ADT 2002 Annual Report Download - page 173

Download and view the complete annual report

Please find page 173 of the 2002 ADT annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

In January 2002, TIG entered into a $1.5 billion bridge loan, which was fully and unconditionally

guaranteed by Tyco, which had a weighted average interest rate of 3.66%. TIG repaid $645.0 million in

April 2002 and the remainder in June 2002.

In February 2002, TIG borrowed the available $2.0 billion of capacity under its 5-year unsecured

revolving credit facility, which had been maintained as liquidity support for its commercial paper

program. The facility, which expires in February 2006, is fully and unconditionally guaranteed by Tyco

and has a variable LIBO-based rate, which was 4.94% as of September 30, 2002.

Also, in February 2002, TIG borrowed $3.855 billion under its 364-day unsecured revolving credit

facility and exercised its option to convert this facility into a term loan expiring on February 6, 2003.

The loan, which is fully and unconditionally guaranteed by Tyco, has a variable LIBO-based rate, which

was 4.99% as of September 30, 2002.

Proceeds from the bridge loan and credit facilities were used to pay off maturing commercial

paper at the scheduled maturities and to provide additional available capital.

During the fourth quarter of fiscal 2002 TIG paid off its $1.037 billion 6.875% private placement

notes due 2002.

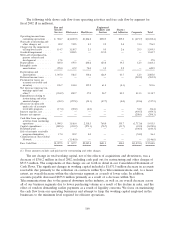

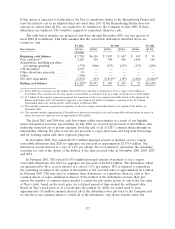

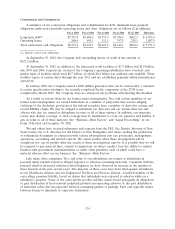

The following table details our debt ratings at September 30, 2001, March 31, 2002 and

September 30, 2002. Following the borrowings in February 2002, Standard & Poor’s and Fitch

downgraded our long-term debt and commercial paper ratings, while Moody’s confirmed its ratings,

resulting in the ratings shown in the March 31, 2002 column in the table below. Subsequent to

March 31, 2002, Moody’s, Standard & Poor’s and Fitch further downgraded our ratings as shown in the

September 30, 2002 column in the table below primarily as a result of Tyco’s revision of its plan to

separate into four independent public companies, the weak economic environment of the electronics

and telecommunications industries, public speculation regarding liquidity concerns at Tyco, and the

resignations of our former chief executive officer, chief financial officer and chief corporate counsel.

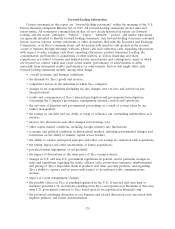

At September 30, 2001 At March 31, 2002 At September 30, 2002

Short Term Long Term Short Term Long Term Short Term Long Term

Moody’s .................. P2 Baa1 P2 Baa1 Not prime Ba2

Standard & Poor’s .......... A1 A A3 BBB A3 BBBw

Fitch .................... F1 A F2 AwBBB

(1) At September 30, 2002, Moody’s differentiated the ratings between Tyco’s and TIG’s outstanding debt. The Moody’s debt

rating on Tyco’s convertible debentures was downgraded to a Ba3 rating.

The security ratings set forth above are not a recommendation to buy, sell or hold securities and

may be subject to revision or withdrawal by the assigning rating organization. Each rating should be

evaluated independently of any other rating.

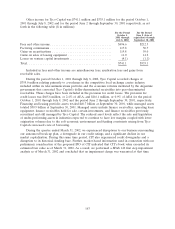

As a result of the rating agencies’ downgrade of Tyco’s debt to below investment grade status in

June 2002, TIG was required to pay $256.7 million to repurchase its ¥30 billion 3.5% notes due 2030

in July 2002. In addition, the rating of below investment grade status caused the interest rate on our

$400 million 7.2% notes due 2008 to increase to 8.2%, until such time that the rating by Moody’s

returns to investment grade. The downgrade also gave the investors in two of our accounts receivable

programs the option to discontinue reinvestment in new receivables and terminate the programs. The

investors did not exercise this option and one program was subsequently amended to continue

reinvestment. The amount outstanding under the other program was $132.4 million at September 30,

2002.

In June 1998, TIG issued $750.0 million 6.25% Dealer Remarketable Securities (‘‘Drs.’’) due 2013.

Under the terms of the Drs., the Remarketing Dealer has an option to remarket the Drs. in June 2003.

171