IBM 2011 Annual Report Download - page 106

Download and view the complete annual report

Please find page 106 of the 2011 IBM annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

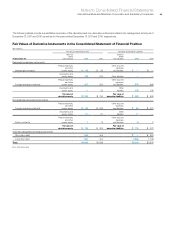

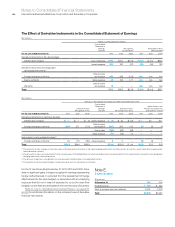

Notes to Consolidated Financial Statements

International Business Machines Corporation and Subsidiary Companies104

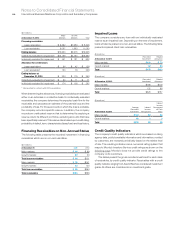

Troubled Debt Restructurings

In 2011, the company adopted new FASB guidance that helps

creditors determine whether a restructuring constitutes a troubled

debt restructuring. The company assessed all restructurings

that occurred on or after January 1, 2011 and determined that there

were no troubled debt restructurings for the 12 months ended

December 31, 2011.

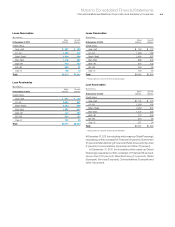

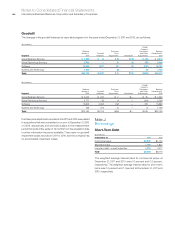

Note G.

Property, Plant and Equipment

($ in millions)

At December 31: 2011 2010

Land and land improvements $ 786 $ 777

Buildings and building improvements 9,531 9,414

Plant, laboratory and office equipment 26,843 26,676

Plant and other property—gross 37,160 36,867

Less: Accumulated depreciation 24,703 24,435

Plant and other property—net 12,457 12,432

Rental machines 2,964 3,422

Less: Accumulated depreciation 1,538 1,758

Rental machines—net 1,426 1,665

Total—net $13,883 $14,096

Note H.

Investments and Sundry Assets

($ in millions)

At December 31: 2011 2010

Deferred transition and setup costs

and other deferred arrangements* $1,784 $1,853

Derivatives—noncur rent ** 753 588

Alliance investments

Equity method 131 122

Non-equity method 127 531

Prepaid software 233 268

Long-term deposits 307 350

Other receivables 208 560

Employee benefit-related 493 409

Prepaid income taxes 261 434

Other assets 598 663

To t a l $4,895 $5,778

* Deferred transition and setup costs and other deferred arrangements are related to

Global Services client arrangements. See note A, “Significant Accounting Policies,”

on pages 76 to 86 for additional information.

**

See note D, “Financial Instruments,” on pages 96 through 100 for the fair value of all

derivatives reported in the Consolidated Statement of Financial Position.

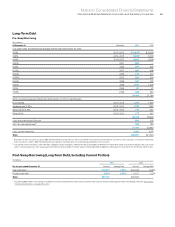

Past Due Financing Receivables

($ in millions)

At December 31, 2011:

Tot a l

Past Due

> 90 Days* Current

Tot a l

Financing

Receivables

Recorded

Investment

> 90 Days

and Accruing

Major markets $ 6 $ 6,504 $ 6,510 $ 6

Growth markets 9 1,911 1,921 6

Total lease receivables $16 $ 8,415 $ 8,430 $12

Major markets $23 $ 9,054 $ 9,077 $ 7

Growth markets 22 2,530 2,552 19

Total loan receivables $46 $11,584 $11,629 $26

To t a l $62 $19,998 $20,060 $38

* Does not include accounts that are fully reserved.

($ in millions)

At December 31, 2010:

Tot a l

Past Due

> 90 Days* Current

Tot a l

Financing

Receivables

Recorded

Investment

> 90 Days

and Accruing

Major markets $10 $ 6,552 $ 6,562 $ 5

Growth markets 13 1,970 1,983 5

Total lease receivables $22 $ 8,523 $ 8,545 $10

Major markets $11 $ 9,076 $ 9,087 $ 4

Growth markets 32 1,961 1,993 17

Total loan receivables $43 $11,037 $11,080 $21

To t a l $65 $19,560 $19,625 $31

* Does not include accounts that are fully reserved.