ADT 2002 Annual Report Download - page 57

Download and view the complete annual report

Please find page 57 of the 2002 ADT annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.TYCO INTERNATIONAL LTD.

NOTES TO CONSOLIDATED FINANCIAL STATEMENTS (continued)

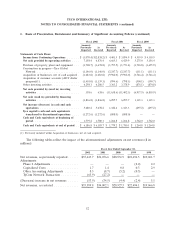

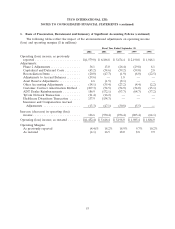

1. Basis of Presentation, Restatement and Summary of Significant Accounting Policies (continued)

temporary. The results of companies acquired or disposed of during the fiscal year are included in the

Consolidated Financial Statements from the effective date of acquisition or up to the date of disposal.

All significant intercompany balances and transactions have been eliminated in consolidation.

Revenue Recognition—The Company adopted Staff Accounting Bulletin No. 101 (‘‘SAB 101’’),

‘‘Revenue Recognition in Financial Statements’’ in the fourth quarter of fiscal 2001 retroactive to the

beginning of the fiscal year and is now recognizing revenues from the installation of owned security

systems and deferring the associated direct incremental costs over the estimated customer lives.

Revenue from the sale of products is recognized according to the terms of the sales arrangement,

which is customarily when the products reach the free-on-board shipping point. Revenue from the sale

of services is recognized as services are rendered. Subscriber billings for services not yet rendered are

deferred and recognized as revenue as the services are rendered, and the associated deferred revenue is

included in current liabilities or long-term liabilities, as appropriate.

Contract sales for the installation of fire protection systems, undersea fiber optic cable systems and

other construction related projects are recorded on the percentage-of-completion method. Profits

recognized on contracts in process are based upon estimated contract revenue and related cost to

completion. Cost to completion for undersea cable systems is measured based on the ratio of costs

incurred to total estimated costs, while cost to completion for the installation of fire protection systems

and other construction related projects is measured using the efforts-expended method based on direct

labor hours expended and actual material used. Revisions in cost estimates as contracts progress have

the effect of increasing or decreasing profits in the current period. Provisions for anticipated losses are

made in the period in which they first become determinable.

Certain of the Company’s long-term contracts have warranty obligations. Estimated warranty costs

for each contract are determined based on the contract terms and technology specific issues. These

costs are included in total estimated contract costs accrued over the construction period of the

respective contracts under percentage-of-completion accounting. In addition, certain product sales also

have normal warranty provisions. The Company accrues estimated product warranty costs at the time of

sale and any additional amounts are recorded when such costs are probable and can be reasonably

estimated.

The Company’s global undersea fiber optic network, on which it sells bandwidth capacity, is known

as the Tyco Global Network (‘‘TGN’’). The Company’s sales of bandwidth capacity are generally

structured as either service arrangements or operating leases. The Company recognizes revenue

associated with the service arrangement ratably over the service period and recognizes revenue

associated with the operating leases over the lease term.

At September 30, 2002, accounts receivable and other long-term receivables included retainage

provisions of $164.8 million, of which $84.9 million remained unbilled. At September 30, 2001, accounts

receivable and other long-term receivables included retainage provisions of $100.7 million, of which

$73.7 million remained unbilled. These retention provisions relate primarily to fire protection and

electronics contracts and become due upon contract completion and acceptance. Of the balance of

$164.8 million at September 30, 2002, $128.3 million is included in accounts receivable and is expected

to be collected during fiscal 2003.

Research and Development—Research and development expenditures are expensed when incurred

and are included in cost of sales. Customer-funded research and development are costs incurred by

Tyco that are reimbursed by customers. There is no net impact on research and development expense

55