ADT 2002 Annual Report Download - page 126

Download and view the complete annual report

Please find page 126 of the 2002 ADT annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

TYCO INTERNATIONAL LTD.

NOTES TO CONSOLIDATED FINANCIAL STATEMENTS (continued)

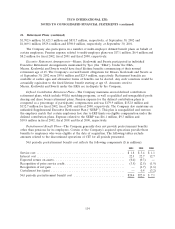

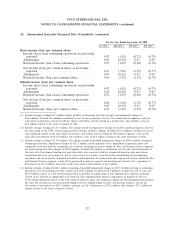

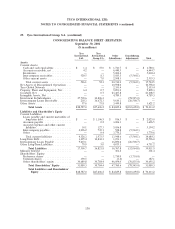

28. Summarized Quarterly Financial Data (Unaudited) (continued)

For the Year Ended September 30, 2001 (restated)

1st Qtr.(1) 2nd Qtr.(2) 3rd Qtr.(3) 4th Qtr.(4)

Net revenues as previously reported ............... $8,029.0 $8,809.8 $8,680.4 $8,517.4

Adjustments ................................ (3.9) (2.0) (34.8) 6.2

Restated net revenues ......................... $8,025.1 $8,807.8 $8,645.6 $8,523.6

Gross profit as previously reported ............... $3,054.6 $3,295.3 $3,292.2 $3,444.2

Adjustments ................................ (7.9) (7.8) (28.3) 24.2

Restated gross profit .......................... $3,046.7 $3,287.5 $3,263.9 $3,468.4

Income from continuing operations as previously

reported ................................. $1,000.8 $1,100.1 $1,105.8 $1,194.8

Adjustments ................................ (56.8) (217.0) (129.1) (103.7)

Restated income from continuing operations ........ $ 944.0 $ 883.1 $ 976.7 $1,091.1

Net income as previously reported(5) .............. $ 317.4 $1,100.1 $1,177.0 $1,376.1

Adjustments ................................ (56.8) (217.0) (129.1) (103.7)

Restated net income(5) ......................... $ 260.6 $ 883.1 $1,047.9 $1,272.4

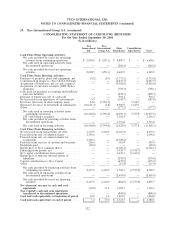

Basic earnings per common share:

Income from continuing operations as previously

reported ............................... 0.58 0.63 0.61 0.62

Adjustments .............................. (0.03) (0.12) (0.07) (0.05)

Restated income from continuing operations ....... 0.54 0.50 0.54 0.56

Net income per common share as previously reported 0.18 0.63 0.65 0.71

Adjustments .............................. (0.03) (0.12) (0.07) (0.05)

Restated net income per common share .......... 0.15 0.50 0.58 0.66

Diluted earnings per common share:

Income from continuing operations as previously

reported ............................... 0.57 0.62 0.60 0.61

Adjustments .............................. (0.03) (0.12) (0.07) (0.05)

Restated income from continuing operations ....... 0.54 0.50 0.53 0.56

Net income per common share as previously reported 0.18 0.62 0.64 0.70

Adjustments .............................. (0.03) (0.12) (0.07) (0.05)

Restated net income per common share .......... 0.15 0.50 0.57 0.65

(1) Includes a net restructuring and other credit of $175.6 million, of which a charge of $25.0 million is included in cost of sales.

The net credit consists of a net gain on the sale of businesses of $410.4 million principally related to the sale of ADT

Automotive; a write-off of purchased in-process research and development of $184.3 million; a charge of $25.0 million

related to the sale of inventory, which had been written-up under purchase accounting; restructuring and other charges of

$18.1 million primarily related to an environmental remediation project and the closure of a manufacturing plant; and a

charge of $7.4 million primarily related to the impairment of property, plant and equipment associated with the closure of a

manufacturing plant.

(Footnotes continued on following page)

124