IBM 2011 Annual Report Download - page 111

Download and view the complete annual report

Please find page 111 of the 2011 IBM annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

Notes to Consolidated Financial Statements

International Business Machines Corporation and Subsidiary Companies 109

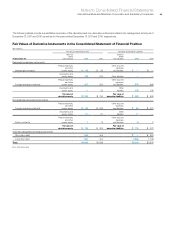

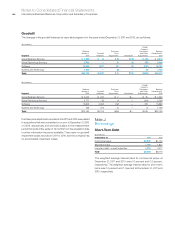

The table below provides a roll forward of the current and noncurrent liabilities associated with these special actions. The current liabilities

presented in the table are included in other accrued expenses and liabilities in the Consolidated Statement of Financial Position.

(in millions)

Liability

as of

January 1,

2011 Payments

Other

Adjustments*

Liability

as of

December 31,

2011

Current

Workforce $ 45 $(46) $ 34 $ 33

Space 8 (8) 4 4

Total current $ 53 $(53) $ 38 $ 38

Noncurrent

Workforce $395 $ 0 $(51) $344

Space 4 0 (1) 3

Total noncurrent $399 $ 0 $(52) $347

* The other adjustments column in the table above principally includes the reclassification of noncurrent to current, foreign currency translation adjustments and interest accretion.

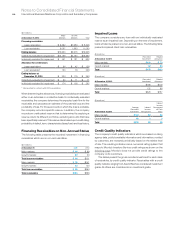

The workforce accruals primarily relate to terminated employees

who are no longer working for the company who were granted annual

payments to supplement their incomes in certain countries. Depending

on the individual country’s legal requirements, these required

payments will continue until the former employee begins receiving

pension benefits or passes away. The space accruals are for ongoing

obligations to pay rent for vacant space that could not be sublet or

space that was sublet at rates lower than the committed lease

arrangement. The length of these obligations varies by lease with

the longest extending through 2014.

The company employs extensive internal environmental protection

programs that primarily are preventive in nature. The company also

participates in environmental assessments and cleanups at a number

of locations, including operating facilities, previously owned facilities

and Superfund sites. The company’s maximum exposure for all

environmental liabilities cannot be estimated and no amounts have

been recorded for non-ARO environmental liabilities that are not

probable or estimable. The total amounts accrued for non-ARO

environmental liabilities, including amounts classified as current in

the Consolidated Statement of Financial Position, that do not reflect

actual or anticipated insurance recoveries, were $262 million at

December 31, 2011 and 2010, respectively. Estimated environmental

costs are not expected to materially affect the consolidated financial

position or consolidated results of the company’s operations in future

periods. However, estimates of future costs are subject to change

due to protracted cleanup periods and changing environmental

remediation regulations.

As of December 31, 2011, the company was unable to estimate

the range of settlement dates and the related probabilities for certain

asbestos remediation AROs. These conditional AROs are primarily

related to the encapsulated structural fireproofing that is not subject

to abatement unless the buildings are demolished and non-

encapsulated asbestos that the company would remediate only if it

performed major renovations of certain existing buildings. Because

these conditional obligations have indeterminate settlement dates,

the company could not develop a reasonable estimate of their fair

values. The company will continue to assess its ability to estimate

fair values at each future reporting date. The related liability will be

recognized once sufficient additional information becomes available.

The total amounts accrued for ARO liabilities, including amounts

classified as current in the Consolidated Statement of Financial

Position were $187 million and $176 million at December 31, 2011

and 2010, respectively.