBM annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

3A Letter from the President and CEO

You see this expressed in nancial terms in our EPS road

maps. We introduced our rst in 2007, and surpassed

our 2010 objectives. Now, we are well on track toward our

2015 Road Map goal of at least $20 in operating earnings

per share.

As before, the road map is not simply a list of targets,

but a management model built on exploiting multiple

ways to create value. Operating leverage will come

from our continuing shift to higher-margin businesses

and improving enterprise productivity

—

expected to

be $8 billion over this ve-year period. We will create

value for shareholders through an anticipated $50 billion

in share repurchases and $20 billion in dividends.

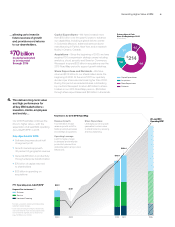

When it comes to growth strategies, we are focused

on four high-growth spaces that should drive

approximately $20 billion in revenue growth by 2015:

1. Growth Markets. Revenue for our Growth Markets

Unit was up 11 percent at constant currency for the second

year in a row. Growth markets contributed 22 percent

of IBM’s geographic revenue in 2011, up from 11 percent in

2000, and we expect them to approach 30 percent by 2015.

2. Business Analytics. Our analytics business grew

16 percent for the year. Having spotted early the

emergence of “big data,” IBM built the world’s leading

analytics software and consulting practice, and we are

translating it into powerful new capabilities, which

enable our clients to identify, manage and even predict

outcomes that matter to their success.

3. Cloud. IBM has helped thousands of clients adopt

aspects of cloud computing, where IT resources are

virtualized, highly automated and accessed by self-service.

Our cloud revenue in 2011 was more than three times

the prior year.

Our strong strategic positioning,

solid balance sheet, recurring

revenue, robust profit streams

and unmatched global

reach give us confidence that

we will achieve success in

the next five years, as we have

during the past decade.

4. Smarter Planet. All of this comes together in our

solutions to build Smarter Planet systems, transforming

systems such as supply chains, retail, energy, transportation,

telecommunications, food and water. It includes the

successful establishment of large new market categories,

such as Smarter Cities and Smarter Commerce. Smarter

Planet revenue grew by almost 50 percent in 2011.