IBM 2011 Annual Report Download - page 134

Download and view the complete annual report

Please find page 134 of the 2011 IBM annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

Notes to Consolidated Financial Statements

International Business Machines Corporation and Subsidiary Companies132

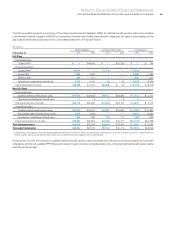

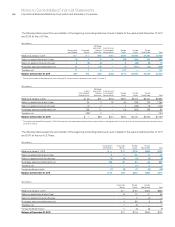

The following tables present the reconciliation of the beginning and ending balances of Level 3 assets for the years ended December 31, 2011

and 2010 for the U.S. Plan.

($ in millions)

Government

and Related

Corporate

Bonds

Mortgage

and Asset-

Backed

Securities

Fixed Income

Commingled/

Mutual Funds

Hedge

Funds

Private

Equity

Private

Real Estate To ta l

Balance at January 1, 2011 $— $— $ 56 $221 $624 $4,251 $2,634 $7,786

Return on assets held at end of year (0) 0 (1) 25 (35) 348 131 468

Return on assets sold during the year 0 (0) (0) — 5 (30) 39 14

Purchases, sales and settlements, net 12 5 (16) — (7) (471) (14) (492)

Transfers, net 17 7 6 — 127*— — 157

Balance at December 31, 2011 $29 $12 $ 45 $246 $713 $4,098 $2,790 $7,932

* Due to an increase in the redemption term during 2011, the asset was transferred from Level 2 to Level 3.

($ in millions)

Equity

Commingled/

Mutual Funds

Mortgage

and Asset-

Backed

Securities

Fixed Income

Commingled/

Mutual Funds

Hedge

Funds

Private

Equity

Private

Real Estate To ta l

Balance at January 1, 2010 $ 26 $37 $192 $587 $3,877 $2,247 $6,964

Return on assets held at end of year 24 3 30 45 829 123 1,054

Return on assets sold during the year (0) 0 — 3 (153) 16 (133)

Purchases, sales and settlements, net 139 11 — (11) (302) 248 85

Transfers, net (188)* 4 — — — — (184)

Balance at December 31, 2010 $ — $56 $221 $624 $4,251 $2,634 $7,786

* During the year ended December 31, 2010, the fund hired an independent administrator responsible for valuing the fund. As a result of this action the asset was transferred from

Level 3 to Level 2.

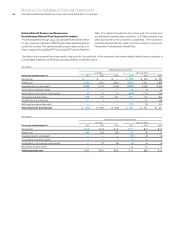

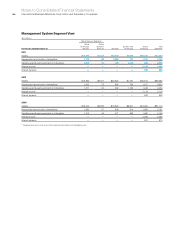

The following tables present the reconciliation of the beginning and ending balances of Level 3 assets for the years ended December 31, 2011

and 2010 for the non-U.S. Plans.

($ in millions)

Government

and Related

Corporate

Bonds

Private

Equity

Private

Real Estate To t a l

Balance at January 1, 2011 $ — $ 11 $176 $533 $720

Return on assets held at end of year 3 2 30 11 46

Return on assets sold during the year (0) (0) (2) (3) (5)

Purchases, sales and settlements, net 100 28 65 44 237

Transfers, net — — (0) 0 0

Foreign exchange impact (7) (2) (7) (6) (22)

Balance at December 31, 2011 $ 96 $39 $262 $580 $977

($ in millions)

Corporate

Bonds

Private

Equity

Private

Real Estate To t a l

Balance at January 1, 2010 $ — $ 93 $492 $585

Return on assets held at end of year (0) 14 41 55

Return on assets sold during the year — 3 (3) 0

Purchases, sales and settlements, net 4 69 9 82

Transfers, net 7 (0) — 7

Foreign exchange impact 0 (3) (6) (8)

Balance at December 31, 2010 $11 $176 $533 $720