ADT 2002 Annual Report Download - page 158

Download and view the complete annual report

Please find page 158 of the 2002 ADT annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.Corporate Items

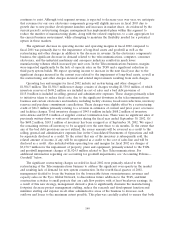

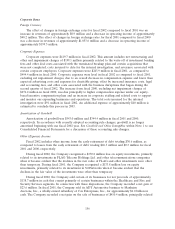

Foreign Currency

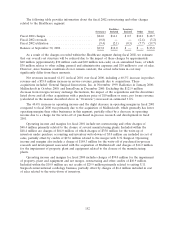

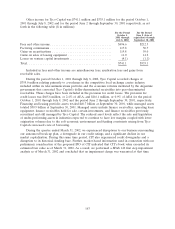

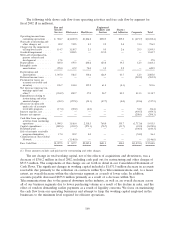

The effect of changes in foreign exchange rates for fiscal 2002 compared to fiscal 2001 was an

increase in revenues of approximately $0.9 million and a decrease in operating income of approximately

$48.2 million. The effect of changes in foreign exchange rates for fiscal 2001 compared to fiscal 2000

was a decrease in revenues of approximately $1,053.6 million and a decrease in operating income of

approximately $199.5 million.

Corporate Expenses

Corporate expenses were $419.7 million in fiscal 2002. This amount includes net restructuring and

other and impairment charges of $199.1 million primarily related to the write-off of investment banking

fees and other deal costs associated with the terminated breakup plan and certain acquisitions that

were not completed, costs incurred to date for the internal investigation, and severance associated with

certain corporate employees. Corporate expenses were $243.9 million in fiscal 2001, as compared to

$494.4 million in fiscal 2000. Corporate expenses were level in fiscal 2002 as compared to fiscal 2001,

excluding net impairment charges, due to an overall decrease in compensation expense and lower than

expected advertising costs and expenses for charitable giving; offset by increased insurance costs, legal

and accounting fees, and other costs associated with the business disruptions that began during the

second quarter of fiscal 2002. The increase from fiscal 2000, excluding net impairment charges of

$276.2 million in fiscal 2000, was due principally to higher compensation expense under our equity-

based incentive compensation plans and an increase in corporate staffing and related costs to support

and monitor our expanding businesses and operations. The total costs incurred for the internal

investigation were $9.1 million in fiscal 2002. An additional expense of approximately $40 million is

estimated to conclude this process in 2003.

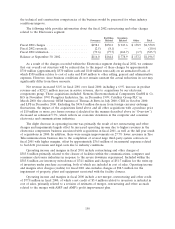

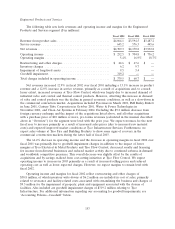

Amortization of Goodwill

Amortization of goodwill was $543.0 million and $344.4 million in fiscal 2001 and 2000,

respectively. In accordance with recently adopted accounting rule changes, goodwill is no longer

amortized beginning with our fiscal 2002 year. See Goodwill and Other Intangibles within Note 1 to our

Consolidated Financial Statements for a discussion of these accounting rule changes.

Other (Expense) Income

Fiscal 2002 includes other income from the early retirement of debt totaling $30.6 million, as

compared to losses from the early retirement of debt totaling $26.3 million and $0.3 million for fiscal

2001 and 2000, respectively.

During fiscal 2002, the Company recognized a $270.8 million loss on equity investments, primarily

related to its investments in FLAG Telecom Holdings Ltd. and other telecommunications companies

when it became evident that the declines in the fair value of FLAG and other investments were other

than temporary. During fiscal 2001, the Company recognized a $133.8 million loss on equity

investments, primarily related to its investment in 360Networks when it became evident that the

declines in the fair value of the investments were other than temporary.

During fiscal 2002, the Company sold certain of its businesses for net proceeds of approximately

$138.7 million in cash that consist primarily of certain businesses within the Healthcare and Fire and

Security Services segments. In connection with these dispositions, the Company recorded a net gain of

$23.6 million. In fiscal 2001, the Company sold its ADT Automotive business to Manheim

Auctions, Inc., a wholly-owned subsidiary of Cox Enterprises, Inc., for approximately $1.0 billion in

cash. The Company recorded a net gain on the sale of businesses of $410.4 million, principally related

156