ADT 2002 Annual Report Download - page 152

Download and view the complete annual report

Please find page 152 of the 2002 ADT annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

the technical and construction competencies of the business would be preserved for when industry

conditions improve.

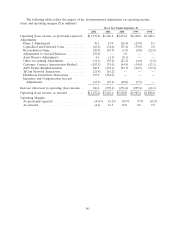

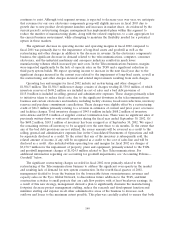

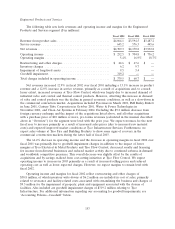

The following table provides information about the fiscal 2002 restructuring and other charges

related to the Electronics segment:

Facilities- Inventory-

Severance Related Related Other Total

Fiscal 2002 charges ....................... $198.1 $250.2 $ 943.6 $ 138.9 $1,530.8

Fiscal 2002 reversals ....................... (2.5) (8.1) — — (10.6)

Fiscal 2002 utilization ...................... (79.6) (77.7) (164.7) (1.7) (323.7)

Balance at September 30, 2002 ............... $116.0 $164.4 $ 778.9 $ 137.2 $1,196.5

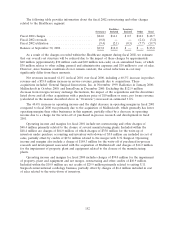

As a result of the charges recorded within the Electronics segment during fiscal 2002, we estimate

that our overall cost structure will be reduced due to the impact of these charges by approximately

$710 million (approximately $570 million cash and $140 million non-cash) on an annualized basis, of

which $550 million relates to cost of sales and $160 million to other selling, general and administrative

expenses. However, since business conditions do not remain constant the actual reductions in cost may

significantly differ from these amounts.

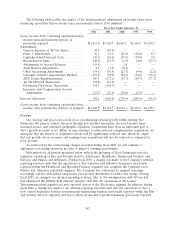

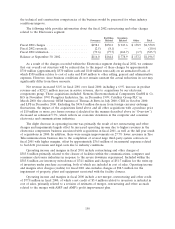

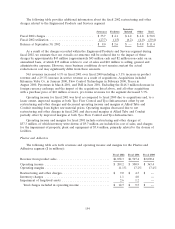

Net revenue increased 8.8% in fiscal 2001 over fiscal 2000, including a 6.9% increase in product

revenue and a $252.1 million increase in service revenue, due to acquisitions by our electronic

components group. These acquisitions included: Siemens Electromechanical Components GmbH & Co.

KG in November 1999; Praegitzer Industries, Inc. in December 1999; Critchley Group PLC in

March 2000; the electronic OEM business of Thomas & Betts in July 2000; CIGI in October 2000;

and LPS in December 2000. Excluding the $436.8 million decrease from foreign currency exchange

fluctuations, the impact of the acquisitions listed above and all other acquisitions with a purchase price

of $10 million or more, pro forma revenue (calculated in the manner described above in ‘‘Overview’’)

decreased an estimated 5.7%, which reflects an economic slowdown in the computer and consumer

electronics and communications industries.

The slight decrease in operating income was primarily the result of net restructuring and other

charges and impairments largely offset by increased operating income due to higher revenues in the

electronics components business associated with acquisitions in fiscal 2001, as well as the full year result

of acquisitions in 2000. In addition, there were margin improvements on 27.7% lower revenues in Tyco

Telecommunications business due to the completion of several large third-party system contracts in

fiscal 2001 with higher margins, offset by approximately $36.5 million of incremental expenses related

to bad debt provisions and legal costs due to industry conditions.

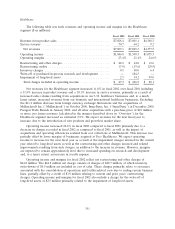

Operating income and margins in fiscal 2001 include restructuring and other charges of

$383.8 million primarily related to the closure of facilities within the communications, computer and

consumer electronics industries in response to the severe downturn experienced. Included within the

$383.8 million are inventory write-downs of $74.1 million and charges of $51.7 million for the write-up

of inventory under purchase accounting, both of which are included in cost of sales. Operating income

and margins after charges (credits) for fiscal 2001 also includes charges of $98.5 million for the

impairment of property, plant and equipment associated with the facility closures.

Operating income and margins in fiscal 2000 include a net merger, restructuring and other credit

of $77.8 million in fiscal 2000, of which a net credit of $5.4 million related to inventory is included in

cost of sales, primarily related to a revision of estimates of merger, restructuring and other accruals

related to the merger with AMP and AMP’s profit improvement plan.

150