ADT 2002 Annual Report Download - page 51

Download and view the complete annual report

Please find page 51 of the 2002 ADT annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.TYCO INTERNATIONAL LTD.

NOTES TO CONSOLIDATED FINANCIAL STATEMENTS (continued)

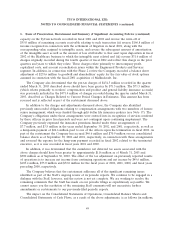

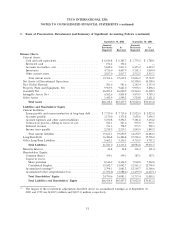

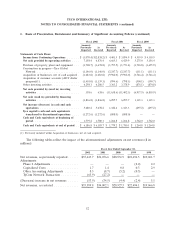

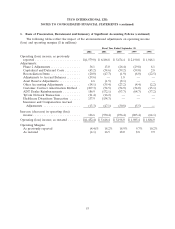

1. Basis of Presentation, Restatement and Summary of Significant Accounting Policies (continued)

capacity on the TyCom network recorded in fiscal 2001 and 2002 and reverse the write-off of

$55.0 million of remaining accounts receivable relating to such transaction (ii) reverse $166.8 million of

income recognized in connection with the settlement of litigation in fiscal 2001, along with the

corresponding value assigned to intangible assets, and reverse the subsequent amount of amortization

of the intangible asset as well as the amount of loss attributable to that asset upon disposition in fiscal

2002 of the Healthcare business to which the intangible asset related and (iii) reverse $31.6 million of

charges originally recorded during the fourth quarter of fiscal 2002 and reflect this charge in the prior

quarters and years to which they relate. These charges relate primarily to intercompany profit,

capitalized costs, and account reconciliation issues within the Engineered Products and Services

segment. In addition, in connection with the Phase 2 review the Company recorded a balance sheet

adjustment of $235.6 million to goodwill and shareholders’ equity for the fair value of stock options

assumed in connection with the fiscal 2001 acquisition of Mallinckrodt, Inc.

The Company also determined that the pre-tax charges of $434.5 million recorded in the quarter

ended March 31, 2003 described above should have been greater by $71.5 million. The $71.5 million

(which relates primarily to workers’ compensation and product and general liability insurance accruals)

was previously included in the $471.4 million of charges recorded during the quarter ended March 31,

2003, described as Charges Related to Current Period Changes in Estimates. This amount has been

reversed and is reflected as part of the restatement discussed above.

In addition to the charges and adjustments discussed above, the Company also identified

previously unrecorded obligations relating to compensation arrangements with two members of former

senior management, which were funded through split dollar life insurance policies (see Note 17). The

Company’s obligations under these arrangements were entered into in recognition of services rendered

by these officers in prior fiscal periods and were not contingent upon continuing employment. The

Company previously expensed the insurance premiums funded under these arrangements of

$7.7 million, and $3.8 million in the years ended September 30, 2002, and 2001, respectively, as well as

a lump-sum payment of $24.6 million paid to one of the officers upon his termination in fiscal 2002. As

part of the restatement the Company has accrued $46.6 million and $70.9 million on our consolidated

balance sheets as of September 30, 2002 and 2001, respectively, in connection with these arrangements

and reversed the expense for the lump-sum payment recorded in fiscal 2002 related to the terminated

executive, as it is now recorded in fiscal years 2001 and 2000.

In addition, it was determined that the cumulative net deferred tax assets associated with the

above charges should have been greater by approximately $116 million as of March 31, 2003 and

$300 million as of September 30, 2002. The effect of the tax adjustment on previously reported results

of operations is to increase net income from continuing operations and net income by $49.6 million,

$103.4 million, $75.0 million and $72.0 million for the fiscal years of 2002, 2001, 2000, and fiscal years

preceding 2000, respectively.

The Company believes that the restatement addresses all of the significant remaining issues

identified as part of the Staff’s ongoing review of its periodic reports. We continue to be engaged in a

dialogue with the Staff, however, and the review is not yet complete. We are working to resolve the

remaining comments that the Staff has made on our periodic filings as expeditiously as possible. We

cannot assure you the resolution of the remaining Staff comments will not necessitate further

amendments or restatements to our previously-filed periodic reports.

The impact on the Consolidated Statements of Operations, Consolidated Balance Sheets and

Consolidated Statements of Cash Flows, as a result of the above adjustments, is as follows (in millions,

49