ADT 2002 Annual Report Download - page 28

Download and view the complete annual report

Please find page 28 of the 2002 ADT annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

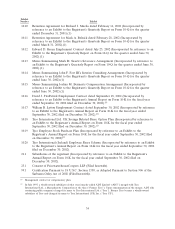

PART II

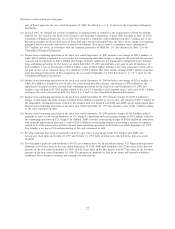

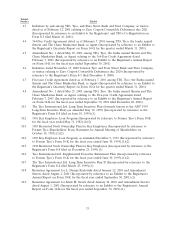

Item 6. Selected Financial Data

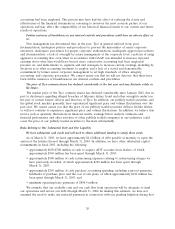

The following table sets forth selected consolidated financial information of Tyco as, at and for the

fiscal years ended September 30, 2002, 2001, 2000, 1999 and 1998. This selected financial information

should be read in conjunction with Tyco’s Consolidated Financial Statements and related notes. The

selected financial data reflect the combined results of operations and financial position of Tyco, United

States Surgical Corporation (‘‘U.S. Surgical’’) and AMP Incorporated (‘‘AMP’’). During fiscal 1999,

subsidiaries of Tyco merged with U.S. Surgical and AMP. Both merger transactions were accounted for

under the pooling of interests accounting method. The selected financial information for each of the

periods presented below has been restated to reflect the revisions discussed in Note 1 to the

Consolidated Financial Statements.

Year Ended September 30,

2002(1) 2001(2)(3) 2000(4) 1999(5) 1998(6)

(in millions, except per share data)

(restated)

Consolidated Statements of Operations

Data:

Net revenues ...................... $35,589.8 $34,002.1 $28,927.5 $22,494.1 $19,066.8

(Loss) income from continuing operations . (2,838.2) 3,894.9 4,318.5 873.7 1,117.0

Cumulative effect of accounting changes,

net of tax ....................... — (683.4) — — —

Net (loss) income .................. (9,179.5) 3,464.0 4,318.5 873.7 1,117.0

Basic (loss) earnings per common share(7):

(Loss) income from continuing

operations .................... (1.43) 2.16 2.56 0.53 0.71

Cumulative effect of accounting

changes, net of tax .............. — (0.38) — — —

Net (loss) income ................. (4.62) 1.92 2.56 0.53 0.71

Diluted (loss) earnings per common

share(7):

(Loss) income from continuing

operations .................... (1.43) 2.13 2.52 0.52 0.69

Cumulative effect of accounting

changes, net of tax .............. — (0.37) — — —

Net (loss) income ................. (4.62) 1.89 2.52 0.52 0.69

Cash dividends per common share(7) ....... See

(8) below.

Consolidated Balance Sheet Data (End of

Period):

Total assets ....................... $65,457.5 $70,413.2 $39,995.6 $32,106.2 $23,346.2

Long-term debt .................... 16,486.8 19,596.0 9,461.8 9,109.4 5,424.7

Shareholders’ equity ................. 24,081.3 31,080.3 16,612.7 12,136.7 9,812.8

(1) Loss from continuing operations in the fiscal year ended September 30, 2002 includes net restructuring and other charges of

$1,874.7 million (of which $635.4 million is included in cost of sales and $115.0 million is included in selling, general and

administrative expenses), charges of $3,309.5 million for the impairment of long-lived assets, goodwill impairment charges of

$1,343.7 million, and a charge for the write-off of purchased research and development of $17.8 million. In addition, loss

from continuing operations for the fiscal year ended September 30, 2002 includes a loss on investments of $270.8 million, a

net gain on the sale of businesses of $23.6 million and $30.6 million of income relating to the early retirement of debt. Net

(loss) income also includes a $6,282.5 million loss from discontinued operations of Tyco Capital and a $58.8 million loss on

(Footnotes continued on following page)

26