ADT 2002 Annual Report Download - page 71

Download and view the complete annual report

Please find page 71 of the 2002 ADT annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

TYCO INTERNATIONAL LTD.

NOTES TO CONSOLIDATED FINANCIAL STATEMENTS (continued)

2. Acquisitions and Divestitures (continued)

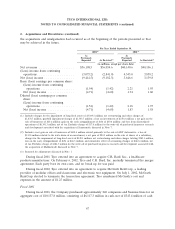

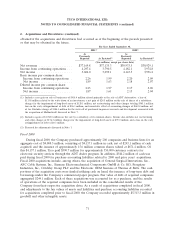

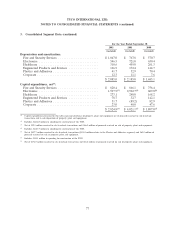

The following table summarizes the purchase accounting liabilities recorded in connection with the

fiscal 2001 purchase acquisitions ($ in millions):

Severance Facilities-Related Distributor &

Number of Number of Supplier

Employees Amount Facilities Amount Cancellation Fees Other Total

Original liabilities established ........ 10,270 $ 413.3 349 $302.2 $179.9 $ 224.6 $1,120.0

Liabilities of discontinued operations . . . (354) (47.2) — (19.3) — (32.2) (98.7)

Original liabilities continuing operations . 9,916 366.1 349 282.9 179.9 192.4 1,021.3

Fiscal 2001 utilization ............. (7,847) (203.2) (172) (21.6) (94.3) (140.9) (460.0)

Ending balance at September 30, 2001 . . 2,069 162.9 177 261.3 85.6 51.5 561.3

Additions to fiscal 2001 acquisition

liabilities .................... 8,570 179.4 493 85.3 25.9 48.8 339.4

Fiscal 2002 utilization ............. (7,060) (180.7) (328) (69.6) (44.5) (50.7) (345.5)

Reclassifications ................. — 5.7 — (29.3) (3.0) (2.7) (29.3)

Reduction of estimates of fiscal 2001

acquisition liabilities ............. (1,383) (37.6) (242) (40.2) (35.3) (17.8) (130.9)

Ending balance at September 30, 2002 . . 2,196 $ 129.7 100 $207.5 $ 28.7 $ 29.1 $ 395.0

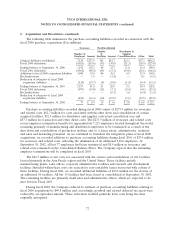

Purchase accounting liabilities recorded during fiscal 2001 consist of $366.1 million for severance

and related costs; $282.9 million for costs associated with the shut down and consolidation of certain

acquired facilities, including unfavorable leases, lease terminations and other related fees, and other

costs; $179.9 million for distributor and supplier contractual cancellation fees; and $192.4 million for

transaction and other costs. These purchase accounting liabilities relate primarily to the acquisitions of

Mallinckrodt Inc. in October 2000, LPS, Simplex Time Recorder Co. in January 2001 and the electronic

security systems businesses of Cambridge Protection Industries, LLC in July 2001 (‘‘SecurityLink.’’)

During fiscal 2001, the Company made payments totaling $20.0 million to Mr. Frank Walsh, a

director of Tyco at the time of the CIT acquisition, and to a charitable organization specified by such

director. The payments were direct and incremental costs incurred in connection with the acquisition of

CIT and, accordingly, were included as part of the purchase price for CIT (see Note 17).

In connection with the fiscal 2001 purchase acquisitions, the Company began to formulate plans at

the date of each acquisition for workforce reductions and the closure and consolidation of an aggregate

of 349 facilities. The costs of employee termination benefits relate to the elimination of 6,297 positions

in the United States, 1,559 positions in Europe, 1,354 positions in the Asia-Pacific region and 706

positions in Canada and Latin America, consisting primarily of manufacturing and distribution,

administrative, technical, and sales and marketing personnel. Facilities designated for closure include

226 facilities in the United States, 54 facilities in Europe, 48 facilities in the Asia-Pacific region and 21

facilities in Canada and Latin America, consisting primarily of manufacturing plants, distribution

facilities, sales offices, corporate administrative facilities and research and development facilities. At

September 30, 2002, 14,907 employees had been terminated and 500 facilities had been closed or

consolidated.

During fiscal 2002, we recorded additions to purchase accounting liabilities as we continued to

formulate the integration plans of fiscal 2001 acquisitions, such as LPS, Microser S.L. (integrated within

the Electronics segment), DAAG, Edison and SecurityLink, among others. Finalization of components

of integration plans associated with acquisitions resulted in additional purchase accounting liabilities of

$339.4 million and a corresponding increase to goodwill and deferred tax assets. These additions reflect

69