ADT 2002 Annual Report Download - page 89

Download and view the complete annual report

Please find page 89 of the 2002 ADT annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.TYCO INTERNATIONAL LTD.

NOTES TO CONSOLIDATED FINANCIAL STATEMENTS (continued)

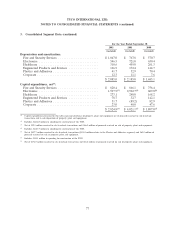

5. Restructuring and Other Charges (Credits), Net (continued)

In addition to segment charges (credits), the Company recorded charges of $275.0 million in fiscal

2000 for certain claims relating to a merged company in the Healthcare business and $1.2 million for

other charges.

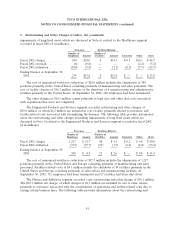

6. Charges for the Impairment of Long-Lived Assets

The Company reviews the recoverability of the carrying value of long-lived assets, primarily

property, plant and equipment and intangible assets, for impairment whenever events or changes in

circumstances indicate that the carrying amount of an asset may not be fully recoverable. The Company

evaluates the recoverability of long-lived assets relying on a number of factors including operating

results, business plans, economic projections and anticipated future cash flows. An impairment in the

carrying value of an asset is recognized whenever anticipated future cash flows (undiscounted) from an

asset are estimated to be less than its carrying value. When indicators of impairment are present, the

carrying values of the assets are evaluated in relation to the operating performance and future

undiscounted cash flows of the underlying business. The net book value of an asset is adjusted to fair

value if its expected future undiscounted cash flows is less than book value. Fair values are based on

assumptions concerning the amount and timing of estimated future cash flows and assumed discount

rates, reflecting varying degrees of perceived risk.

2002 Charges

During fiscal 2002, the Company recorded total charges for the impairment of long-lived assets in

continuing operations of $3,309.5 million.

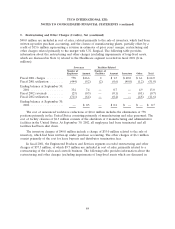

During fiscal 2002, the Fire and Security Services segment recorded a charge of $5.6 million

related to the impairment of intangible assets resulting from the curtailment, and in certain markets,

the termination of the ADT dealer program. In addition, the Fire and Security Services segment

recorded a charge of $109.1 million primarily related to the impairment of property, plant and

equipment associated with the termination of a software development project. The software

development project related to a strategy to develop a new comprehensive integrated customer

database and associated applications for this segment and its acquired companies. During fiscal 2002,

management, with the assistance of a third-party consultant, performed a full evaluation to determine

the information technology needs of the Fire and Security business relative to where it stood then and

expectations for it over the near future. As a result of this review, the Company decided to abandon

the project, which was still in the development and testing stage, resulting in the write-off of capitalized

costs of $109.1 million.

During fiscal 2002, the Electronics segment recorded a charge of $3,150.7 million, of which

$2,581.7 million related to the impairment of the TGN, $541.0 million primarily related to property,

plant and equipment associated with the closure of facilities as discussed in Note 5 and $28.0 million

related to the impairment of intangible assets associated with undersea systems technology and

know-how acquired through acquisitions. The fiberoptic capacity available in the market continues to

significantly exceed overall market demand, creating sharply declining prices and reduced anticipated

future cash flows.

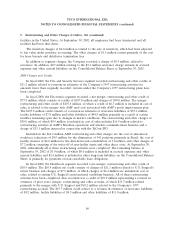

The Company has assessed the carrying value of the TGN using an analysis that employs estimates

as to current and future market pricing, demand and network completion costs. This analysis is highly

sensitive to changes in those estimates noted above. Based upon management’s estimates, the Company

87