ADT 2002 Annual Report Download - page 82

Download and view the complete annual report

Please find page 82 of the 2002 ADT annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

TYCO INTERNATIONAL LTD.

NOTES TO CONSOLIDATED FINANCIAL STATEMENTS (continued)

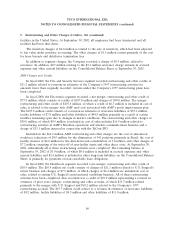

5. Restructuring and Other Charges (Credits), Net (continued)

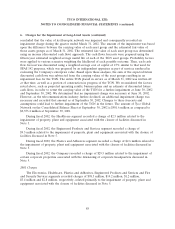

(excluding impairments of long-lived assets which are discussed in Note 6) related to the Electronics

segment recorded in fiscal 2002 ($ in millions):

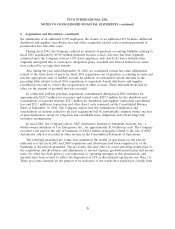

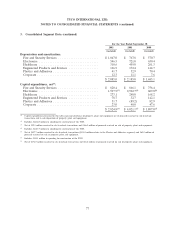

Severance Facilities-Related

Number of Number of

Employees Amount Facilities Amount Inventory Other Total

Fiscal 2002 charges .......... 8,996 $198.1 31 $250.2 $ 943.6 $138.9 $1,530.8

Fiscal 2002 reversals ......... (356) (2.5) (1) (8.1) — — (10.6)

Fiscal 2002 utilization ........ (4,336) (79.6) (13) (77.7) (164.7) (1.7) (323.7)

Ending balance at September 30,

2002 ................... 4,304 $116.0 17 $164.4 $ 778.9 $137.2 $1,196.5

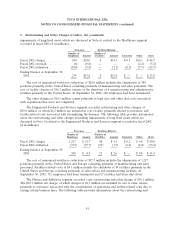

The cost of announced workforce reductions of $198.1 million includes the elimination of 8,996

positions across all regions consisting primarily of manufacturing personnel. Facilities-related costs of

$250.2 million include building lease termination fees and other contract cancellation costs for the

shutdown of 31 facilities, primarily manufacturing plants in the United States. At September 30, 2002,

4,336 employees had been terminated and 13 facilities had been shut down.

The $943.6 million inventory charges include $608.2 million of inventory write-downs and

$335.4 million of supplier contract termination fees. The inventory write-downs and the supplier

contract termination fees are primarily the result of the sudden and significant decrease in demand for

our products and services, primarily in the telecommunications end markets. As a result, the Company

determined that its current and committed inventory levels are in excess of forecasted needs. There

were no significant sales of previously written-down or written-off inventory during the year ended

September 30, 2002. Of the $608.2 million, $143.1 million of inventory has been scrapped as of

September 30, 2002. We expect the remaining written-off inventory to be scrapped over the next three

to six months. Also, as a result of the uncertainty related to the continued financial viability of a certain

customer in the telecommunications industry, a bad debt provision of $115.0 million was recorded to

selling, general and administrative expenses, which is included in the ‘‘Other’’ column above. In

addition to the $115.0 million bad debt provision, the remaining other charges also include a write-off

of an uncollectible receivable of $5.7 million as a result of the downturn in the telecommunications

industry. To the extent that any of the bad debt provisions are not utilized, the excess amounts will be

reversed as a credit to the selling, general and administrative expenses line in the Consolidated

Statement of Operations and will be described as a credit in Tyco’s Consolidated Financial Statements

and Managements’ Discussion and Analysis. To the extent that any of the inventory is subsequently

sold, the related amount of income, if any will be disclosed separately as a credit in Tyco’s Consolidated

Financial Statements and Managements’ Discussion and Analysis.

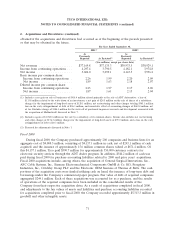

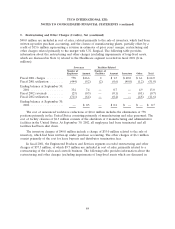

The Healthcare segment recorded a net restructuring and other charge of $44.8 million. The

$44.8 million net charge consists of charges of $48.7 million, of which charges of $0.5 million are

included in cost of sales, related primarily to severance associated with the consolidation of operations

and facility-related costs due to exiting certain business lines. These charges were partially offset by a

credit of $3.9 million representing a revision in estimates of current and prior years’ restructuring

charges. The following table provides information about the restructuring and other charges (excluding

80