IBM 2011 Annual Report Download - page 120

Download and view the complete annual report

Please find page 120 of the 2011 IBM annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

Notes to Consolidated Financial Statements

International Business Machines Corporation and Subsidiary Companies118

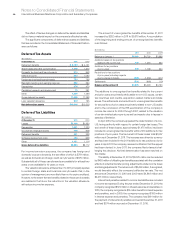

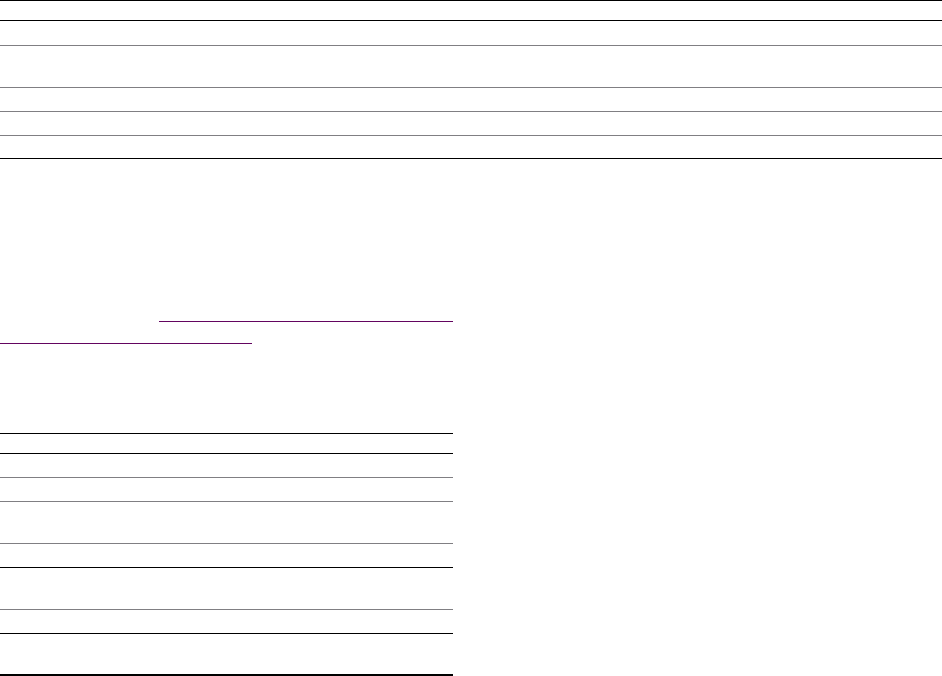

($ in millions)

2012 2013 2014 2015 2016 Beyond 2016

Operating lease commitments

Gross minimum rental commitments

(including vacant space below) $1,562 $1,324 $1,000 $689 $443 $613

Vacant space $ 29 $ 10 $ 9 $ 7 $ 3 $ 1

Sublease income commitments $ 29 $ 14 $ 9 $ 5 $ 4 $ 8

Capital lease commitments $ 19 $ 28 $ 13 $ 14 $ 7 $ 5

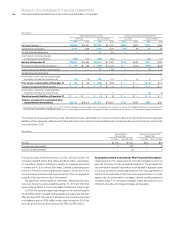

Note Q.

Rental Expense and Lease Commitments

Rental expense, including amounts charged to inventories and

fixed assets, and excluding amounts previously reserved, was

$1,836 million in 2011, $1,727 million in 2010 and $1,677 million in 2009.

Rental expense in agreements with rent holidays and scheduled rent

increases is recorded on a straight-line basis over the lease term.

Note R.

Stock-Based Compensation

Stock-based compensation cost is measured at grant date, based

on the fair value of the award, and is recognized over the employee

requisite service period. See note A, “Significant Accounting Policies,”

on page 82 for additional information.

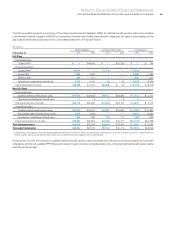

The following table presents total stock-based compensation

cost included in the Consolidated Statement of Earnings.

($ in millions)

For the year ended December 31: 2011 2010 2009

Cost $ 120 $ 94 $ 94

Selling, general and administrative 514 488 417

Research, development

and engineering 62 48 47

Other (income) and expense* — (1) —

Pre-tax stock-based

compensation cost 697 629 558

Income tax benefits (246) (240)(221)

Total stock-based

compensation cost $ 450 $ 389 $ 337

* Reflects the one-time effects of the sale of the Product Lifecycle Management activities.

Total unrecognized compensation cost related to non-vested awards

at December 31, 2011 and 2010 was $1,169 million and $1,044 million,

respectively, and is expected to be recognized over a weighted-

average period of approximately three years.

There was no significant capitalized stock-based compensation

cost at December 31, 2011, 2010 and 2009.

Contingent rentals are included in the determination of rental

expense as accruable. The table below depicts gross minimum

rental commitments under noncancelable leases, amounts related

to vacant space associated with infrastructure reductions and

special actions taken through 1994, and in 1999, 2002 and 2005

(previously reserved), sublease income commitments and capital

lease commitments. These amounts reflect activities primarily

related to office space, as well as manufacturing facilities.

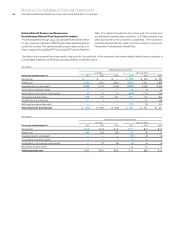

Incentive Awards

Stock-based incentive awards are provided to employees under

the terms of the company’s long-term performance plans (the

“Plans”). The Plans are administered by the Executive Compen sation

and Management Resources Com mittee of the Board of Directors

(the “Committee”). Awards available under the Plans principally

include stock options, restricted stock units, performance share

units or any combination thereof.

The amount of shares originally authorized to be issued under

the company’s existing Plans was 274.1 million at December 31, 2011.

In addition, certain incentive awards granted under previous plans,

if and when those awards were canceled, could be reissued under

the company’s existing Plans. As such, 66.2 million additional awards

were considered authorized to be issued under the company’s existing

Plans as of December 31, 2011. There were 124.8 million unused shares

available to be granted under the Plans as of December 31, 2011.

Under the company’s long-standing practices and policies, all

awards are approved prior to or on the date of grant. The exercise

price of at-the-money stock options is the average of the high and

low market price on the date of grant. The options approval process

specifies the individual receiving the grant, the number of options or

the value of the award, the exercise price or formula for determining the

exercise price and the date of grant. All awards for senior management

are approved by the Committee. All awards for employees other than

senior management are approved by senior management pursuant to

a series of delegations that were approved by the Committee, and the

grants made pursuant to these delegations are reviewed periodically

with the Committee. Awards that are given as part of annual total

compensation for senior management and other employees are

made on specific cycle dates scheduled in advance. With respect

to awards given in connection with promotions or new hires, the

company’s policy requires approval of such awards prior to the grant

date, which is typically the date of the promotion or the date of hire.