ADT 2002 Annual Report Download - page 151

Download and view the complete annual report

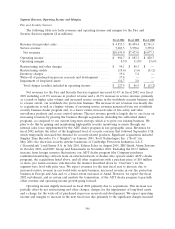

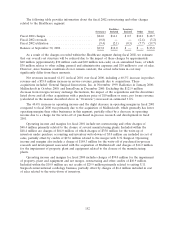

Please find page 151 of the 2002 ADT annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.continues to exist. Although total segment revenue is expected to decrease year over year, we anticipate

that revenues for our core electronics components group will slightly increase in fiscal 2003 due to

growth due to new product development launches and increases in market share. As evidenced by the

current period’s restructuring charges, management has implemented plans within this segment to

reduce the number of manufacturing plants, along with the related employees, to a size appropriate for

the current business environment, while attempting to maintain the flexibility needed for a potential

upturn in these markets.

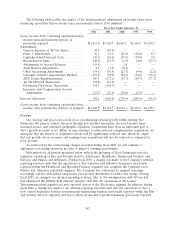

The significant decrease in operating income and operating margins in fiscal 2002 compared to

fiscal 2001 was primarily due to the impairment of long-lived assets and goodwill as well as the

restructuring and other charges in addition to the decrease in revenue. In the electronics components

business, the significant decrease in demand related to the telecommunications, computer, consumer

electronics, and the industrial machinery and aerospace industries resulted in much lower

manufacturing volumes which increased per unit costs. In the Telecommunications business, margins

were impacted significantly by the lack of capacity sales on the TGN and a significant reduction in

third party system builds. We expect operating income to increase in the next fiscal year due to the

significant charges incurred in the current year related to the impairment of long-lived assets, as well as

the restructuring and other charges incurred and related improvements resulting from such charges.

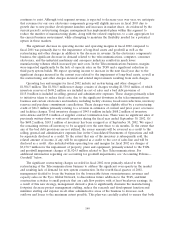

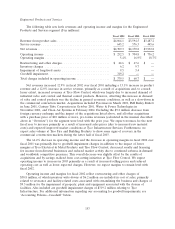

Operating loss and margins for fiscal 2002 include net restructuring and other charges of

$1,504.5 million. The $1,504.5 million net charge consists of charges totaling $1,530.8 million, of which

inventory reserves of $608.2 million are included in cost of sales and a bad debt provision of

$115.0 million is included in selling, general and administrative expenses. These charges primarily relate

to initiatives taken to reduce fixed costs, due to the significant downturn in the telecommunications

business and certain electronics end markets, including facility closures, headcount reductions, inventory

reserves and purchase commitment cancellations. These charges were slightly offset by a restructuring

credit of $26.3 million primarily relating to a revision in estimates of current and prior years’ severance

and facilities charges. Total inventory charges of $943.6 million include $608.2 million of inventory

write-downs and $335.4 million of supplier contract termination fees. There were no significant sales of

previously written-down or written-off inventory during the fiscal year ended September 30, 2002. Of

the $608.2 million, $143.1 million of inventory has been scrapped as of September 30, 2002. We expect

the remaining written-off inventory to be scrapped over the next three to six months. To the extent that

any of the bad debt provisions are not utilized, the excess amounts will be reversed as a credit to the

selling, general and administrative expenses line in the Consolidated Statements of Operations and will

be separately disclosed as a credit. To the extent that any of the inventory is subsequently sold, the

related amount of income, if any, will be recognized as a credit to the cost of sales line and will be

disclosed as a credit. Also included within operating loss and margins for fiscal 2002 are charges of

$3,150.7 million for the impairment of property, plant and equipment, primarily related to the TGN,

and goodwill impairment charges of $1,024.5 million related to Tyco Telecommunications. For

additional information regarding our accounting for goodwill impairments, see ‘‘Accounting Policies—

Goodwill’’ below.

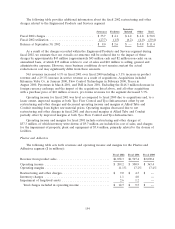

The significant restructuring charges recorded in fiscal 2002 were primarily related to the

restructuring of the Telecommunications business to address the significant overcapacity in the market

and resulting lack of demand for new system construction. In the fourth fiscal quarter of 2002,

management decided to focus the business for the foreseeable future on maintenance revenues and

capacity sales on the Tyco Global Network, to discontinue future additions to the TGN, and limit

construction activities to small projects that are cash flow positive with at least breakeven earnings. As

a result of this new strategy, management devised a plan to significantly downsize the manufacturing

footprint, decrease project management staffing, reduce the research and development function and

minimize staffing and expense in all other administrative areas of the business to decrease cash

outflows and losses to the maximum extent possible. This plan was carefully crafted to ensure that both

149