IBM 2011 Annual Report Download - page 119

Download and view the complete annual report

Please find page 119 of the 2011 IBM annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

Notes to Consolidated Financial Statements

International Business Machines Corporation and Subsidiary Companies 117

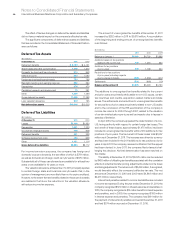

Within the next 12 months, the company believes it is reasonably

possible that the total amount of unrecognized tax benefits associated

with certain positions may be reduced. The company expects that

certain foreign and state issues may be concluded in the next

12 months. The company estimates that the unrecognized tax benefits

at December 31, 2011 could be reduced by $138 million.

With limited exception, the company is no longer subject to U.S.

federal, state and local or non-U.S. income tax audits by taxing

authorities for years through 2007. The years subsequent to 2007

contain matters that could be subject to differing interpretations of

applicable tax laws and regulations as it relates to the amount and/

or timing of income, deductions and tax credits. Although the

outcome of tax audits is always uncertain, the company believes

that adequate amounts of tax and interest have been provided for

any adjustments that are expected to result for these years.

The company has not provided deferred taxes on $37.9 billion

of undistributed earnings of non-U.S. subsidiaries at December 31, 2011,

as it is the company’s policy to indefinitely reinvest these earnings

in non-U.S. operations. However, the company periodically repatriates

a portion of these earnings to the extent that it does not incur an

additional U.S. tax liability. Quantification of the deferred tax liability,

if any, associated with indefinitely reinvested earnings is not practicable.

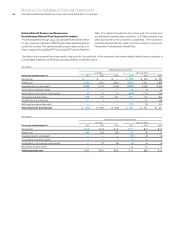

Note O.

Research, Development and Engineering

RD&E expense was $6,258 million in 2011, $6,026 million in 2010

and $5,820 million in 2009.

The company incurred expense of $5,990 million, $5,720 million

and $5,523 million in 2011, 2010 and 2009, respectively, for scientific

research and the application of scientific advances to the development

of new and improved products and their uses, as well as services

and their application. Within these amounts, software-related expense

was $3,097 million, $3,028 million and $2,991 million in 2011, 2010

and 2009, respectively.

Expense for product-related engineering was $267 million,

$306 million and $297 million in 2011, 2010 and 2009, respectively.

Note P.

Earnings Per Share of Common Stock

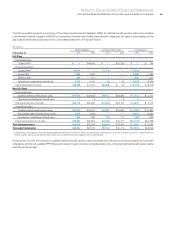

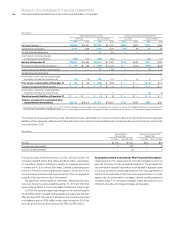

The following table presents the computation of basic and diluted earnings per share of common stock.

($ in millions except per share amounts)

For the year ended December 31: 2011 2010 2009

Weighted-average number of shares on which earnings per share calculations are based:

Basic 1,196,951,006 1,268,789,202 1,327,157,410

Add—incremental shares under stock-based compensation plans 14,241,131 16,189,053 12,258,864

Add—incremental shares associated with contingently issuable shares 2,575,848 2,377,133 1,936,480

Assuming dilution 1,213,767,985 1,287,355,388 1,341,352,754

Net income on which basic earnings per share is calculated $15,855 $14,833 $13,425

Less—net income applicable to contingently issuable shares 00 —

Net income on which diluted earnings per share is calculated $15,855 $14,833 $13,425

Earnings/(loss) per share of common stock

Assuming dilution $ 13.06 $ 11.52 $ 10.01

Basic $ 13.25 $ 11.69 $ 10.12

Stock options to purchase 612,272 common shares in 2009 were outstanding, but were not included in the computation of diluted earnings

per share because the exercise price of the options was greater than the average market price of the common shares for the applicable full

year, and therefore, the effect would have been antidilutive.