ADT 2002 Annual Report Download - page 90

Download and view the complete annual report

Please find page 90 of the 2002 ADT annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.TYCO INTERNATIONAL LTD.

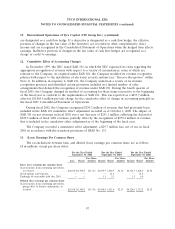

NOTES TO CONSOLIDATED FINANCIAL STATEMENTS (continued)

6. Charges for the Impairment of Long-Lived Assets (continued)

concluded that the value of its fiberoptic network was impaired and consequently recorded an

impairment charge during the quarter ended March 31, 2002. The amount of the impairment was based

upon the difference between the carrying value of each asset group and the estimated fair value of

those assets groups as of March 31, 2002. The estimated fair value of each asset group was determined

using an income (discounted cash flow) approach. The cash flows forecasts were prepared using the

fifteen year estimated weighted average useful life of each of the TGN asset groups. Probability factors

were applied to various scenarios weighting the likelihood of each possible outcome. Then, each cash

flow forecast was discounted using a weighted average cost of capital of 15% similar to that used for

SFAS 142 purposes, which was prepared by an independent appraiser as part of services rendered in

evaluating the Company’s enterprise value. Based upon these analyses, the sum of the expected future

discounted cash flows was subtracted from the carrying values of the asset groups resulting in an

impairment loss for the TGN. The entire TGN placed in service as of March 31, 2002 was written-off

at that time, as well as a portion of construction in progress of the TGN. We reconsidered the factors

noted above, such as projected operating results, business plans and an estimate of discounted future

cash flows, in order to retest the carrying value of the TGN for a further impairment at June 30, 2002

and September 30, 2002. We determined that no impairment charge was necessary at June 30, 2002.

However, as the telecommunications industry further declined, an additional impairment charge was

necessary and recorded that amount as of September 30, 2002. Changes to these forecasts and

assumptions could lead to further impairment of the TGN in the future. The amount of Tyco Global

Network on the Consolidated Balance Sheet at September 30, 2002 is $581.6 million as compared to

$2,353.4 million at September 30, 2001.

During fiscal 2002, the Healthcare segment recorded a charge of $2.5 million related to the

impairment of property, plant and equipment associated with the closure of facilities discussed in

Note 5.

During fiscal 2002, the Engineered Products and Services segment recorded a charge of

$9.5 million related to the impairment of property, plant and equipment associated with the closure of

facilities discussed in Note 5.

During fiscal 2002, the Plastics and Adhesives segment recorded a charge of $2.6 million related to

the impairment of property, plant and equipment associated with the closure of facilities discussed in

Note 5.

During fiscal 2002, the Company recorded a charge of $29.5 million related to the impairment of

certain corporate properties associated with the downsizing of corporate headquarters discussed in

Note 5.

2001 Charges

The Electronics, Healthcare, Plastics and Adhesives, Engineered Products and Services and Fire

and Security Services segments recorded charges of $98.5 million, $14.2 million, $1.2 million,

$3.4 million and $2.8 million, respectively, related primarily to the impairment of property, plant and

equipment associated with the closure of facilities discussed in Note 5.

88