ADT 2002 Annual Report Download - page 176

Download and view the complete annual report

Please find page 176 of the 2002 ADT annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

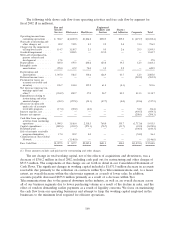

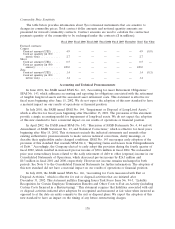

Commitments and Contingencies

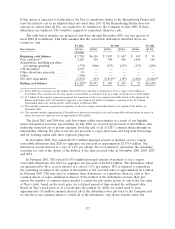

A summary of our contractual obligations and commitments for debt, minimum lease payment

obligations under non-cancelable operating leases and other obligations are as follows ($ in millions):

Fiscal 2003 Fiscal 2004 Fiscal 2005 Fiscal 2006 Fiscal 2007 Thereafter

Long-term debt(1) ............ $7,719.0 $3,680.6 $1,755.9 $3,744.2 $602.3 $ 6,703.8

Operating leases ............ 808.4 685.1 511.5 397.9 258.1 1,087.5

Total contractual cash obligations $8,527.4 $4,365.7 $2,267.4 $4,142.1 $860.4 $ 7,791.3

(1) Includes capital lease obligations.

At September 30, 2002, the Company had outstanding letters of credit in the amount of

$627.2 million.

At September 30, 2002, in addition to the unsecured credit facilities of $3.9 billion and $2.0 billion

due 2003 and 2006, respectively, certain of the Company’s operating subsidiaries have overdraft and

similar types of facilities which total $0.7 billion, of which $0.4 billion was undrawn and available. These

facilities expire at various dates through the year 2012 and are established primarily within international

operations.

In January 2002, the Company issued a $200 million guarantee that can be exercised by a customer

if certain specifications relating to the recently completed Pacific component of the TGN is not

completed by March 2003. The Company does not anticipate any problems with meeting this deadline.

As a result of actions taken by our former senior management, Tyco and certain members of our

former senior management are named defendants in a number of purported class actions alleging

violations of the disclosure provisions of the federal securities laws, a number of derivative actions and

several ERISA claims. We may be obliged to indemnify our directors and our former directors and

officers who also are named as defendants in some or all of these matters. In addition, our insurance

carrier may decline coverage, or such coverage may be insufficient to cover our expenses and liability, if

any, in some or all of these matteres. See ‘‘Business—Risk Factors’’ and ‘‘Legal Proceedings’’ in our

Form 10-K filed on December 30, 2002.

We and others have received subpoenas and requests from the SEC, the District Attorney of New

York County, the U.S. Attorney for the District of New Hampshire and others seeking the production

of voluminous documents in connection with various investigations into our governance, management,

operations, accounting and related controls. We cannot predict when these investigations will be

completed, nor can we predict what the results of these investigations may be. It is possible that we will

be required to pay material fines, consent to injunctions on future conduct, lose the ability to conduct

business with government instrumentalities or suffer other penalties, each of which could have a

material adverse effect on our business. See ‘‘Business—Risk Factors.’’

Like many other companies, Tyco and some of our subsidiaries are named as defendants in

personal injury lawsuits based on alleged exposure to asbestos-containing materials. Consistent with the

national trend of increased asbestos-related litigation, we have observed an increase in the number of

these lawsuits in the past several years. The majority of these cases have been filed against subsidiaries

in our Healthcare division and our Engineered Products and Services division. A limited number of the

cases allege premises liability, based on claims that individuals were exposed to asbestos while on a

subsidiary’s property. Some of the cases involve product liability claims, based principally on allegations

of past distribution of heat-resistant industrial products incorporating asbestos or the past distribution

of industrial valves that incorporated asbestos-containing gaskets or packing. Each case typically names

between dozens to hundreds of corporate defendants.

174