IBM 2011 Annual Report Download - page 55

Download and view the complete annual report

Please find page 55 of the 2011 IBM annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

53

Management Discussion

International Business Machines Corporation and Subsidiary Companies

currency impacts (up 1 point). RD&E investments represented

6.0 percent of total revenue in 2010, compared to 6.1 percent in 2009.

Operating (non-GAAP) RD&E expense increased 3.5 percent in 2010

compared to the prior year driven by the same factors.

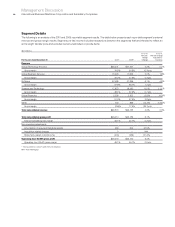

Intellectual Property and Custom Development Income

($ in millions)

For the year ended December 31: 2010 2009

Yr.-to-Yr.

Percent

Change

Sales and other transfers of

intellectual property $ 203 $ 228 (10.8)%

Licensing/royalty-based fees 312 370 (15.6)

Custom development income 638 579 10.3

To t a l $1,154 $1,177 (1.9)%

The timing and amount of sales and other transfers of IP may

vary significantly from period to period depending upon timing of

divestitures, industry consolidation, economic conditions and the

timing of new patents and know-how development. There were no

significant individual IP transactions in 2010 or 2009.

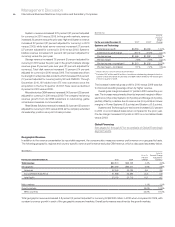

Interest Expense

($ in millions)

For the year ended December 31: 2010 2009

Yr.-to-Yr.

Percent

Change

Interest expense

To t a l $368 $402 (8.5)%

The decrease in interest expense was primarily due to lower average

interest rates in 2010 versus 2009, partially offset by higher average

debt balances in 2010 versus 2009. Total debt at December 31, 2010

was $28.6 billion; an increase of $2.5 billion from the prior year-end

position. Interest expense is presented in cost of financing in the

Consolidated Statement of Earnings if the related external borrowings

are to support the Global Financing external business. Overall interest

expense for 2010 was $923 million, a decrease of $185 million

versus 2009.

Income Taxes

The effective tax rate for 2010 was 24.8 percent, compared with

26.0 percent in 2009. The operating (non-GAAP) tax rate for 2010

was 24.4 percent compared to 25.8 percent in 2009. The 1.2 point

decrease in the as-reported effective tax rate was primarily driven

by a more favorable geographic mix of pre-tax income and incentives

(2.5 points), the increased utilization of foreign tax credits (4.1 points)

and the completion in 2010 of the U.S. federal income tax examination

for the years 2006 and 2007 including the associated reserve

redeterminations (6.4 points). These benefits were partially offset by

tax charges related to certain intercompany payments made by foreign

subsidiaries (6.6 points), the tax impact of certain business restructuring

transactions (2.7 points) and the tax costs associated with the

intercompany licensing of certain intellectual property (2.9 points).

The remaining items were individually insignificant.

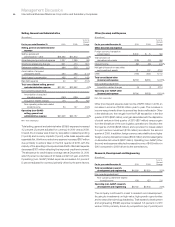

Financial Position

Key drivers in the company’s balance sheet and total cash flows in

2010 compared to 2009 are highlighted below.

Total assets increased $4,430 million ($3,609 million adjusted

for currency) from December 31, 2009, driven by:

• Increased goodwill ($4,946 million) and intangible assets

($975 million) driven by 2010 acquisitions;

• Higher level of total receivables ($1,337 million) and increased

total other assets ($679 million); partially offset by

• Decreases in cash and cash equivalents ($1,522 million)

and marketable securities ($800 million); and

• Lower total deferred taxes ($1,140 million).

Total liabilities increased $4,012 million ($3,673 million adjusted for

currency) from December 31, 2009 driven by:

• Higher total debt ($2,525 million);

• Increase in deferred income ($839 million); and an

• Increase in compensation and benefits ($523 million).

Total equity of $23,172 million increased $418 million from the prior

year-end balance as a result of:

• Higher retained earnings ($11,632 million);

• Increase in common stock ($3,608 million);

• Increase in foreign currency translation adjustments

($643 million); and an

• Increase in net unrealized gains on hedge of cash flow

derivatives ($385 million); partially offset by an

• Increase in treasury stock ($14,918 million); and

• Decrease in retirement-related items ($992 million).

The company generated $19,549 million in cash flow from operations,

a decrease of $1,224 million, compared to 2009, primarily driven by

a decrease in cash from total receivables ($2,620 million), partially

offset by the increase in net income ($1,408 million). Net cash used

in investing activities of $8,507 million was $1,778 million higher than

2009, primarily due to increased acquisitions ($4,728 million),

decreased cash from divestitures ($345 million) and increased net

capital spending ($299 million), partially offset by the year-to-year

net impacts related to marketable securities and other investments

($3,753 million).

Net cash used in financing activities of $12,429 million was

$2,271 million lower versus 2009, primarily due to the net benefit

from debt ($9,812 million) and an increase in cash from other

common stock transactions ($722 million), partially offset by higher

common stock repurchases ($7,946 million).