ADT 2002 Annual Report Download - page 137

Download and view the complete annual report

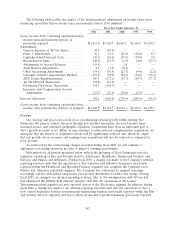

Please find page 137 of the 2002 ADT annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.preceding our prior Chief Executive Officer’s resignation in June 2002, the Company’s prior

management engaged in a pattern of aggressive accounting which, even when in accordance with

Generally Accepted Accounting Principles, was intended to increase reported earnings above what they

would have been if more conservative accounting had been employed. The report also noted that this

pattern may have had the effect of reducing the clarity and effectiveness of the financial statements in

conveying to investors the most accurate picture of our operations and may affect the comparability of

our historical financial results to our current and future results of operations. While most of the

matters identified by the investigation as ‘‘aggressive accounting’’ were determined by the Company, in

consultation with its auditors, to be in accordance with Generally Accepted Accounting Principles,

there were certain adjustments identified as relating to years preceding fiscal 2002. Such adjustments

were initially recorded in the first quarter of fiscal 2002, and have now been included as part of the

current restatements discussed below. See also Item 14. ‘‘Controls and Procedures’’.

Restatement—As previously disclosed, we have been engaged in a dialogue with the staff of the

Division of Corporation Finance of the U.S. Securities and Exchange Commission (the ‘‘Staff’’) as part

of a review of our periodic filings. We believed that we had resolved the material accounting issues at

the time of the original filing of our Form 10-K for the year ended September 30, 2002. Subsequent

correspondence and discussions with the Staff, principally regarding the method of amortizing contracts

acquired through our ADT dealer program as well as the accounting for amounts reimbursed to us

from ADT dealers, coupled with issues related to prior periods identified during our intensified internal

audits and detailed operating reviews in the quarter ended March 31, 2003 have led us to restate our

consolidated financial statements for the quarters ended March 31, 2003 and December 31, 2002, and

for the fiscal years ended September 30, 2002, 2001, 2000, 1999 and 1998.

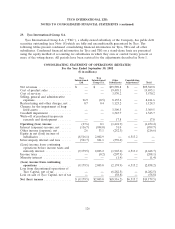

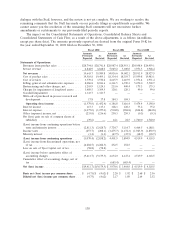

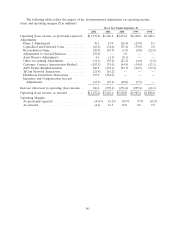

The restatement principally relates to (i) recording charges in the prior years and quarters to

which they relate, rather than in the period such charges were initially identified, (ii) a revision in the

method of amortization used to allocate the costs of contracts acquired through our ADT dealer

program so that the amortization of such costs better matches the pattern of revenue related to such

contracts, (iii) a revision in the method of accounting for amounts reimbursed to us from ADT dealers

as part of the ADT dealer program to effectively treat such amounts as an integral part of the purchase

of the underlying contracts, and (iv) certain other adjustments regarding charges or credits so as to

record them in earlier accounting periods to which they relate. Each of these matters are described

further below:

Charges Relating to Prior Years Initially Recorded in Fiscal 2002

As disclosed in the Company’s previously filed Form 10-K for the fiscal year ended September 30,

2002, the Company identified various adjustments during the fourth quarter of fiscal 2002 relating to

prior year financial statements. These adjustments, which aggregated $261.6 million on a pre-tax basis

or $199.7 million on an after-tax basis, were recorded effective October 1, 2001. The adjustments

primarily were related to reimbursements from ADT dealers in years prior to fiscal 2002 in excess of

the costs incurred, a lower net gain on the issuance of TyCom shares previously reported for fiscal 2001

and adjustments identified both as a result of the Phase 2 review and the recording of previously

unrecorded audit adjustments (which were more appropriately recorded as expenses as opposed to part

of acquisition accounting). The restatement includes adjustments to reverse the charges recorded in the

first quarter of fiscal 2002 and present those charges in the historical periods to which they relate.

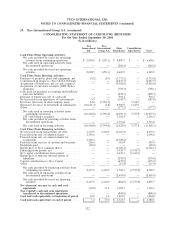

Charges Relating to Prior Years and Quarters Recorded in the Quarter Ended March 31, 2003

As disclosed in the Company’s previously filed Form 10-Q for the quarter ended March 31, 2003,

the Company conducted intensified internal audits and detailed controls and operating reviews that

resulted in the Company identifying and recording pre-tax charges of $434.5 million in that quarter for

charges related to prior periods. These charges resulted from capitalizing certain selling expenses to

property, plant and equipment and other non-current assets, mostly in the Fire and Security Services

segment, and reconciliation items relating to balance sheet accounts where certain account analysis or

135