IBM 2011 Annual Report Download - page 44

Download and view the complete annual report

Please find page 44 of the 2011 IBM annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

42

Management Discussion

International Business Machines Corporation and Subsidiary Companies

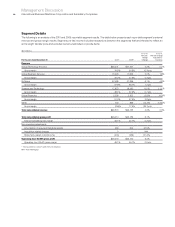

Geographic Revenue

Total geographic revenue increased 1.9 percent (2 percent adjusted

for currency) to $28,772 million in the fourth quarter of 2011 compared

to the prior year. Revenue in the major markets increased 0.5 percent

(flat adjusted for currency) in the fourth quarter. In North America,

revenue performance was led by Canada which was up 11.6 percent

(13 percent adjusted for currency). The U.S. was up 1.1 percent

compared to a strong fourth quarter of 2010, which increased

10 percent driven by mainframe performance. In Europe, the revenue

growth rate at constant currency improved sequentially compared

to the third quarter of 2011. Germany returned to growth in the

quarter with revenue up 2.9 percent (4 percent adjusted for currency).

Revenue increased in Spain 8.2 percent (9 percent adjusted for

currency) and in the U.K. 8.4 percent (9 percent adjusted for currency).

This was the fifth and ninth consecutive quarters of constant

currency revenue growth in Spain and the U.K, respectively. Growth

markets revenue increased 7.1 percent (8 percent adjusted for

currency) in the fourth quarter and outpaced growth in the major

markets by 8 points on a constant currency basis. The growth markets

gained 4 points of share in the fourth quarter. Revenue performance

was broad based with double-digit constant currency revenue growth

in 40 growth market countries. In the BRIC countries, combined

revenue increased 9.6 percent (11 percent adjusted for currency).

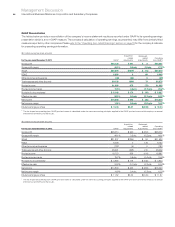

Expense

($ in millions)

For the fourth quarter: 2011 2010

Yr.-to-Yr.

Percent/

Margin

Change

Total consolidated expense

and other (income) $7,448 $7,271 2.4%

Non-operating adjustments

Amortization of acquired

intangible assets (72) (75) (4.2)

Acquisition-related charges (13) (23) (42.8)

Non-operating retirement-related

(costs)/income 25 61 (58.9)

Total operating (non-GAAP)

expense and other (income) $7,388 $7,235 2.1%

Total consolidated

expense-to-revenue ratio 25.3% 25.1%0.2 pts.

Operating (non-GAAP)

expense-to-revenue ratio 25.1% 24.9%0.1 pts.

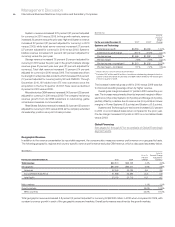

Total expense and other income increased 2.4 percent year to

year with an expense-to-revenue-ratio of 25.3 percent compared

to 25.1 percent in the fourth quarter of 2010. The increase in total

expense and other income was primarily driven by the company’s

acquisitions over the past 12 months (1 point) and higher base

expense (1 point). There was effectively no year-to-year impact

from the combination of currency translation and hedging dynamics

in the fourth quarter. Within Selling, general and administrative

expense, accounts receivable provisions increased approximately

$55 million in the fourth quarter of 2011 year to year due to higher

receivables balances and the European credit environment. The

accounts receivable reserve coverage at December 31, 2011 decreased

30 basis points compared to December 31, 2010, and decreased

20 basis points since September 2011.

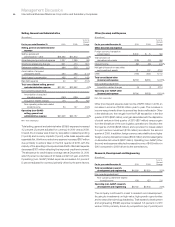

Cash Flow

The company generated $7,097 million in cash flow from operations,

an increase of $302 million compared to the fourth quarter of 2010,

primarily driven by higher net income. Net cash used in investing

activities of $3,505 million decreased $577 million, primarily due

to less cash used for acquisitions ($1,340 million), partially offset

by a net reduction of $762 million from purchases and sales of

marketable securities and other investments in 2011 versus 2010. Net

cash used in financing activities of $2,810 million increased $950

million compared to the prior year, primarily due to a net decrease

in cash from common stock transactions ($704 million).

In the fourth quarter, the company repurchased 19 million shares

of its common stock. The weighted-average number of diluted common

shares outstanding in the fourth quarter of 2011 was 1,188.7 million

compared with 1,258.4 million in the fourth quarter of 2010.