ADT 2002 Annual Report Download - page 108

Download and view the complete annual report

Please find page 108 of the 2002 ADT annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

TYCO INTERNATIONAL LTD.

NOTES TO CONSOLIDATED FINANCIAL STATEMENTS (continued)

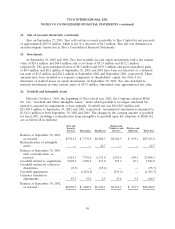

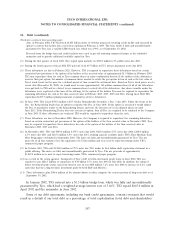

18. Debt

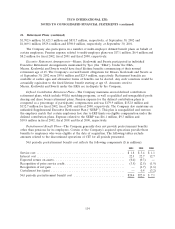

Debt is as follows(1) ($ in millions):

September 30,

2002 2001

Commercial paper program(2) .............................. $ — $ 3,909.5

Euro commercial paper program(2) ........................... — 80.7

Notes payable to Tyco Capital .............................. — 200.0

6.5% public notes due 2001(3) .............................. — 300.0

6.875% private placement notes due 2002(4) .................... — 1,037.2

Variable-rate unsecured bank credit facilities due 2003(2)(11) ......... 3,855.0 —

Zero coupon convertible debentures with 2003 put options(5)(11) ...... 1,944.6 2,272.4

6.25% public Dealer Remarketable Securities with 2003 put

options(6)(11) .......................................... 751.9 754.6

Floating rate private placement notes due 2003(11) ............... 493.8 498.4

4.95% notes due 2003(11) .................................. 565.1 598.0

6.0% notes due 2003 ..................................... 72.7 72.7

Zero coupon convertible senior debentures with 2003 put options(7) . . . 3,519.1 3,499.4

5.875% public notes due 2004 .............................. 399.1 398.6

4.375% Euro denominated notes due 2004(8) ................... 486.5 —

6.375% public notes due 2005 .............................. 747.0 745.9

6.75% notes due 2005 .................................... 76.7 76.6

6.375% public notes due 2006 .............................. 993.7 991.9

Variable rate unsecured revolving credit facility due 2006(2) ......... 2,000.0 —

5.8% public notes due 2006 ................................ 695.7 694.5

6.125% Euro denominated public notes due 2007 ................ 582.4 550.1

6.5% notes due 2007 ..................................... 99.3 99.2

6.125% public notes due 2008 .............................. 396.6 396.0

8.2% notes due 2008(10) ................................... 388.4 393.4

5.50% Euro denominated notes due 2008(8) .................... 664.4 —

6.125% public notes due 2009 .............................. 393.1 386.5

Zero coupon convertible subordinated debentures due 2010 ........ 26.3 30.8

6.75% public notes due 2011 ............................... 992.8 991.9

6.375% public notes due 2011(9) ............................. 1,490.7 —

6.50% British pound denominated public notes due 2011(8) ......... 285.3 —

7.0% debentures due 2013 ................................ 86.2 86.1

7.0% public notes due 2028 ................................ 493.2 492.9

6.875% public notes due 2029 .............................. 782.5 781.8

3.5% Yen denominated private placement notes due 2030(10) ........ — 252.1

6.50% British pound denominated public notes due 2031(8) ......... 438.9 —

Other(11) .............................................. 484.8 1,027.8

Total debt ............................................ 24,205.8 21,619.0

Less current portion ..................................... 7,719.0 2,023.0

Long-term debt ........................................ $16,486.8 $19,596.0

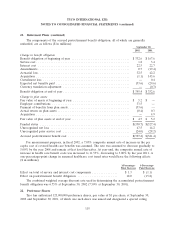

(1) Debt maturity dates are presented on a calendar basis, consistent with the respective offering documents.

(2) In February 2002, Tyco International Group S.A. (‘‘TIG’’) borrowed the available $2.0 billion of capacity under its 5-year

unsecured revolving credit facility, which had been maintained as liquidity support for its commercial paper program. The

facility, which expires in February 2006, is fully and unconditionally guaranteed by Tyco and has a variable LIBO-based rate,

which was 4.94% as of September 30, 2002.

(Footnotes continued on following page)

106