IBM 2011 Annual Report Download - page 93

Download and view the complete annual report

Please find page 93 of the 2011 IBM annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

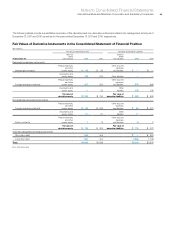

Notes to Consolidated Financial Statements

International Business Machines Corporation and Subsidiary Companies 91

The table below reflects the purchase price related to the 2010 acquisitions and the resulting purchase price allocations as of December 31, 2010.

2010 Acquisitions

($ in millions)

Amortization

Life (in Years) Netezza

Sterling

Commerce

Other

Acquisitions

Current assets $ 218 $ 196 $ 377

Fixed assets/noncurrent assets 73 106 209

Intangible assets

Goodwill N/A 1,410 1,032 2,312

Completed technology 3 to 7 202 218 493

Client relationships 2 to 7 52 244 293

In-process R&D 5 4 — 17

Patents/trademarks 1 to 7 16 14 27

Total assets acquired 1,975 1,810 3,728

Current liabilities (9) (129) (161)

Noncurrent liabilities (120) (266) (291)

Total liabilities assumed (128) (395) (452)

Total purchase price $1,847 $1,415 $3,277

N/A—Not applicable

Unica, a leading provider of software and services used to automate

marketing processes, will expand the company’s ability to help

organizations analyze and predict customer preferences and develop

more targeted marketing campaigns. PSS Systems is a leading

provider of legal information governance and information management

software. OpenPages is a leading provider of software that helps

companies more easily identify and manage risk and compliance

activities across the enterprise through a single management system.

Clarity Systems delivers financial governance software that enables

organizations to automate the process of collecting, preparing,

certifying and controlling financial statements for electronic filing.

Wilshire’s mortgage servicing platform will continue the strategic

focus on the mortgage services industry and strengthens the

commitment to deliver mortgage business process outsourcing

solutions. National Interest Security Company will strengthen the

ability to deliver advanced analytics and IT solutions to the public

sector. Storwize, a provider of in-line data compression appliance

solutions, will help the company to make it more affordable for clients

to analyze massive amounts of data in order to provide new insights

and business outcomes. BLADE provides server and top-of-rack

switches as well as software to virtualize and manage cloud

computing and other workloads.

Purchase price consideration for the “Other Acquisitions” as

reflected in the table above, is paid primarily in cash. All acquisitions

are reported in the Consolidated Statement of Cash Flows net of

acquired cash and cash equivalents. For the “Other Acquisitions,”

the overall weighted-average life of the identified intangible assets

acquired is 6.4 years. These identified intangible assets will be

amortized on a straight-line basis over their useful lives. Goodwill of

$2,312 million has been assigned to the Software ($1,653 million),

GTS ($32 million), GBS ($252 million) and STG ($375 million) segments.

It is expected that approximately 10 percent of the goodwill will be

deductible for tax purposes.

2009

In 2009, the company completed six acquisitions at an aggregate

cost of $1,471 million.

SPSS, Inc. (SPSS)—On October 2, 2009, the company acquired

100 percent of the outstanding common shares of SPSS for cash

consideration of $1,177 million. SPSS is a leading global provider of

predictive analytics software and solutions and this acquisition

strengthened the company’s business analytics and optimization

capabilities. SPSS was integrated into the Software segment upon

acquisition, and goodwill, as reflected in the table on the next page,

was entirely assigned to the Software segment. Substantially all of

the goodwill is not deductible for tax purposes. The overall weighted

average useful life of the identified intangible assets acquired,

excluding goodwill, is 7.0 years.