ADT 2002 Annual Report Download - page 96

Download and view the complete annual report

Please find page 96 of the 2002 ADT annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

TYCO INTERNATIONAL LTD.

NOTES TO CONSOLIDATED FINANCIAL STATEMENTS (continued)

11. Discontinued Operations of Tyco Capital (CIT Group Inc.) (continued)

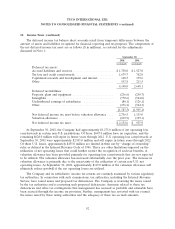

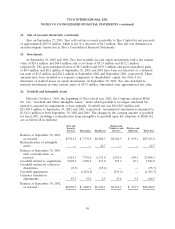

Operating results from the discontinued operations of Tyco Capital through July 8, 2002 were as

follows ($ in millions):

For the Period

June 2

For the Period (date of

October 1, acquisition)

2001 through through

July 8, 2002 September 30, 2001

Finance income ........................... $3,327.6 $1,676.5

Interest expense ........................... 1,091.5 597.1

Net finance income ........................ 2,236.1 1,079.4

Depreciation on operating lease equipment ....... 944.4 448.6

Net finance margin ........................ 1,291.7 630.8

Provision for credit losses .................... 665.6 116.1

Net finance margin, after provision for credit losses . 626.1 514.7

Other income ............................ 741.1 335.1

Operating margin .......................... 1,367.2 849.8

Selling, general, administrative and other costs and

expenses .............................. 687.8 398.7

Goodwill impairment ....................... 6,638.1 —

Operating expenses ........................ 7,325.9 398.7

(Loss) income before income taxes and minority

interest ............................... (5,958.7) 451.1

Income taxes ............................. (316.1) (195.0)

Minority interest .......................... (7.7) (3.6)

(Loss) income from discontinued operations ...... $(6,282.5) $ 252.5

During the quarter ended March 31, 2002, Tyco experienced disruptions to its business surrounding

its announced break-up plan, a downgrade in its credit ratings, and a significant decline in its market

capitalization. During this same time period, CIT also experienced credit downgrades and a disruption

to its historical funding base. Further, market-based information used in connection with the

Company’s preliminary consideration of the proposed IPO of CIT indicated that CIT’s book value

exceeded its estimated fair value as of March 31, 2002. As a result, the Company performed a

SFAS 142 first step impairment analysis as of March 31, 2002 and concluded that an impairment charge

was warranted at that time.

Management’s objective in performing the SFAS 142 first step analysis was to obtain relevant

market-based data to calculate the estimated fair value of CIT as of March 31, 2002 based on its

projected earnings and market factors expected to be used by market participants in ascribing value to

CIT in the planned separation of CIT from Tyco. Management obtained relevant market data from

financial advisors regarding the range of price to earnings multiples and market condition discounts

applicable to CIT as of March 31, 2002 and applied these market data to CIT’s projected annual

earnings as of March 31, 2002 to calculate an estimated fair value and any resulting goodwill

94