IBM 2011 Annual Report Download - page 82

Download and view the complete annual report

Please find page 82 of the 2011 IBM annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

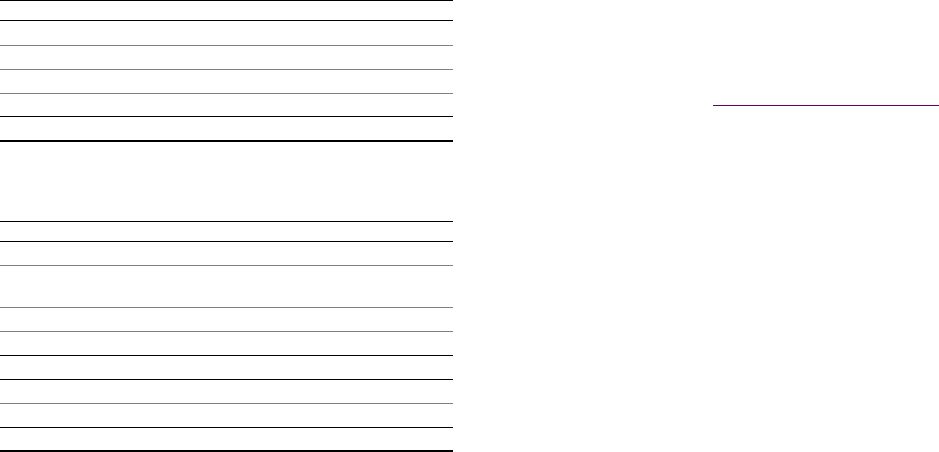

Notes to Consolidated Financial Statements

International Business Machines Corporation and Subsidiary Companies80

Revenue from separately priced extended warranty contracts is

recorded as deferred income and subsequently recognized on a

straight-line basis over the delivery period. Changes in the company’s

deferred income for extended warranty contracts and warranty

liability for standard warranties, which are included in other accrued

expenses and liabilities and other liabilities in the Consolidated

Statement of Financial Position, are presented in the following tables:

Standard Warranty Liability

($ in millions)

2011 2010

Balance at January 1 $ 375 $ 316

Current period accruals 435 407

Accrual adjustments to reflect actual experience 18 69

Charges incurred (420) (418)

Balance at December 31 $ 407 $ 375

Extended Warranty Liability (Deferred Income)

($ in millions)

2011 2010

Balance at January 1 $ 670 $ 665

Revenue deferred for new extended

warranty contracts 314 329

Amortization of deferred revenue (330) (301)

Other* (19) (22)

Balance at December 31 $ 636 $ 670

Current portion $ 301 $ 315

Noncurrent portion 335 355

Balance at December 31 $ 636 $ 670

* Other consists primarily of foreign currency translation adjustments.

Shipping and Handling

Costs related to shipping and handling are recognized as incurred

and included in cost in the Consolidated Statement of Earnings.

Expense and Other Income

Selling, General and Administrative

Selling, general and administrative (SG&A) expense is charged to

income as incurred. Expenses of promoting and selling products

and services are classified as selling expense and include such items

as compensation, advertising, sales commissions and travel. General

and administrative expense includes such items as compensation,

office supplies, non-income taxes, insurance and office rental. In

addition, general and administrative expense includes other operating

items such as an allowance for credit losses, workforce rebalancing

accruals for contractually obligated payments to employees terminated

in the ongoing course of business, acquisition costs related to

business combinations, amortization of certain intangible assets

and environmental remediation costs.

Advertising and Promotional Expense

The company expenses advertising and promotional costs when

incurred. Cooperative advertising reimbursements from vendors are

recorded net of advertising and promotional expense in the period

in which the related advertising and promotional expense is incurred.

Advertising and promotional expense, which includes media,

agency and promotional expense, was $1,373 million, $1,337 million

and $1,255 million in 2011, 2010 and 2009, respectively, and is

recorded in SG&A expense in the Consolidated Statement of Earnings.

Research, Development and Engineering

Research, development and engineering (RD&E) costs are expensed

as incurred. Software costs that are incurred to produce the finished

product after technological feasibility has been established are

capitalized as an intangible asset. See “Software Costs” on page 79.

Intellectual Property and Custom Development Income

The company licenses and sells the rights to certain of its intellectual

property (IP) including internally developed patents, trade secrets

and technological know-how. Certain IP transactions to third parties

are licensing/royalty-based and others are transaction-based sales

and other transfers. Licensing/royalty-based fees involve transfers

in which the company earns the income over time, or the amount of

income is not fixed or determinable until the licensee sells future

related products (i.e., variable royalty, based upon licensee’s revenue).

Sales and other transfers typically include transfers of IP whereby

the company has fulfilled its obligations and the fee received is

fixed or determinable at the transfer date. The company also enters

into cross-licensing arrangements of patents, and income from

these arrangements is recorded only to the extent cash is received.

Furthermore, the company earns income from certain custom

development projects for strategic technology partners and specific

clients. The company records the income from these projects when

the fee is realized or realizable and earned, is not refundable and

is not dependent upon the success of the project.

Other (Income) and Expense

Other (income) and expense includes interest income (other than

from Global Financing external business transactions), gains and

losses on certain derivative instruments, gains and losses from

securities and other investments, gains and losses from certain real

estate transactions, foreign currency transaction gains and losses,

gains and losses from the sale of businesses and amounts related

to accretion of asset retirement obligations.